Many people assume the US dollar is the strongest currency in the world. It dominates global trade, appears in most Forex transactions, and is widely held in reserves. However, when currencies are ranked purely by exchange rate value against the dollar, the USD ranks tenth.

At the same time, “strongest” can mean different things. A higher exchange rate does not automatically make a currency the most traded or the most influential in the Forex market. For traders, that distinction matters.

Understanding the difference helps traders focus on where real opportunities exist: whether that is in high-value currencies, high-liquidity pairs, or markets with stronger price movement.

This ranking focuses on exchange rate strength while also looking at what it means in practical trading terms, including liquidity, volatility, and overall market relevance.

Top 10 Strongest Currencies in the World Ranked by Global Forex Influence

Before we get into the details of each currency, here is the full picture at a glance. This table ranks all 10 currencies by their exchange rate against the US dollar as of early 2026.

| Currency Name | Code | Exchange Rate (vs USD) | Key Strength Factor |

| Kuwaiti Dinar | KWD | 3.26 | Oil reserves, basket peg, sovereign wealth |

| Bahraini Dinar | BHD | 2.65 | Oil exports, financial hub, USD peg |

| Omani Rial | OMR | 2.60 | Oil-driven economy, USD peg |

| Jordanian Dinar | JOD | 1.40–1.41 | Strategic location, fiscal discipline |

| British Pound | GBP | 1.30 | Diversified economy, London financial centre |

| Gibraltar Pound | GIP | 1.30 | Pegged 1:1 to GBP, strategic location |

| Cayman Islands Dollar | KYD | 1.20–1.22 | Offshore finance hub, tax haven status |

| Swiss Franc | CHF | 1.27 | Safe-haven status, low inflation |

| Euro | EUR | 1.17–1.18 | Second most traded currency, 20-nation bloc |

| US Dollar | USD | 1.00 (base) | Reserve currency, 90% of Forex transactions |

You may notice a few patterns right away. For example, Gulf currencies dominate the top three spots, which is backed by hydrocarbon exports and fixed or managed exchange rates. The middle section mixes strategic small economies with legacy currencies like the pound. And the bottom half features the currencies that actually dominate global trading volume, which tells you something about the gap between exchange rate strength and practical Forex relevance.

Now let’s break down each one.

Kuwaiti Dinar (KWD)

The Kuwaiti Dinar has held the number one position for decades, and the reasons are fairly straightforward once you look at the numbers. Kuwait sits on some of the largest oil reserves on the planet, and it shares that resource income across a population of just 5.2 million people. That math produces extremely high per capita income and a steady stream of foreign currency flowing into the country from oil and gas exports.

Unlike some neighbouring Gulf currencies that are fixed directly to the US dollar, the KWD is pegged to a basket of currencies. This structure gives Kuwait’s central bank more flexibility and can help reduce the impact of sharp dollar movements.

Behind the scenes, Kuwait’s sovereign wealth fund is one of the largest in the world, holding foreign exchange reserves that give the currency a thick safety net.

For Forex traders, however, the KWD is not a highly active choice. Liquidity is limited compared to major pairs such as EUR/USD or GBP/USD, and spreads are often wider. In practice, the dinar functions more as a reference point for currency value than as a commonly traded instrument.

Bahraini Dinar (BHD)

At around 2.65 USD per dinar, the Bahraini Dinar ranks among the highest-valued currencies in the world. Like Kuwait, Bahrain benefits from oil and gas revenues, which remain an important part of its economy. At the same time, the country has spent years developing its financial services sector and positioning itself as a regional banking hub.

Bahrain has attracted international capital by developing its banking and financial services sector, giving its economy a second pillar beyond hydrocarbons. That diversification matters because it means the BHD is not entirely at the mercy of oil price swings.

The currency is firmly fixed to the US dollar, which removes exchange rate uncertainty for investors and businesses operating in the region. This peg, combined with the financial sector growth, helps the Bahraini Dinar maintain strong demand and consistent value.

For Forex traders, the BHD is not a high-volume pair. But it is a useful case study in how a small nation can support a strong currency through a combination of resource income, smart diversification, and a stable peg.

Omani Rial (OMR)

Trading at around 2.60 USD, the Omani Rial completes the top three Gulf currencies by exchange rate value. Oman’s economy still relies heavily on oil, which accounts for roughly 30% of its GDP.

Like the BHD, the Omani Rial is pegged directly to the US dollar. This peg creates price stability and predictability, which is attractive for trade and investment in the region.

At the same time, Oman has been investing in tourism and other non-oil industries in an effort to strengthen its economy over the long term. Relying too much on a single commodity can create vulnerability when prices fluctuate. For now, however, steady oil revenues and the dollar peg help keep the rial among the highest-valued currencies globally.

