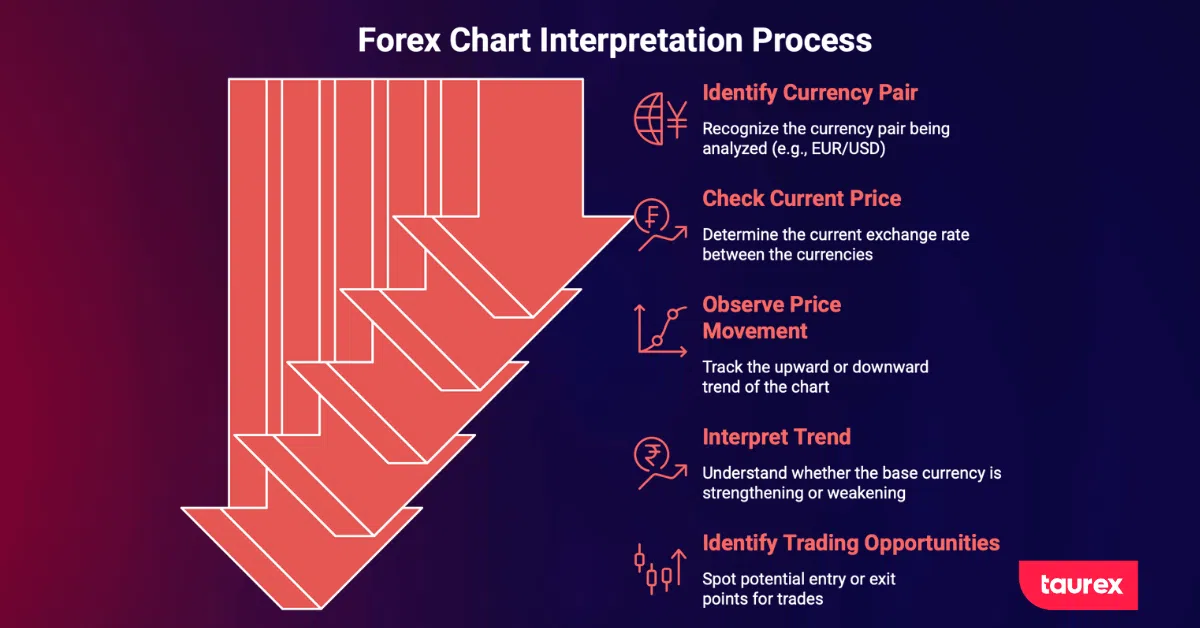

How to Read Forex Charts: A Simple Visual Guide

If you’re diving into forex trading for the first time, staring at a forex chart can feel overwhelming. The lines, colors, and candlestick patterns may seem like a foreign language, leaving you unsure of what you’re really looking at. You’re not alone. Many traders share the same confusion when they start.

But here’s the good news: learning how to read forex charts is much simpler than it seems. Think of it like learning to read a weather map. At first, the symbols may look random, but once you understand the basics of trading forex, patterns will start to jump out at you.

Ready to decode those charts? Let’s get started!

What Exactly Are Forex Charts Showing You?

A forex chart provides a visual representation of how a currency pair’s price changes over time. The vertical axis shows the price – how many units of one currency are required to purchase another, and the horizontal axis shows time.

For example, when viewing EUR/USD at 1.0850, it means one euro costs $1.0850. If the chart moves upward, the euro is strengthening against the dollar. If it moves downward, the dollar is gaining value.

As of 2025, the forex market moves approximately $7.5 trillion each day, which makes it the largest financial market in the world. With so much activity, charts are essential tools for understanding price behaviour and identifying trading opportunities.

How to Read Different Forex Charts?

Line Charts: Your Training Wheels

Line charts are the most straightforward type of price chart. They connect closing prices with a continuous line, much like the market tickers seen on financial news channels. These charts are clean, easy to interpret, and ideal for identifying the overall direction of a trend.

However, they only display closing prices, leaving out valuable information about intraday movement. Many traders still use line charts to review long-term trends over months or years because they provide a clear view without unnecessary noise. For making precise trading decisions, though, more detailed charts are preferred.

