The Forex market recorded around $9.6 trillion in daily turnover in 2025. With numbers like that, it is no surprise that traders are turning to automation. The global trading bot market, valued at $3.15 billion in 2024, is expected to reach $18.79 billion by 2030.

Automation has become more common across the trading landscape, particularly among traders who use structured processes and defined risk management.

At the same time, the majority of retail traders continue to struggle, often due to gaps in preparation, unrealistic expectations, or inconsistent execution.

This contrast highlights an important point: trading tools alone do not determine outcomes. What matters most is how those tools are selected, configured, and monitored within a broader trading approach.

So how can robots help some traders succeed while others continue to struggle?

The answer is knowing what these systems can really do, where they fall short, and how to separate useful tools from scams.

Platforms like Taurex provide vetted access to trading tools and robots, helping traders make more informed choices within a broader risk‑aware approach.

CFDs and Forex are complex instruments and come with a high risk of losing money rapidly. Make sure you understand how CFDs work and whether you can afford the high risk.

What is a Forex Trading Robot?

A Forex trading robot is a software program that can make trading decisions for you. It follows pre‑defined rules to initiate actions, but does not guarantee outcomes. You may also hear these called Expert Advisors, or EAs, especially on platforms like MetaTrader 4 or MetaTrader 5, where most of these systems are used.

Think of it this way. A Forex trading robot follows a set of pre-programmed instructions. When certain market conditions appear, such as a moving average crossover, an RSI reading reaching a specific level, or a particular candlestick pattern forming, the robot executes a trade automatically. There is no hesitation, no second-guessing, and no emotional decision-making.

The appeal is simple. Markets never sleep. Forex operates 24 hours a day, five days a week, covering time zones from Sydney to New York. You need rest. A Forex trading robot does not.

These systems have been around for years and gained widespread use after MetaTrader 4 launched in 2005. That platform made it easy for developers to create automated strategies, leading to a whole ecosystem of Forex trading robots.

How do they work technically? Most Forex trading robots continuously scan market data for conditions that match their programmed rules. When a match occurs, they generate signals and, if automation is fully enabled, execute trades through your broker’s platform, often within milliseconds.

Many robots also include built-in risk management features, such as stop-loss orders, take-profit levels, and position sizing rules. Platforms like Taurex offer additional guidance and tools to help you configure robots safely and efficiently.

How Forex Trading Robots Actually Work

Understanding how Forex trading robots operate can help you decide whether they might fit your trading approach.

How the Automation Works

A Forex trading robot monitors the market constantly, analysing market data based on programmed conditions. It looks at price movements and checks technical indicators like RSI, moving averages, Bollinger Bands, and MACD. When it spots a setup that matches its rules, it sends a signal.

Once the signal appears, the robot can place the trade automatically. That means it can act in seconds, faster than any human could, and without letting emotions get in the way.

Most robots also manage risk for you. They can set stop-loss and take-profit levels and adjust how much you trade on each position. Some even manage multiple trades at once and adapt to changing market conditions.

What Are The Different Strategy Types

Not all Forex trading robots use the same approach. Their strategies vary significantly.

- Scalping robots try to make small profits from tiny price changes. They trade frequently and need fast execution to work well.

- Trend-following robots aim to ride market momentum. They perform best when the market has a clear direction, but can struggle in sideways markets.

- Grid trading systems place trades above and below the current price to capture moves in any direction. These can be risky in strong trends.

- Arbitrage robots hunt for price differences between brokers or instruments. These chances are rare today, though.

- Hedging robots open opposite trades to manage risk, but they need careful setup.

What You Need to Make Them Work

Running a Forex trading robot effectively involves more than just purchasing the software. You need a reliable internet connection, and many traders use a Virtual Private Server to ensure their robot runs continuously, avoiding interruptions from power outages or connectivity issues.

The robot must be compatible with your Forex trading platform, and your broker must support automated trading with competitive spreads and fast execution. ECN or STP brokers are often best for robot trading, especially for scalping strategies.

Your account balance also matters. Robots need enough capital to handle normal drawdowns without triggering margin issues.

Platforms like Taurex can simplify this setup by providing integrated broker connections and automated tools to monitor your robot’s performance, while emphasising risk management and transparency.

CFDs and Forex are complex instruments and come with a high risk of losing money rapidly. Make sure you understand how CFDs work and whether you are comfortable with the risks involved.