Jordanian Dinar (JOD)

The Jordanian Dinar trades between 1.40 and 1.41 USD, which places it fourth in global exchange rate rankings. Unlike the Gulf currencies above it, Jordan does not rely on large oil reserves. Its currency strength comes from a different economic foundation.

Economic indicators also contribute to stability. Inflation is relatively low at around 2.5% in 2026, and foreign reserves stand at about $20 billion, covering more than 100% of the IMF’s reserve adequacy measure. Jordan also operates under an IMF-supported reform programme, which adds policy credibility and financial oversight.

The JOD is pegged to the US dollar within a narrow range, so it does not trade freely on global markets. Liquidity is limited for Forex traders, but the dinar demonstrates how fiscal discipline, stable policy, and strategic positioning can support a strong currency even without major natural resource income.

British Pound Sterling (GBP)

The British pound is one of the oldest currencies still in circulation, and at around 1.30 USD as of February 2026, it remains among the highest-valued globally. Unlike several currencies ranked above it, the pound floats freely, so its price moves in response to market demand, economic data, and decisions from the Bank of England.

London’s position as a major global financial centre plays an important role in supporting the currency. The UK also has a diversified economy that includes financial services, manufacturing, and technology, which adds depth beyond a single industry.

The post-Brexit period brought adjustments, and according to J.P. Morgan, the pound may face headwinds in 2026 from a softening labour market and potential fiscal tightening. Those are the kinds of macroeconomic signals that Forex traders pay close attention to when sizing positions on GBP pairs.

For active traders, GBP/USD (often called “Cable”) is one of the most liquid and actively traded pairs in the market. It responds quickly to UK economic releases, Bank of England commentary, and shifts in risk sentiment. If you are trading Forex and want exposure to a freely floating currency with real price action, the pound tends to deliver.

As with any major currency, trading the pound involves real risk. Choosing a broker that operates under clear regulatory standards can provide added transparency and structure when managing capital.

Gibraltar Pound (GIP)

The Gibraltar Pound is pegged one-to-one with the British Pound, which means 1 GIP is always equal to 1 GBP. The two currencies are interchangeable, and Gibraltar’s close political and economic ties with the UK help maintain that fixed relationship.

Gibraltar’s economy is supported mainly by shipping services and its role as a financial centre. Its location at the entrance of the Mediterranean has also contributed to its strategic importance. First introduced in 1934, the GIP functions largely as a regional currency rather than a globally traded one.

For Forex traders, the Gibraltar Pound does not have a separate market. In practice, exposure comes through trading GBP, since the GIP does not trade independently on major Forex trading platforms.

Cayman Islands Dollar (KYD)

Trading between 1.20 and 1.22 USD, the Cayman Islands Dollar is the strongest currency in the Caribbean by exchange rate value. The Cayman Islands are widely known as an offshore financial centre, attracting international capital through a favourable tax system and an established regulatory framework.

The territory’s banking sector and offshore financial services create consistent demand for the KYD. That demand, combined with the fixed exchange rate against the dollar, keeps the currency stable and strong relative to most global currencies.

If you are involved in international trading or hold positions through offshore structures, understanding how fund safety works in different jurisdictions gives you more confidence in where your capital sits.

Swiss Franc (CHF)

The Swiss Franc is the classic safe-haven currency, and 2025 was a year that proved exactly why. According to SWI swissinfo.ch, in 2025, the franc strengthened by about 12% against the US dollar and reached its highest level since 2011, trading near 0.770 per USD in early 2026. This made it one of the stronger-performing G10 currencies during the year.

Several factors support the franc’s appeal. Switzerland maintains political neutrality, low public debt, and a large current account surplus. Inflation remains relatively low at around 1.2%, compared to roughly 2.3% across Europe. Even with interest rates at 0%, investors continue to hold francs, largely because of the country’s financial stability.

For Forex traders, the CHF is most commonly traded through USD/CHF and EUR/CHF. It has historically been used in carry trade strategies due to its low-interest-rate environment. However, during periods of global uncertainty, demand for safe assets can push the franc higher, which may create sharp moves.

Some forecasts suggest EUR/CHF could move toward 0.95 in the near term, indicating that franc strength may continue into 2026.

Euro (EUR)

The euro trades around 1.17 to 1.18 USD and represents the combined economy of 20 EU member states, with Croatia joining in January 2023. It is the second most traded currency globally, and EUR/USD is the most actively traded pair in the Forex market, known for strong liquidity and relatively tight spreads.

2025 was a standout year for the euro. According to Cambridge Currencies, EUR/USD strengthened 13.5% year-to-date by the end of 2025, its best annual performance since the 2008 financial crisis. The pair climbed from roughly 1.03 in January to the mid-1.17s by December.