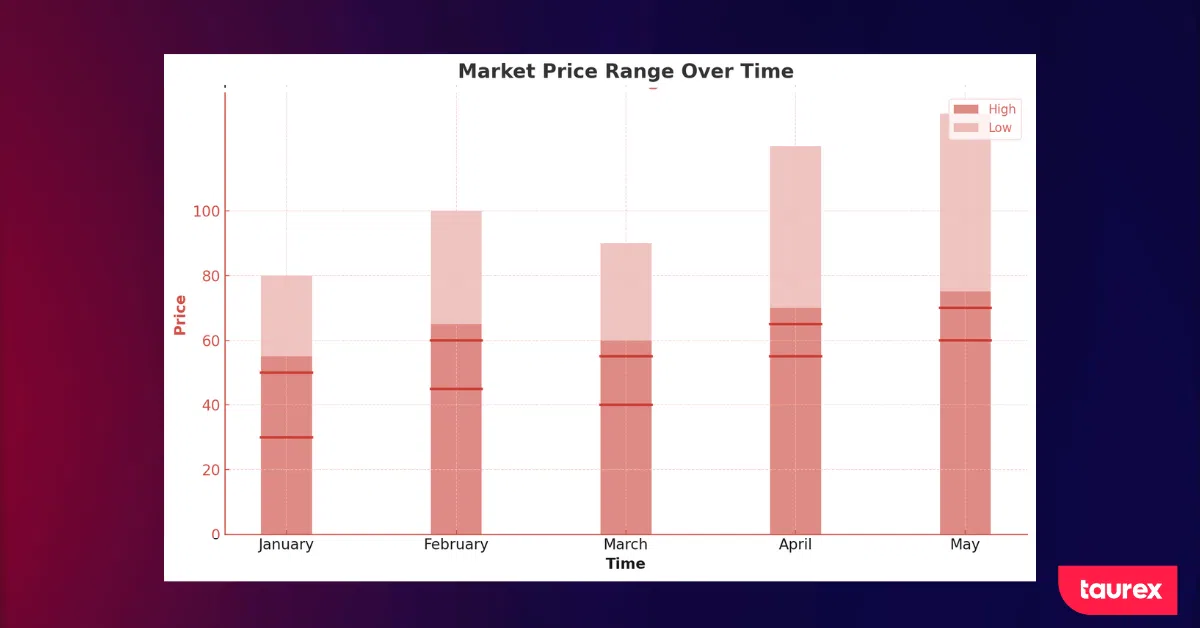

Bar Charts: The Old-School favourite

Bar charts present a more complete view by showing the High, Low, Open, and Close (HLOC) for each time period. Each bar is a vertical line representing the price range, with small horizontal notches indicating where the price opened and closed.

This format allows traders to see the full scope of market activity, not just the final price. Bar charts were the standard among professionals for many years before more intuitive options became available.

