Many traders wonder why some people catch market reversals so accurately while others keep buying at the top and selling at the bottom.

The difference often comes from understanding how big institutions trade. Banks, hedge funds, and other large investors move the market with their large orders. Order block trading helps traders see where that activity happens.

Order blocks are like footprints left by institutions. When they buy or sell large amounts, their actions leave clear marks on the chart. Learning to identify these areas allows traders to follow the “smart money” rather than trade against it.

Understanding Order Blocks in Trading

An order block is a price area where institutional traders placed large buy or sell orders that caused a noticeable market move. Unlike simple support and resistance levels, order blocks highlight where institutions actually entered the market.

For example, imagine the EUR/USD pair moving sideways before rising sharply. The last consolidation area marks the bullish order block. This is where institutions quietly built their long positions before pushing the price higher.

Order block trading is a core part of Smart Money Concepts (SMC). It focuses on how big players shape market structure instead of reacting to surface-level price patterns. Traditional levels respond to what has already happened. Order blocks, on the other hand, indicate where institutions are likely to defend their positions when prices return.

If a hedge fund entered long positions around 1.1000, it would try to prevent the price from dropping below that level. Recognising this behavior helps traders find strong entry zones with a higher chance of success.

The Mechanics of Institutional Price Zones

Institutions cannot easily buy or sell billions in a single order. Doing so would move the market dramatically and worsen their entry prices. Instead, they divide large positions into smaller orders and execute them gradually using trading algorithms.

According to LiteFinance, institutional traders divide their large orders into smaller parts specifically to minimise market impact. This process creates the distinctive price patterns we recognise as order blocks. This reflects experienced investors gradually building their positions, while retail traders become increasingly impatient.

Market makers and liquidity providers also play an essential role. They absorb institutional orders and provide the liquidity needed for these large transactions. To fill their positions efficiently, institutions often drive prices toward liquidity clusters, such as areas where stop losses or pending orders are concentrated.

Modern trading algorithms have made this process more precise. High-frequency systems execute thousands of micro-orders per second, but their activity still leaves distinct order block formations. Taurex’s advanced trading platforms, such as MetaTrader 4 and MetaTrader 5, allow traders to analyse these formations clearly through multi-timeframe charting and real-time data.

Liquidity is the key to understanding institutional behavior. Every strong market move requires liquidity as fuel. Institutions know where it sits and use order blocks to position themselves before major price movements begin.

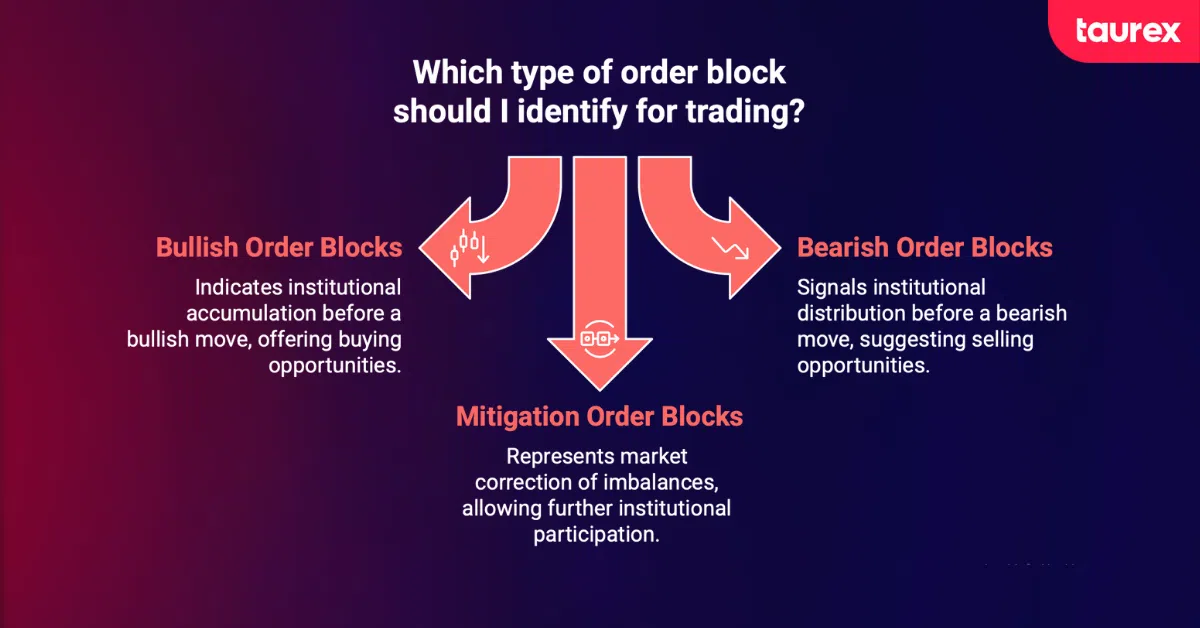

Types of Order Blocks You Need to Know

There are three main types of order blocks, each with its own structure and trading implications.