But here is a nuance that matters for traders. According to EBC Financial Group, much of that euro strength was driven by US dollar weakness rather than European economic outperformance. German fiscal expansion, ECB rate stability, and improved eurozone resilience all played supporting roles. The ECB noted that during periods of US turbulence, investors treated the euro as an alternative safe haven.

Looking ahead, some forecasts suggest EUR/USD could move toward the 1.19 to 1.22 range by the end of 2026, depending largely on how the dollar performs.

For new traders, EUR/USD may often be the first pair they trade. Its high liquidity, steady price movement, and tight spreads make it a practical starting point for developing trading experience.

United States Dollar (USD)

The US dollar ranks last on this list by exchange rate value, yet it remains the dominant force in global currency markets. It appears on one side of nearly 90% of all Forex transactions and makes up more than half of allocated global foreign exchange reserves. In terms of usage, settlement, and institutional demand, no other currency matches its reach.

So why does it rank tenth here? Because one Kuwaiti Dinar buys 3.26 dollars, one Bahraini Dinar buys 2.65 dollars, and so on down the list. Exchange rate value and global influence are simply measuring different things.

That said, 2025 was a rough year for the greenback. The dollar weakened by around 10–11% year-to-date against a broad basket of major currencies, its worst showing since 1973. By Christmas Eve 2025, according to Forex.com, the Dollar Index (DXY) had dropped to around 98.00, its weakest reading since 2022.

For Forex traders, shifts in the dollar matter across the entire market. When the Dollar Index falls, pairs like EUR/USD, GBP/USD, and AUD/USD often move higher, while USD/CHF and USD/JPY may trend lower. Tracking the dollar’s broader direction can provide useful context when trading major pairs.

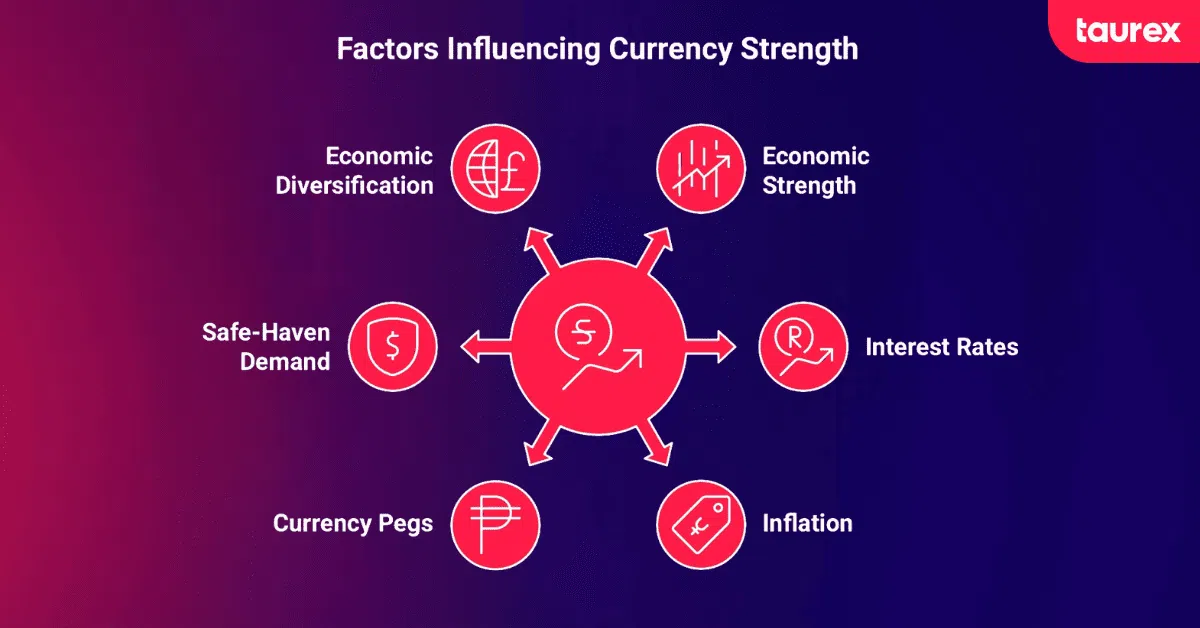

What Makes Some Currencies Stronger Than Others

After looking at the top ten, it helps to understand what actually drives currency strength. The same factors that determine long-term value are the ones moving prices every day in the Forex market.