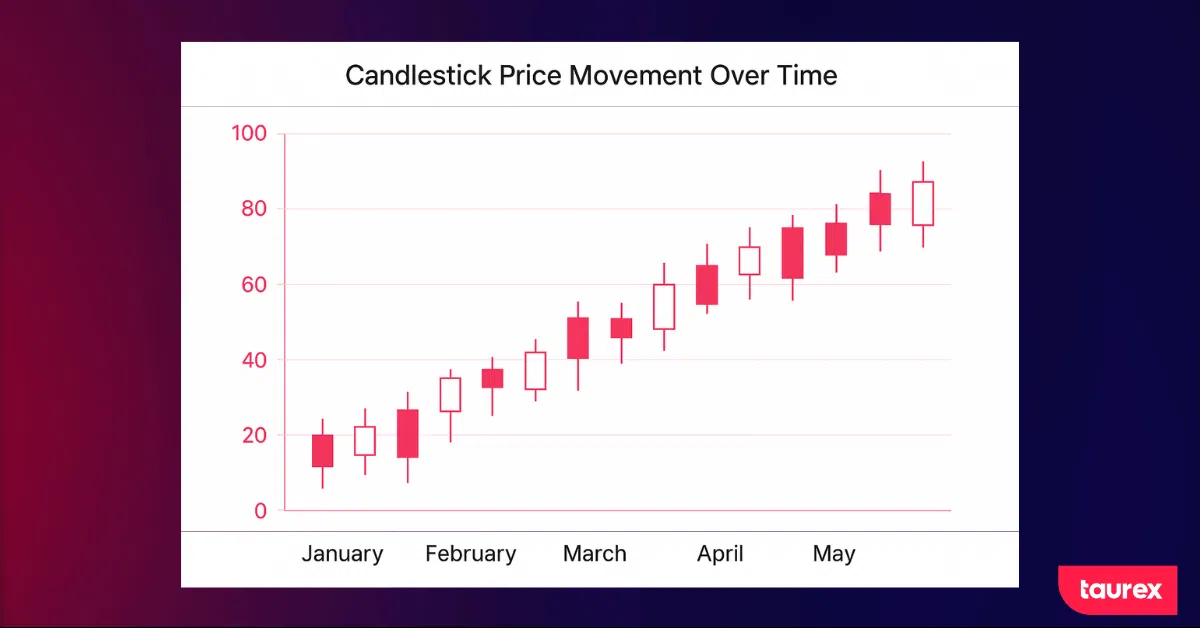

Candlestick Charts: The Trader’s Choice

Candlestick charts show the same HLOC data as bar charts, but in a way that’s much easier to read at a glance. Each “candle” has a body (the rectangle) showing the open-to-close range, and wicks (the thin lines) showing the high and low.

Here’s why candlesticks dominate modern forex trading: color coding. Green (or white) candles mean the price closed higher than it opened. This shows that buyers were in control. Red (or black) candles mean sellers won that time period. You can literally see the battle between bulls and bears playing out candle by candle.

The Japanese developed this system centuries ago for rice trading, and it has remained relevant for a good reason. One glance tells you not just what happened, but the psychology behind it. A long green body with minimal wicks indicates strong dominance from buyers. A small body with long wicks suggests indecision in the market.

Mountain Charts: Pretty But Pointless

Mountain charts resemble line charts, but with the area below the line filled in. They may look appealing in presentations, but they offer no additional analytical value. For serious trading, it is best to focus on more informative chart types.

Candlestick Patterns That Actually Matter

Candlestick patterns reveal how buyers and sellers interact during each trading period. While no pattern can guarantee a specific outcome, certain formations appear often enough to provide valuable insight into potential market direction.

Single Candle Signals

A doji represents indecision. The opening and closing prices are almost the same, forming a cross or plus-shaped candle. When it appears after a strong trend, it can indicate that momentum is fading and a possible reversal may be near.

A hammer has a small body near the top and a long lower wick. When it forms at the bottom of a downtrend, it often signals buying pressure returning to the market. Sellers pushed the price down, but buyers managed to bring it back up by the close. That was a sign of shifting control.

A marubozu is a full-bodied candle without wicks, where one side dominates the price action. A green marubozu indicates higher buying activity during the period, while a red one indicates higher selling activity.

Two-Candle Combinations

The bullish engulfing pattern consists of a smaller red candle followed by a larger green candle that fully covers the previous one. Research from the University of Michigan observed that this formation was associated with price increases in historical data, though past patterns do not guarantee future results.

The psychology is straightforward: sellers begin in control, but buyers quickly reverse momentum and push prices higher.

Multi-Candle Patterns

The three white soldiers pattern features three consecutive green candles, each opening within the body of the previous one and closing near its high. This pattern signals strong, sustained buying pressure and often appears at the beginning of a trend reversal from bearish to bullish conditions.

No pattern is foolproof. Candlestick signals can fail, especially during periods of high volatility or around major news events. Continually evaluate patterns in context. Consider the timeframe, nearby support and resistance levels, and the overall market trend before making a trading decision.

How to Choose The Right Timeframe For Your Trading Style?

A chart timeframe is like looking at a map. A long-term map (longer timeframe) shows the big picture. A detailed street map (shorter timeframe) shows the finer details. Both views are useful. Which one you focus on depends on your trading style.

