Last week saw mixed global economic data. The United States showed strong economic performance, supported by solid GDP growth, accelerating consumer spending, improved consumer confidence, and continued resilience in the labor market, despite a rise in crude oil inventories. In contrast, the Eurozone recorded a relative slowdown, with weaker services sector activity and easing inflation, reinforcing expectations of continued accommodative monetary policies. The United Kingdom showed noticeable improvement in purchasing managers’ indices and retail sales, although inflationary pressures remain elevated. In Asia, Japan maintained a stable monetary policy stance despite a slowdown in industrial production, while Australia demonstrated clear strength in its labor market and overall economic activity. China, meanwhile, continued to display mixed signals, with weak domestic demand in the property and consumption sectors offset by improving industrial production and a record trade surplus, highlighting the country’s continued reliance on exports to support growth.

Market Analysis

USD/THB (US Dollar / Thai Baht)

The US dollar continues its downward trend against the Thai baht, reaching a level of 30.88 on Wednesday, its lowest level since March 23, 2021, before closing at 31.06. The pair has declined by around 6% from its peak on October 22, 2025, at 32.91 to last Wednesday’s low of 30.88, and is down approximately 1% since the beginning of the year.

This decline comes amid broad selling pressure on the US dollar against most major currencies, while recent economic data from Thailand indicate a relatively resilient economy. The Relative Strength Index (RSI) currently stands near 39, signaling negative momentum for USD/THB. In addition, a bearish crossover between the MACD line and the signal line reinforces the likelihood of continued downside momentum.

Earnings of Major US Corporations

Markets are closely watching this week’s earnings releases from five major US technology companies for the fourth quarter of last year.

Wednesday, January 28:

Microsoft is expected to report earnings of $3.91 per share, compared with $3.23 previously. Revenues are expected to reach $80.25 billion, versus $69.60 billion in the prior reading. The RSI stands at 46, indicating bearish momentum, alongside a bearish MACD crossover that strengthens the downside outlook for the stock.

Meta is expected to post earnings of $8.19 per share, compared with $8.02 previously, with revenues forecast at $58.34 billion versus $48.39 billion.

Tesla is expected to report earnings of $0.44 per share, down from $0.77 previously, while revenues are projected at $24.96 billion, compared with $25.71 billion in the previous period.

Thursday, January 29:

Apple is expected to report earnings of $2.67 per share, compared with $2.40 previously, with revenues projected at $137.23 billion versus $124.30 billion.

Amazon is expected to post earnings of $1.95 per share, up from $1.86 previously, while revenues are forecast at $211.26 billion, compared with $187.79 billion.

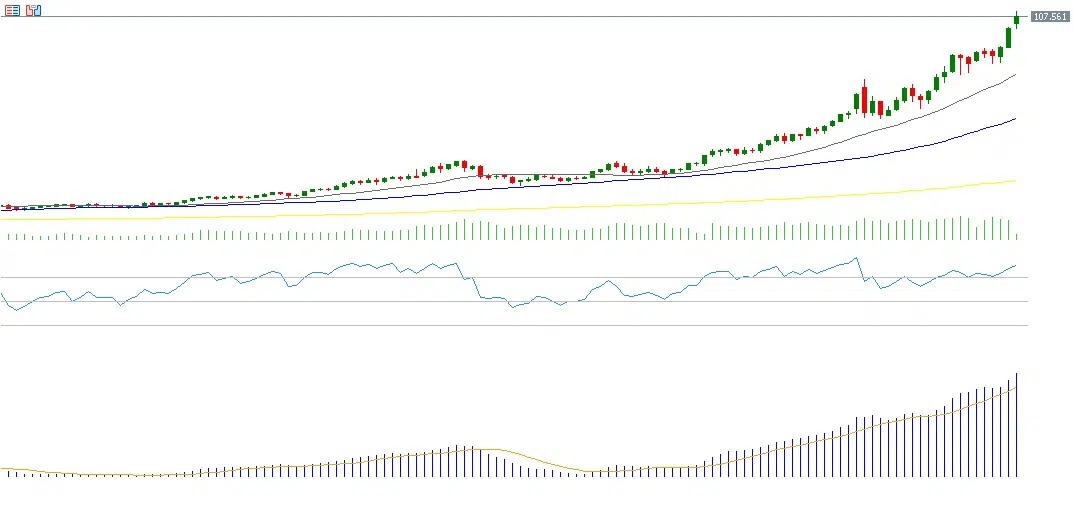

Silver

Silver prices rose by around 15% last week, reaching a new all-time high on Friday at $103.39. Prices are also up roughly 44% since the beginning of the year, outperforming most commodities, including gold and platinum.

The outlook points to a continuation of the bullish trend, supported by several factors, most notably the positive correlation between gold and silver, as silver typically rises at a faster pace when gold advances. Strong industrial demand, driven by its use in medical equipment, electronics, electric vehicles, and solar panels, continues to support prices. In addition, a persistent supply deficit—where demand exceeds annual supply—adds upward pressure, alongside market expectations that the US Federal Reserve will cut interest rates twice over the coming year. The RSI currently stands at 78, placing silver in overbought territory and indicating strong bullish momentum. A bullish crossover between the MACD and the signal line further supports the positive outlook.

Nasdaq 100 Index

The Nasdaq 100 rose by approximately 0.30% over the past week, closing at 25,605 points and posting gains of about 1% since the beginning of the year. Expectations remain for continued positive momentum in US equities, despite elevated valuations, driven by several factors. These include easing tensions between the United States and the European Union over Greenland, as well as strong US economic performance, with third-quarter GDP growth reaching 4.4%, exceeding expectations and the previous reading, supported by higher consumer spending, stronger exports, and accelerated government spending.

Corporate earnings for the last quarter of the previous year have generally been positive, particularly in the banking sector, with investors awaiting results from major technology companies this week. The positive momentum in large technology stocks linked to artificial intelligence also continues, supported by strong demand and significant investment flows into AI-related infrastructure. The RSI currently stands near 53, indicating a bullish bias for the index.

Key Events This Week

Markets are set to focus on several important economic indicators this week.

On Monday, US durable goods orders will be released.

On Tuesday, investors will watch the US consumer confidence index.

On Wednesday, attention will turn to interest rate decisions from both the Bank of Canada and the US Federal Reserve, with expectations for rates to remain unchanged at 2.75% in Canada and between 3.75% and 4.00% in the United States. Markets will closely monitor Federal Reserve Chair Jerome Powell’s tone and comments regarding the future path of monetary policy. Data on Australian consumer prices and US crude oil inventories will also be released.

On Thursday, Eurozone consumer confidence data will be published, along with US jobless claims, factory orders, and trade balance figures.

Finally, on Friday, Tokyo consumer price data will be released, along with GDP figures for both the Eurozone and Canada.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.