- Economic strength

Countries with solid GDP growth, strong employment, and productive industries tend to have stronger currencies. Oil-exporting nations, such as those in the Gulf, benefit from steady foreign income that supports demand for their currencies. - Interest rates

Higher interest rates usually attract foreign investment. When investors can earn better returns in one country, demand for that currency increases. Differences between major central banks often create clear trading opportunities. - Inflation

Lower inflation helps preserve purchasing power. Currencies from stable, low-inflation economies tend to hold their value better over time. - Currency pegs

Some countries fix their currency to the US dollar or a basket of currencies. This reduces volatility and keeps exchange rates stable. Others, like the euro or Swiss franc, float freely and move more with market forces. - Safe-haven demand

During global uncertainty, investors move money into currencies seen as stable, such as the Swiss franc or Japanese yen. - Economic diversification

Countries that rely on multiple industries, rather than just one resource, tend to have more resilient currencies over the long term.

What Do You Need to Know Before Trading Currencies?

Understanding which currencies are strong gives you useful context. But to actually trade them, you need to understand a few simple basics.

How Do Currency Pairs Work?

Currencies always trade in pairs. If EUR/USD is 1.18, it means one euro equals 1.18 US dollars. If the price goes up, the euro is strengthening. If it goes down, the dollar is strengthening.

Some pairs include the US dollar, such as EUR/USD or USD/JPY. These are called major pairs. Others, like EUR/GBP, do not include the dollar and are known as minor pairs. Exotic pairs combine a major currency with one from a smaller or emerging economy.

How to Get Started?

To begin trading, you need to choose a regulated broker. Regulation matters because it determines how your funds are held and what protections are in place.

For example, trading with a regulated broker like Taurex means your account operates within established financial oversight and compliance standards.

After opening an account, it is wise to start with a demo account (if you are new to this, you can check out our guide on Forex demo trading). This allows you to practise with real market prices and learn how the platform works without risking real money.

What Are the Key Trading Terms You Should Know?

- A pip is a small price movement in a currency pair.

- A lot is the size of your trade.

- Leverage lets you control a larger position with less money, but it also increases risk.

- The spread is the difference between the buy and sell price, and it represents your trading cost.

What Are Some Simple Trading Approaches for Beginners?

Many beginners choose to trade in the same direction as the market. If prices are generally rising, they look for buying opportunities. If prices are generally falling, they look for selling opportunities.

Another common method is watching support and resistance levels. These are price areas where the market often pauses or reverses.

Before entering any trade, decide where you will exit if the trade moves against you and where you will take profit.

How to Manage Your Risk?

Risk management is essential. Some traders may not want to risk more than 1-2% of their account on a single trade and can use stop-loss orders to limit potential losses.

When Can You Trade Forex?

The Forex market is open 24 hours a day, five days a week. Trading activity is usually highest when the London and New York sessions overlap, which often brings stronger price movement and tighter spreads.

Wrapping up

The highest-valued currencies are mostly found in the Gulf, supported by oil income and fixed exchange rates. But in daily Forex trading, the most active currencies are the US dollar, the euro, the pound, and the Swiss franc.

Exchange rate value and trading opportunity are not the same thing. A currency can rank highly by value yet see far less trading activity than major pairs like EUR/USD.

Looking ahead, central bank decisions and global economic conditions will continue to drive price movements across major currencies.

If you’re ready to take the next step, open a demo account with Taurex and trade on a regulated platform designed to support your growth as a trader.

Disclaimer: Trading involves significant risk, including the potential loss of your principal. Past performance does not guarantee future results, and the value of your investments may fluctuate. The content in this article is for educational purposes only and does not constitute financial advice. Please consider your own financial situation and risk tolerance before making any trading decisions.

Frequently Asked Questions

What is the strongest currency in the world in 2026?

The Kuwaiti Dinar (KWD) is the strongest currency by exchange rate. One dinar is worth more than 3 US dollars. This is mainly due to Kuwait’s oil income and its managed exchange rate system. However, the US dollar is still the most widely used currency in the world.

Why is the Kuwaiti Dinar so strong?

Kuwait earns significant income from oil and has a relatively small population. This supports a high national income per person. The dinar is also linked to a basket of currencies, which helps keep it stable.

Can I trade the strongest currencies like the Kuwaiti Dinar?

Technically, yes, but they are not widely available for retail traders. Trading volumes are low, and spreads can be high. Most active traders focus on major pairs like EUR/USD or GBP/USD, where liquidity is much higher.

What is the most traded currency pair for beginners?

EUR/USD is the most traded pair in the world. It has high liquidity and usually lower trading costs, which is why many beginners start with it.

Does a strong currency mean a strong economy?

Not always. A high exchange rate does not automatically mean a large or diversified economy. Currency strength depends on many factors, including inflation, trade balance, interest rates, and investor demand.

How much capital do I need to start Forex trading?

Many brokers allow you to start with a few hundred dollars. However, it is best to begin with a demo account. This allows you to practise without risking real money.