Scalping And Day Trading (1-Minute To 1-Hour Charts)

Traders making multiple trades per day rely on 1-minute to 15-minute charts. Price moves quickly, and each move is relatively small. Peak activity occurs between 1-4 pm GMT when London and New York overlap. Liquidity is highest and spreads are tightest during this window.

This style is intense. Decisions must be made in seconds, and even a single news spike can erase hours of work. Many traders find this pace exhausting and difficult to sustain over time.

Swing Trading (4-Hour To Daily Charts)

Swing trading is the most popular approach for many traders. Daily charts offer a balance between meaningful price movement and manageable screen time. Here, traders can monitor positions a few times per day without being glued to their computer.

Patterns on daily charts can be more reliable. Support and resistance levels are clearer, and minor news events are less likely to trigger false signals. Daily charts are often the recommended starting point for beginners.

Position Trading (Weekly To Monthly Charts)

This is investing territory. You’re holding positions for weeks or months, riding major economic trends. You need deep pockets for the wider stop losses and strong conviction in your analysis. But the beauty is you’re hardly spending any time actually trading, maybe an hour per week analyzing and adjusting positions.

The Multi-Timeframe Approach That Professionals Use

Professional traders rarely rely on a single timeframe. They use a top-down analysis approach. Start with a higher timeframe to determine the overall trend, then move to a lower timeframe to identify potential entry points. Finally, zoom in further to refine the timing of your trade.

For example, a swing trader might begin with the weekly chart to confirm the trend. Next, they check the daily chart to see if the price is approaching a key support or resistance level. Finally, they use the 4-hour chart to time their entry, looking for a confirming pattern or indicator signal.

The recommended ratio between timeframes is 1:4 to 1:6. So, if you’re trading off the 4-hour chart, check the daily for context and the 1-hour for entry timing.

Support And Resistance: The Backbone Of Chart Analysis

Support and resistance are among the most essential concepts in trading. These are the levels where price tends to pause, bounce, or reverse. Understanding them is essential for reading charts effectively.

What Creates These Levels?

Support forms where buyers consistently enter the market, believing the price represents value. Resistance forms where sellers step in, seeing the price as too high. These levels reflect introductory market psychology.

For example, if EUR/USD bounces off 1.0800 multiple times, traders begin to notice. Some places buy orders just above that level, anticipating another bounce. Others set stops slightly below it. Over time, the level strengthens. The more often price tests it without breaking, the more significant it becomes.

Finding These Levels On Your Charts

Start with previous highs and lows. If the price reversed there before, it may do so again. Round numbers, such as 1.1000 or 1.2000, also serve as psychological levels where traders place orders.

Moving averages, particularly the 50-day and 200-day, often act as dynamic support and resistance. Price often reacts to them. Trendlines also help by connecting a series of lows in an uptrend or highs in a downtrend, revealing additional key levels.

It is important to note that support and resistance are not precise lines. They are better thought of as zones. Price may temporarily move beyond these areas before reversing. Focus on the area where reactions are likely, not an exact number.

Trading Strategies Using Support And Resistance

Bounce trading is straightforward. When the price approaches support in an uptrend, look for bullish candlestick patterns or indicator confirmations to enter long. Place a stop just below support and target the next resistance level. Reverse this approach when trading off resistance in a downtrend.

Breakout trading focuses on price movements around key levels. A breakout occurs when the price moves beyond a major support or resistance level, often followed by continued activity in the same direction. A cautious approach is to wait for a retest of the broken level (old resistance becomes new support) before entering.

Range trading occurs when price moves between defined support and resistance levels. Traders observe how price reacts near these levels and monitor for potential breaks outside the range.

How to Read Forex Charts with the Help of Technical Indicators?