Bullish Order Blocks

A bullish order block forms where institutions accumulate long positions. According to XS.com, it appears after a downtrend and just before a sharp bullish move. The last bearish candle before this reversal marks the accumulation zone.

The candle body is typically vast and closes near its low, indicating selling pressure that institutions absorbed before the market turned upward. When the price later revisits this zone, institutions often defend it, making it a strong area for potential buying opportunities.

Bearish Order Blocks

Bearish order blocks appear near market tops or before strong downward moves. FXOpen confirms that they form when institutions distribute their long positions or initiate prominent sell positions. To identify them, look for the last bullish candle before a rapid decline.

This zone represents the point where “smart money” offloaded positions to retail buyers entering late. When price returns here, it often meets heavy selling pressure again.

Mitigation Order Blocks

As Noctorial points out, a mitigation order block appears when the market revisits a previously formed block to correct an imbalance.

This happens because significant moves often create “unfilled” price zones or inefficiencies. When price returns to these levels, it “mitigates” the imbalance by allowing further institutional participation or profit-taking.

Finding High-Probability Order Blocks

Not all order blocks are reliable. Some offer crystal-clear trading opportunities while others lead to false signals. Let’s walk through the process of identifying the ones worth trading.

Start with the basic identification process. FluxCharts outlines it clearly: find an area of consolidation, then look for a significant directional movement. Your order block is the last candle moving against that direction.

But most traders fail when they mark every candle before a move as an order block. According to ATAS, valid bullish order blocks must meet specific criteria. The bearish candle must be the lowest among all bearish candles during the decline and close in its lower half.

ForexBee emphasises that high-probability order blocks align with other Smart Money Concepts, such as break of structure, liquidity grabs, and change of character. When you see an order block form after a liquidity sweep above old highs or below old lows, you’re looking at institutional positioning after stop hunting.

Timeframe selection matters more than most traders realise. FXOpen Market Pulse notes that order blocks visible on higher timeframes tend to be more reliable. A daily order block carries more weight than a 5-minute one because it represents larger institutional positions that take longer to build.

Some common identification mistakes include marking wicks as order blocks (with a focus on the body), ignoring market structure (since order blocks should align with the trend), and failing to wait for confirmation.

Your tools don’t need to be complicated. While some traders use specialised indicators, the best order block traders rely on clean charts and price action. Draw rectangles from the high to the low of your identified order block candle. That’s your zone. When price returns, watch how it reacts. If you’re not yet comfortable reading price action, start with our guide on how to read charts to build that essential skill.

Trading Strategies That Actually Work

Success with order block trading is not just about spotting the zones. It comes from knowing how to act when the price returns to them. Execution and proper planning are key.

One common method is using limit orders. For a bullish order block, place your buy order near the top of the zone. For a bearish block, place your sell order near the bottom. This approach offers a strong risk-reward setup, but it does not trigger every time. Another approach is to wait for confirmation. Let price enter the order block and show signs of rejection. Understanding the types of Forex orders, including limit orders, stop orders, and OCO setups, is essential for executing order block strategies effectively.

Look for candlestick patterns like pin bars, engulfing candles, or small structure shifts on lower timeframes. This method may result in a slightly worse entry price but avoids many false signals. Some traders combine these strategies. They enter a partial position at the order block and add more once the rejection is confirmed.

Multiple-timeframe analysis can improve accuracy. Start with a daily or 4-hour order block to grasp the overall trend. Next, switch to hourly or 15-minute charts to pinpoint precise entries. When a smaller timeframe order block aligns with a higher timeframe block, it signals a high-probability setup.

Executing trades around order blocks also involves understanding how the price behaves near institutional zones. Institutions often defend these areas when prices return. Watching for subtle rejections or consolidations around the block helps confirm the strength of the zone. Taurex platforms, such as MetaTrader 4 and 5, make it easier to track these reactions with clear charts and real-time data.

Risk management is critical when trading order blocks. Poor management can destroy accounts even if your analysis is correct.

Stop placement is essential. Place your stop slightly beyond the order block instead of at its edge. For bullish blocks, this means a stop below the lowest point with a small buffer. For bearish blocks, a stop goes above the high of the zone. This approach accounts for temporary spikes that could trigger your stop before the main move begins.

Position sizing should be disciplined. Risk only 1-2% of your trading capital per trade. Even if a setup looks perfect, taking on too much risk can wipe out gains.

Risk-reward ratios should always be considered. Aim for at least 1:2, but order blocks often allow much better setups. Since you enter near institutional levels, stops can be tighter, and potential targets can stretch to the next structural level or opposing order block.