What Are The Advantages of Using a Forex Trading Robot?

It is important to be fair. Forex trading robots are not magic, but there are genuine reasons why traders use them, and some benefits are very real.

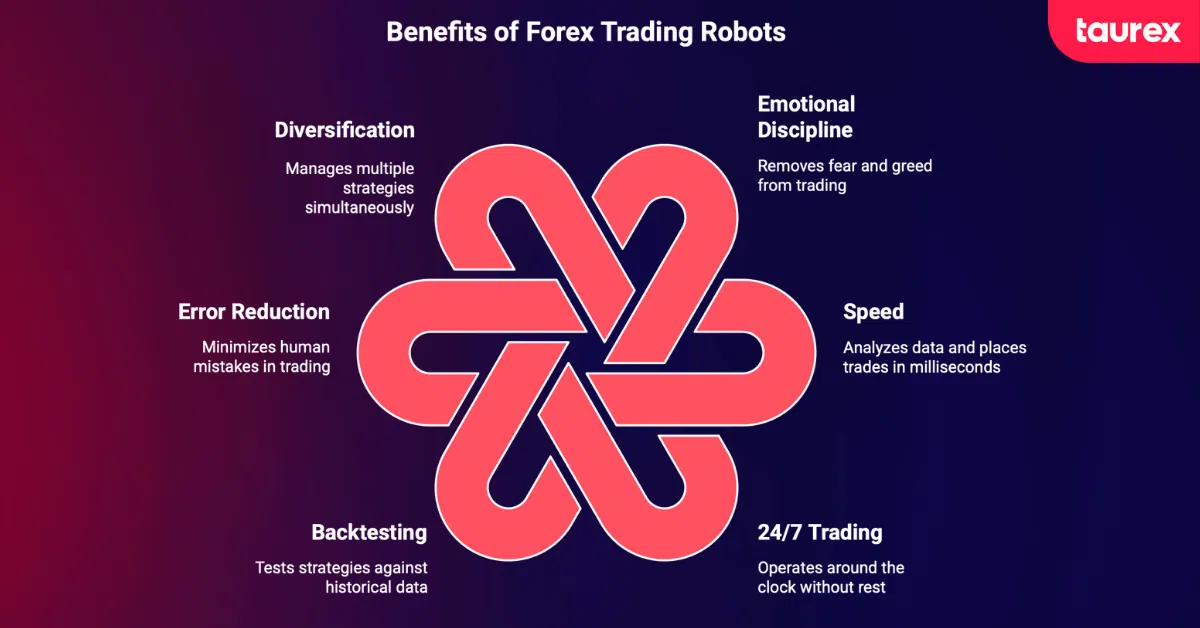

Emotional Discipline

One of the strongest reasons to use automation is to remove emotion from trading. Fear, greed, and hesitation can ruin even the best strategies. You might have a solid plan, but fail to follow it because emotions get in the way.

Automated systems stick to their programmed rules. They do not panic during losses or get overconfident after winning trades. They simply follow the strategy every single time. If you have ever closed a position too early out of fear or held a losing trade hoping it would recover, you know how valuable this consistency can be.

Speed That Humans Cannot Match

Markets move fast, and timing is critical. A Forex trading robot can analyse data, spot opportunities, and place trades in milliseconds. For strategies that rely on small price movements, this speed can make a significant difference.

Robots can also monitor several currency pairs at once, tracking multiple indicators across timeframes without losing focus. A human trader watching one chart might miss what is happening elsewhere.

Trading Around the Clock

The Forex market operates 24 hours a day, five days a week. It moves from Sydney to Tokyo, London, and New York without pause. If you are asleep during the Asian session, you may be missing potential trades.

A Forex trading robot does not need rest. It can operate through every session, reacting to market conditions at 3 AM as effectively as at 3 PM.

Backtesting Before Using Real Money

Reputable trading robots let you test strategies against historical data before risking your capital. Backtesting helps you see how a system might have performed under different market conditions.

This does not guarantee future success, but it gives you a clearer idea of the strategy’s logic and potential behaviour.

Reducing Human Error

Even experienced traders make mistakes. You might enter the wrong position size, forget a stop-loss, or click buy when you meant to sell. Automation removes these errors, keeping your trading consistent and disciplined.