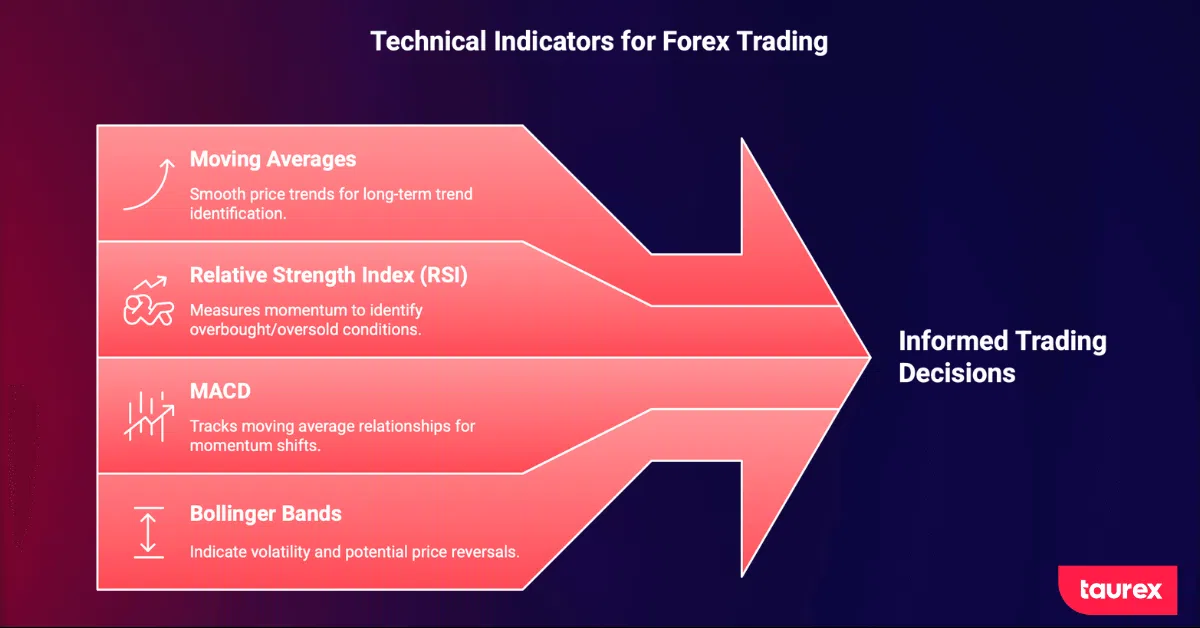

Charts show price action, but indicators provide confirmation. They act as a second opinion on what the chart reveals.

Moving averages smooth out price movements to highlight the underlying trend. When the price is above the 200-day moving average and the line is rising, it indicates a long-term uptrend. This simple tool is highly effective for trend identification.

The Relative Strength Index (RSI) measures momentum. A reading above 70 suggests overbought conditions, while a reading below 30 indicates oversold conditions. These levels can signal potential entries, but strong trends may remain overbought or oversold for extended periods.

MACD (Moving Average Convergence Divergence) tracks the relationship between two moving averages. A cross of the MACD line above the signal line often signals a buying opportunity. A cross below may indicate a sell. MACD is helpful for spotting momentum shifts before they appear clearly on price charts.

Bollinger Bands expand and contract with volatility. When the bands tighten, a significant price move is often imminent. A price touching the upper band in a range-bound market can signal a potential reversal. In strong trends, the price may ride the bands for an extended period.

Best Practices:

Use no more than two or three indicators. Adding too many can create conflicting signals and overwhelm your analysis. Keeping it simple improves clarity and helps you make informed trading decisions.

Common Forex Chart Reading Mistakes That Will Cost You Money

New traders often make predictable errors that can be costly. Avoiding them improves your chances of long-term success.

Trading against the trend is the fastest way to lose money. Picking tops and bottoms may feel clever when it works, but the saying “the trend is your friend” exists for a reason. Until you can trade with the trend consistently, avoid fighting it.

Failing to manage risk can quickly deplete your account. No matter how skilled you become at chart reading, losing trades are inevitable. Always use stop losses. Limit risk to 1–3% of your account per trade. This approach may seem cautious, but it preserves capital and keeps you in the market long enough to improve.

Jumping timeframes to justify a losing trade is self-sabotage. Entering on a 15-minute chart and then switching to the daily chart when the price moves against you can be costly. Pick a timeframe and follow it consistently.