Exits require planning. Some traders take partial profits when the trade reaches a 1:1 or 1:2 ratio, then trail the remaining position. Others aim for the next significant order block or liquidity zone. Trailing stops protect profits while keeping you in a trend. Once the price moves 1:1 in your favor, move your stop to breakeven. Continue trailing stops below higher lows for long trades or above lower highs for short trades.

Order Blocks vs. Other Trading Concepts

Understanding how order blocks differ from other trading concepts helps prevent confusion and improve analysis. Many traders mix up these ideas, which can lead to poor decisions.

Order blocks are specific areas tied to institutional activity. They show where large players actually traded. Supply and demand zones, on the other hand, are broader areas where price has historically reversed. Order blocks are more precise and indicate real institutional participation.

Support and resistance levels are horizontal lines that many traders watch. They show where the price bounced before. Order blocks show where institutions positioned themselves and are likely to defend.

Breaker blocks are related to order blocks. When an order block is invalidated, it can turn into a breaker block. For example, a bullish order block that fails and closes below the zone often becomes a resistance level. This reflects the psychology of institutions that now seek to exit their positions at breakeven.

Fair value gaps are another concept in the Smart Money framework. These gaps indicate areas where the price moved quickly due to institutional activity, resulting in miniature trading in between. Order blocks highlight where institutions entered, while fair value gaps show the price imbalances created.

Liquidity zones are the areas where stops and pending orders cluster. Order blocks often form near these zones because institutions need liquidity to fill prominent positions efficiently. Understanding these relationships helps traders anticipate market moves with more confidence. For another advanced technique that reveals hidden market signals, explore Forex divergence strategy, which shows when price and momentum indicators disagree, often signaling potential reversals.

Advanced Order Block Concepts

Once you grasp the fundamentals of order blocks, you can leverage advanced concepts to enhance precision and gain a competitive edge.

Nested order blocks occur when smaller timeframe blocks form inside larger ones. For example, a daily bearish block might contain multiple 4-hour bullish blocks. These create complex zones where institutional interests overlap. Trades in these zones can be choppy but offer strong opportunities when handled carefully (Alchemy Markets).

Refining order blocks can improve entry points. Instead of treating the whole candle as the zone, focus on areas like the candle body or the midpoint. This often provides more accurate entries.

Combining order blocks with other Smart Money concepts multiplies their effectiveness. Look for breaker blocks, structure shifts, or changes of character patterns near a block. These confluences often mark primary institutional interest (FTMO).

According to TradeThePool, identifying institutional manipulation patterns can also help. Stop hunts or liquidity grabs often occur before order block formation. Recognising these moves provides insight into where large players are positioning themselves.

Mastering these advanced ideas allows traders to see the market through the lens of institutions. Order blocks remain a key tool, but combining them with other SMC concepts strengthens your trading strategy.

Common Mistakes and How to Avoid Them

Even experienced traders can make errors when using order blocks. Learning from these mistakes helps you trade more effectively.

One common error is relying on order blocks alone. No single concept works in isolation. Order blocks are powerful, but you should always consider the broader market context, including trend direction, momentum, and fundamental events.

Ignoring the trend is another frequent mistake. A textbook order block in a strong downtrend may fail if you trade against the dominant market structure. Always align trades with the primary trend rather than against it.

Timeframe selection also matters. Many new traders focus on tiny charts and mark order blocks everywhere. These micro zones rarely hold because they do not represent significant institutional interest. Start with daily or 4-hour charts, then refine entries on smaller timeframes.

Risk management is crucial. Even if an order block looks perfect, taking too many risks can destroy your account. Stick to rules like limiting risk to 1-2% per trade.

Finally, patience is essential. Waiting for confirmation prevents entering trades too early. Let price approach the zone and show rejection signals before committing capital. This simple step reduces false entries and increases success over time. If you’re still building your foundation, our guide on how to become a Forex trader covers the essential steps (from education to risk management) that every trader needs before applying advanced strategies like order blocks.

Conclusion

Order block trading offers insight into institutional operations, a perspective often overlooked by retail traders. Understanding where smart money positions itself helps you trade with the market rather than against it.

The framework we covered—from basic identification to advanced manipulation patterns—gives a complete approach to trading alongside institutions. Knowledge alone is not enough. Practice is key. Start by identifying order blocks on higher timeframes in markets you follow. Watch how the price reacts when it returns to these zones.

Consistency and proper risk management are more important than finding perfect setups. Each order block tells a story about institutional behavior. Your task is to read these stories and position yourself accordingly.

Take action today. Mark three potential order blocks in trending markets and observe price behavior. Start with demo trading to build your confidence. With Taurex’s platforms, such as MetaTrader 4 and MetaTrader 5, you have the tools to identify and trade institutional zones effectively. Compare your options in our guide to the best Forex platforms to find the charting capabilities you need for order block analysis.