Diversification Across Strategies

One trader can realistically manage only a few strategies at once. Robots can run multiple approaches simultaneously, trading different currency pairs and spreading risk across different market conditions. This allows a broader, more diversified approach than manual trading often permits.

With Taurex, you can access robots vetted for performance and transparency, giving you tools to make automation work safely.

What Are The Real Disadvantages and Risks of Forex Trading Robots You Need to Understand?

Now it is time for the harder truths. Forex trading robots can offer advantages, but they also come with serious limitations. Understanding these before committing your money is essential.

-

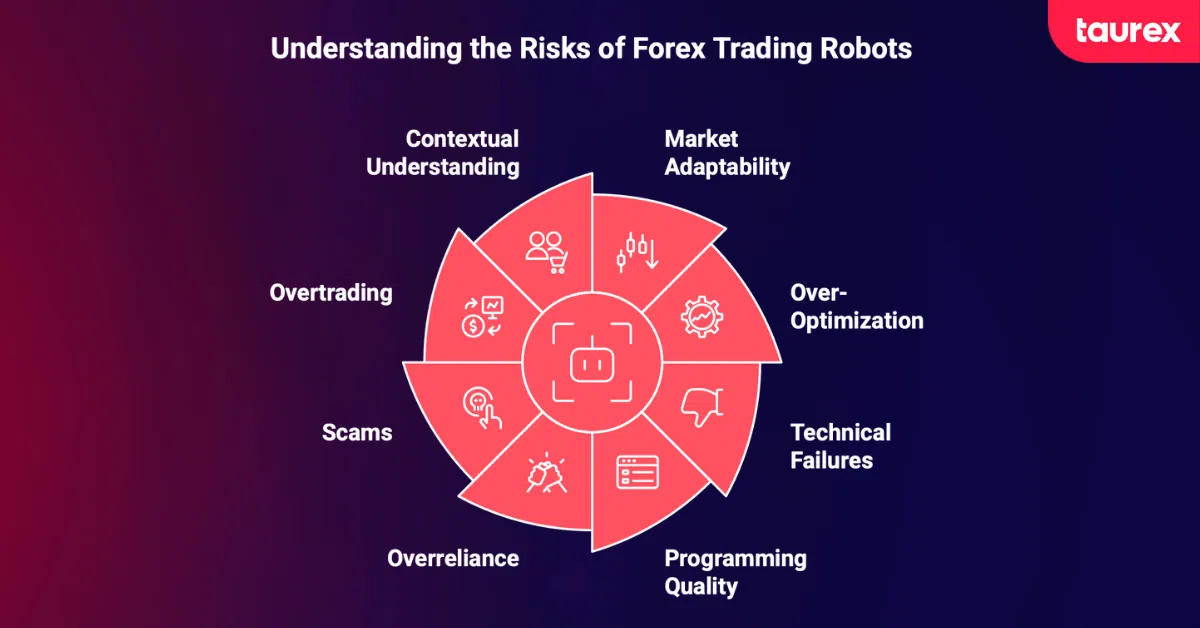

Markets Change, but Robots Cannot Adapt

This is perhaps the biggest challenge. A bot for Forex follows programmed rules and cannot truly understand context. When market conditions shift unexpectedly, whether due to an economic shock, a geopolitical crisis, or a rare “black swan” event, robots often struggle. During periods of high volatility, robots may fail because they stick rigidly to predefined rules. A strategy that works in normal conditions can generate heavy losses when volatility spikes or liquidity disappears.

-

The Trap of Over-Optimisation

Many traders fall into this trap. A robot can be “overfitted” to historical data, producing impressive backtest results. The problem is these results often reflect patterns that do not persist in live markets. Real trading introduces slippage, variable spreads, and differing liquidity that backtests cannot fully replicate. A robot that looks brilliant on paper may perform poorly in practice.

-

Technical Failures Happen

Software is not perfect. Bugs, connectivity issues, platform updates, and server downtime can all disrupt trading. If your robot opens a position and then loses connection, or a glitch causes it to enter the wrong trade size, the consequences can be costly. Having contingency plans for technical problems is critical.

-

Programming Quality Varies

The effectiveness of a robot depends on the skill of the programmer. Poorly designed algorithms produce poor results. Most traders cannot assess code quality themselves and must rely on marketing claims, which may be misleading.