Information overload is a genuine challenge. Focus on mastering one currency pair, one timeframe, and one or two strategies first. This will reduce errors and help you make better trading decisions.

The Psychology Behind The Charts

Charts are more than lines and candles. They visually reflect the emotions that drive the market. Every price movement shows collective fear, greed, hope, and caution from traders worldwide.

A long upper wick on a candle represents more than price movement. It shows buyers pushing the price higher, encountering strong selling pressure, and retreating. This rejection indicates that sellers are defending that level.

Candlestick patterns reveal market psychology. A doji after a strong trend shows indecision, when bulls and bears are equally matched, and neither side can gain control. An engulfing pattern shows one side gaining decisive control, indicating a shift in market power.

Understanding these dynamics helps anticipate price action. Long red candles with rising volume suggest panic selling, often signalling a peak in fear. Small, indecisive candles after a rally indicate that enthusiasm is fading and may be a time to consider taking profits.

Market Conditions Matter More Than Patterns

The same chart pattern can produce very different results depending on market conditions.

In a strong trending market, focus on continuation patterns and pullbacks to support and resistance. Reversal patterns in these conditions are less reliable. The trend often overrides them.

In a ranging market, those reversal patterns become more effective. Price moves predictably between support and resistance, allowing traders to take both long and short positions with greater confidence.

Identifying the market context is essential. Look for higher highs and higher lows for an uptrend, lower highs and lower lows for a downtrend, or sideways movement within a channel for a range. This perspective guides trading decisions.

Irregularity also affects pattern reliability. During major economic releases or geopolitical events, spreads widen, slippage increases, and stop losses may be less effective. In such periods, sometimes the best decision is to wait for more stable conditions.

Reading Market Psychology Through Forex Charts

Charts don’t just show price movement. They reveal trader psychology. Every candle represents a battle between buyers and sellers. The winner determines the color of the candle.

When you see a long green candle with barely any wicks, that’s pure buyer dominance. A doji after a trend indicates indecision, as the market pauses to reassess its next move. According to Pepperstone, understanding this psychology helps you anticipate what might happen next.

Volume shows how much trading activity occurs during a price movement. Larger moves accompanied by higher volume indicate increased market participation compared with moves on lower volume. For example, if EUR/USD rises above a resistance level on higher-than-average volume, it reflects stronger activity during that move.

Your Trading Toolkit with Taurex

At Taurex, we provide professional charting tools for all traders. Our platform supports both MetaTrader 4 and MetaTrader 5, giving you flexibility in your analysis.

Integration with Trading Central offers advanced technical insights. Real-time market updates from Acuity explain the reasoning behind price movements. Whether on desktop or mobile, you get the same robust charting features.

For beginners, our demo account allows practice without risking real funds. Combined with educational resources through Taurex Academy, you can develop chart-reading skills at your own pace.

Putting It All Together

Reading forex charts is a skill that develops over time. Start with one chart type, candlesticks are highly recommended, and one or two timeframes. Focus on identifying trends and major support/resistance levels before adding complexity.

Practise spotting the basic candlestick patterns we discussed. Don’t worry about memorizing every obscure pattern out there. The common ones appear daily and are more than enough to get you started.

Most importantly, always consider the context. A hammer at the bottom of a downtrend means something very different from a hammer in the middle of nowhere. Multiple timeframe analysis helps here: check the daily chart for the overall trend, then drop to the 4-hour or 1-hour for entry signals.

Risk management should be baked into your chart analysis from day one. When you identify a setup, know where your stop loss goes before you enter. According to NAGA, placing stops just beyond support or resistance levels helps protect against false breakouts.

With daily forex volumes exceeding $7.5 trillion, the opportunities are endless. But success comes from patience, practice, and proper chart analysis. Take your time, start small, and let the charts tell their story.

Ready to put your chart-reading skills into practice? Open a demo account with Taurex today and explore our advanced charting tools risk-free. With multi-regulated security, competitive spreads, and comprehensive educational support, we’re here to help you take charge of your trading journey.