-

Overreliance Can Breed Complacency

Automation can create a false sense of security. Traders might assume the robot will handle everything and stop monitoring their trades. Even the best systems require human oversight. Treating a robot as completely hands-off is a path to disappointment.

-

Scams Are Common

The market contains many scam robots. Some promise guaranteed profits or zero risk, which are immediate red flags. Others present cherry-picked results or fabricated backtests. Some are designed to steal account information or drain funds. Experienced reviewers note that a large proportion of Forex trading robots are either scams or ineffective. The low barrier to entry means poor-quality products are widespread.

-

Overtrading Can Erode Accounts

Some robots, especially high-frequency scalping systems, execute too many trades. Each trade carries costs, and excessive trading can deplete an account through fees and spreads without producing meaningful profits.

-

Robots Cannot Read Context

A human trader can assess news, sentiment, and geopolitical developments. Robots cannot. They only react to price changes after they occur and miss the nuanced context that shapes market behaviour. Unexpected central bank announcements or economic data surprises can catch automated systems off guard.

What Does the Data Actually Show About Forex Trading Robot Performance?

Let’s take a closer look at what research tells us about how well Forex trading robots perform.

According to Traders Union, the average success rate for legitimate robots ranges from 50 to 75%. These figures may vary widely depending on market conditions and methodology. Some developers publish high win-rate figures, but these numbers are often based on limited datasets or specific market phases. Without verified, long-term results across varying conditions, such claims offer little insight into real-world performance.

Verified performance data presents a mixed picture. For example, QuantVPS reports that some top-performing robots, such as Forex Fury, have claimed win rates of 93 percent through Myfxbook verification. However, these verified results represent only a small portion of the overall market, specific timeframes and conditions, not guaranteed results.

Here is the paradox we mentioned earlier. While automation is widely used, outcomes differ significantly based on preparation, discipline, and ongoing involvement. Automation can support a structured approach, but it does not compensate for gaps in experience or planning.

Several factors explain it. Traders who use automation effectively typically have a solid understanding of market behaviour, risk management, and strategy limitations. They treat robots as tools to support decision-making, not as replacements for knowledge or oversight. They do not simply buy a system and hope for the best. Instead, they choose suitable robots, configure them carefully, monitor performance, and intervene when necessary.

They also use robots as tools within a broader trading strategy rather than relying on them entirely. Even profitable traders often see mixed results over time. A robot might perform well for months and then struggle when market conditions change.

Success Depends on Multiple Factors

- Algorithm quality: High-quality robots that are rigorously tested across different market conditions separate functional systems from those that only look good on paper.

- Market alignment: A trend-following robot will struggle in sideways markets. A scalping system designed for quiet markets will suffer during high volatility.

- Proper configuration: Adjusting risk settings, choosing the right currency pairs, and fine-tuning settings for current conditions all affect outcomes.

- Maintenance and updates: Markets evolve, and robots need periodic recalibration to remain effective.

How to Identify Forex Trading Robot Scams?

Fraud is common in the world of Forex trading robots, so knowing how to protect yourself is essential. The biggest red flag is unrealistic profit claims. A key warning sign is claims of guaranteed outcomes or predictable performance. Any robot promising 100 percent returns, guaranteed profits, or risk-free trading is almost certainly a scam. Legitimate traders and developers know that every trade involves risk, and no system can eliminate it.

Transparency is another important factor. If a vendor cannot explain how the robot works in general terms, it is worth questioning why. Similarly, missing or unverifiable trading history is a warning sign. Reliable robots can show verified results on independent platforms like Myfxbook or FX Blue. If a vendor only shares self-reported data and cannot provide independently verifiable result, take that with caution.

Fake reviews are common, so look for independent user experiences on trading forums rather than relying on testimonials from the vendor’s website. High fees without a refund policy can also indicate a lack of confidence in the product, and poor customer support before purchase often predicts the same after purchase. Be wary of pressure tactics, like “limited time offers,” or vague claims that the robot can adapt to any market condition. These are often marketing gimmicks.

Before committing real money, verify live account results on independent platforms, test the robot extensively on a demo account, and research the developer’s track record. Check not only win rates but also drawdowns. A robot with a 90 percent win rate but occasional 50 percent losses can be much riskier than one with a 60 percent win rate and moderate losses.

Taking these precautions helps you separate legitimate tools from scams and reduces the risk of losing your investment to fraud.

What Are The Best Practices for Using Forex Trading Robots?

If you are thinking about trying automated trading, there are a few practical steps you can take to make it work better and reduce unnecessary risk.

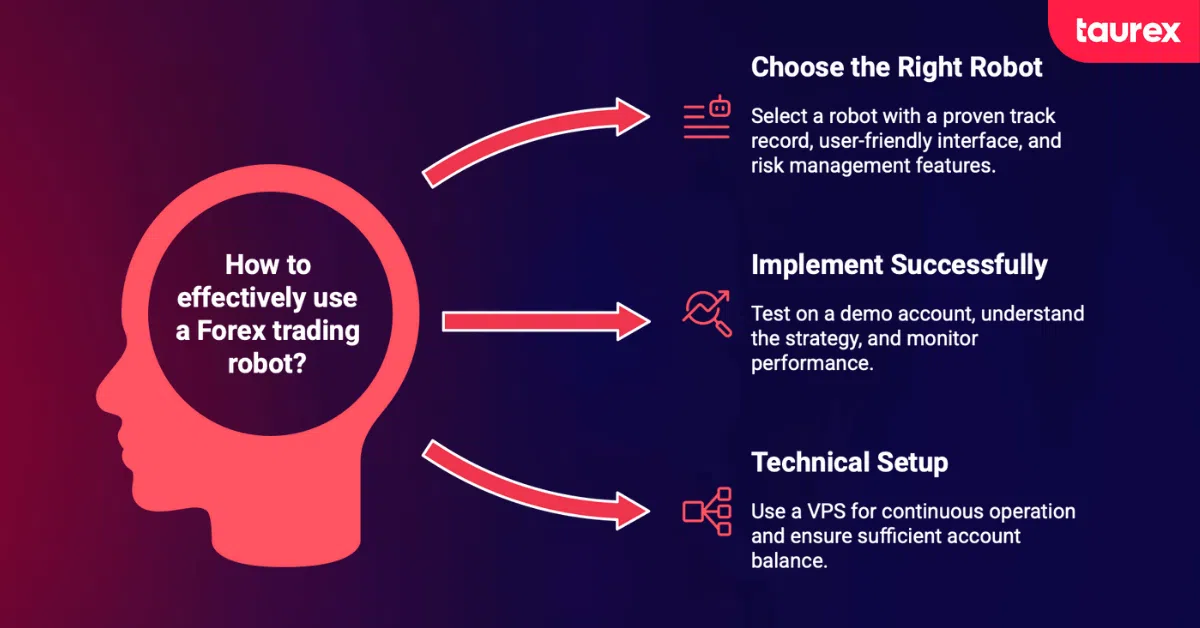

Choose the Right Robot

First, focus on robots with a longer track record of transparent performance across conditions. Short-term gains can be impressive, but they rarely tell the whole story. Backtesting is useful, but only if it is realistic. That means considering slippage, varying spreads, and actual tick data instead of idealised scenarios.

You will also want a robot with a user-friendly interface. If you are not very technical, this makes it easier to set up and monitor. Flexibility is important too. Robots that let you tweak settings to match your risk tolerance and trading style give you much more control.

Risk management features are non-negotiable. Look for built-in stop-losses, take-profit levels, and drawdown limits. It also helps if the robot works on MetaTrader 4 or 5, so you can pick a compatible broker. Transparent pricing, responsive customer support, and regular software updates are good signs that the developer is committed to their product.

Implement a Robot Successfully

Always start on a demo account. This lets you test the robot without risking your money and helps you see how it behaves in real market conditions. Take time to understand the strategy behind it. Know which indicators it uses and how it makes decisions. If you do not understand it, you cannot manage it effectively.

Even though the robot trades automatically, you still need to check in regularly. Watch for unusual behaviour, track performance, and keep an eye on market conditions. A trend-following robot, for example, may not do well in a sideways market. You may need to pause or adjust it.

Diversification matters. If you have enough capital, running more than one robot can spread risk. Set realistic expectations. Losses are part of trading, and knowing a system’s normal drawdown helps you stay prepared. Adjust settings as conditions change, but always maintain proper risk limits. Never risk more than you are comfortable losing, regardless of any claims.

Keep the software up to date. Developers release patches and improvements to fix bugs and keep their robots compatible with changing platforms. And choose brokers carefully. Low spreads, fast execution, and policies that support automated trading make a real difference.

Technical Setup Considerations

Using a Virtual Private Server, or VPS, ensures your robot keeps running even if your local internet goes down or there is a power outage. You still want a reliable connection at your location for monitoring.

Make sure your account has enough balance to handle normal drawdowns and avoid margin calls. Brokers that offer ECN or STP execution usually provide faster trades and tighter spreads, which is especially useful for scalping strategies.

The Bottom Line: Should You Use a Forex Trading Robot?

The realistic view is that Forex trading robots may have value for some traders when used appropriately, but “can” comes with important caveats. How well they perform depends on how they are used.

When Robots Tend to Work Well

- Built on solid, thoroughly tested algorithms.

- Used by traders who understand the underlying strategy.

- Properly configured for current market conditions.

- Regularly monitored and adjusted as needed.

- Combined with human oversight and sound risk management.

- Operate in market conditions they were designed to handle.

When Robots Tend to Fail

- Treated as “set and forget” solutions requiring no attention.

- Based on poor programming or fraudulent products.

- Market conditions shift dramatically from what the robot expects.

- Traders expect guaranteed profits without effort.

- Over-optimised for historical data that does not reflect current reality.

- Used as complete replacements for trading knowledge.

For new traders, the priority should be education. Understanding how Forex works, developing analytical skills, and learning risk management lay a strong foundation for evaluating and using automation effectively.

For experienced traders, a Forex bot can be a useful tool within a comprehensive trading approach. It can help maintain discipline, monitor markets during off-hours, and execute strategies consistently. But it works best when you remain actively engaged with its performance.

Traders who succeed with automation typically:

- Have a deep understanding of trading.

- Research products thoroughly.

- Test extensively before committing real capital.

- Maintain ongoing oversight of their systems.

- Integrate automation into a disciplined risk‑aware approach.

Remember, trading always carries risk. No robot can eliminate that reality, and any product claiming otherwise should be avoided.

Approach automated trading with realistic expectations, thorough research, and active engagement. If you do, a robot can enhance your trading approach. If you are looking for effortless profits without knowledge or involvement, you are likely to be disappointed.

If you want to explore Forex trading robots without risking real money, opening a free demo account with Taurex is a practical next step. A demo environment lets you test automated strategies, understand how robots behave in real market conditions, and practice risk management before committing capital. This hands-on experience can help you decide whether automation fits your trading style and experience level.

Frequently Asked Questions

What win rates can legitimate Forex trading robots achieve?

Research from the Traders Union shows that most reputable robots have success rates between 50 percent and 75 percent. Some premium systems advertise higher rates, but you should treat these claims with caution and always verify results independently using platforms like Myfxbook. Numbers alone don’t tell the full story. Note that win rates vary widely and depend on conditions, strategy, and timeframe.

If I use a robot, why do so many traders still fail?

A robot is a tool, not a magic solution. Traders often fail because they rely on automation without understanding the market, choosing the right system, setting it up properly, or keeping a close eye on performance. A robot may enhance a well-planned strategy, but it cannot replace trading knowledge or careful decision-making.

How can I spot a Forex trading robot scam?

There are several warning signs. Be suspicious if a robot promises guaranteed profits, makes unrealistic claims, or provides no verified performance data. High-pressure sales tactics, a lack of transparency about how the system works, and poor customer support are also red flags. Legitimate robots show verifiable results on independent platforms and often provide refund options if things don’t go as expected.

Do I need any special setup to run a robot?

Yes. Most robots run on MetaTrader 4 or 5 and require a broker that supports automated trading. Many traders use a Virtual Private Server (VPS) to keep the robot running 24/7 without interruptions from power or internet outages. You’ll also need reliable internet connectivity and enough account capital to handle normal market drawdowns.

Can a Forex bot trader replace learning how to trade?

Not at all. Experts agree that you should learn the fundamentals of trading first. Understanding the basics helps you distinguish good robots from scams and allows you to monitor and adjust automated systems effectively. A robot works best as part of a strategy you understand, not as a substitute for trading knowledge.

Risk Disclosure: Trading involves significant risk, including potential loss of principal. Past performance does not guarantee future outcomes. The information in this article is educational and should not be considered financial advice. Always conduct your own research and consider your risk tolerance before engaging in any trading activity.