By Samir El Khoury

United States of America

· The Empire State Manufacturing Index in New York State declined to -43.70 points, lower than expectations (-5.0) and the previous reading (-14.50).

· The retail sales index rose on a monthly basis, recording a growth of 0.6%, which exceeded expectations (0.4%) and the previous reading (0.3%). The core retail sales index (which excludes automobile sales) also rose on a monthly basis, registering a growth of 0.4%. This percentage exceeded expectations and the previous reading (0.2%).

· The industrial production index rose on a monthly basis, registering a growth of 0.1%, a rate that exceeded expectations and the previous reading (0.0%).

· The building permits index rose, recording 1.495 million, which exceeded expectations (1.480M) and the previous reading (1.467M).

· The initial jobless claims index fell to 187K, which is lower than expectations (207K) and the previous reading (203K).

· The Philadelphia Manufacturing Index recorded a contraction of 10.6 points, which is lower than expectations (-7.0) but higher than the previous reading (-12.8).

· US crude oil inventories fell by 2.492 million barrels, which is lower than expectations (-0.313M) and the previous reading (-1.338M).

· The existing home sales index recorded 3.78 million, which is lower than expectations and the previous reading (3.82M).

· The Michigan Consumer Confidence Index rose to 78.8 points, which exceeded expectations (70.0) and the previous reading (69.7).

Eurozone

· The headline consumer price index rose on an annual basis, recording 2.9%, which is in line with expectations but exceeds the previous reading (2.4%). The core consumer price index on an annual basis recorded 3.4%, which is in line with expectations but lower than the previous reading (3.6%).

· The industrial production index declined on an annual basis, recording a contraction of 6.8%, which is lower than expectations (-5.9) and the previous reading (-6.8%).

United Kingdom

· The income rate including bonuses decreased, recording 6.5%, which is lower than expectations (6.8%) and the previous reading (7.2%).

· The headline consumer price index rose year-on-year, recording 4.0%, which exceeded expectations (3.8%) and the previous reading (3.9%). The core consumer price index on an annual basis recorded 5.1%, which was higher than expectations (4.9%) but in line with the previous reading.

· The retail sales index declined on a monthly basis, recording a contraction of 3.2%, which is lower than expectations (-0.5%) and the previous reading (1.4%).

Switzerland

· The producer price index rose on an annual basis, recording a contraction of 1.1%, which is higher than the previous reading (-1.3%).

Australia

· The rate of change in employment declined, recording a loss of 65.1K jobs, which is a lower percentage than expectations (17.6K) and the previous reading (72.6K).

Canada

· Retail sales declined on a monthly basis, recording a contraction of 0.2%, which is lower than expectations (0.0%) and the previous reading (0.5%).

China

· The investment index in fixed assets recorded 3.0%, which is a rate that exceeded expectations and the previous reading (2.9%).

· The GDP index on an annual basis (fourth quarter) recorded a growth of 5.2%, which is lower than expectations (5.3%) but higher than the previous reading (4.9%).

· The industrial production index recorded an annual rate of 6.8%, which exceeded expectations and the previous reading (6.6%).

· Retail sales recorded an annual rate of 7.4%, which is lower than expectations (8.0%) and the previous reading (10.1%).

· The unemployment rate rose to 5.1%, which exceeded expectations and the previous reading (5.0%).

Japan

· The headline CPI recorded an annual rate of 2.6%, which is lower than the previous reading (2.8%). The core consumer price index on an annual basis recorded 2.3%, which is in line with expectations but lower than the previous reading (2.5%).

The most important events of this week

This week, financial markets are eagerly awaiting the release of several key economic indicators:

- The People’s Bank of China’s key lending rate is released today.

- On Tuesday, the markets are awaiting the interest rate decision issued by the Central Bank of Japan, amid expectations that the bank will maintain its accommodative policy, in addition to turning attention to the speech of the President of the Japanese Central Bank, Kazuo Ueda, on the issue of the interest rate path during the coming period.

- On Wednesday, the markets await the interest decision issued by the Central Bank of Canada, amid expectations that the bank will keep interest rates unchanged at the level of 5.00%. The services and industrial purchasing managers’ index is issued in Australia, Japan, the Eurozone, Britain, and the United States of America.

- As for Thursday, the markets are awaiting the interest decision issued by the European Central Bank amid expectations that the bank will keep interest rates unchanged at the level of 4.50%. In addition, attention is directed to the speech of European Central Bank President Christine Lagarde on the issue of the interest rate path during the coming period, especially on the timing of the first interest rate cut. It issues indicators of durable goods orders, gross domestic product, unemployment claims rates, new home sales, and US crude oil stocks in the United States of America.

- Finally, the Core Personal Consumption Exchange Price Index, which is the Federal Reserve’s preferred inflation indicator in the United States of America, will be released on Friday.

Technical Analysis:

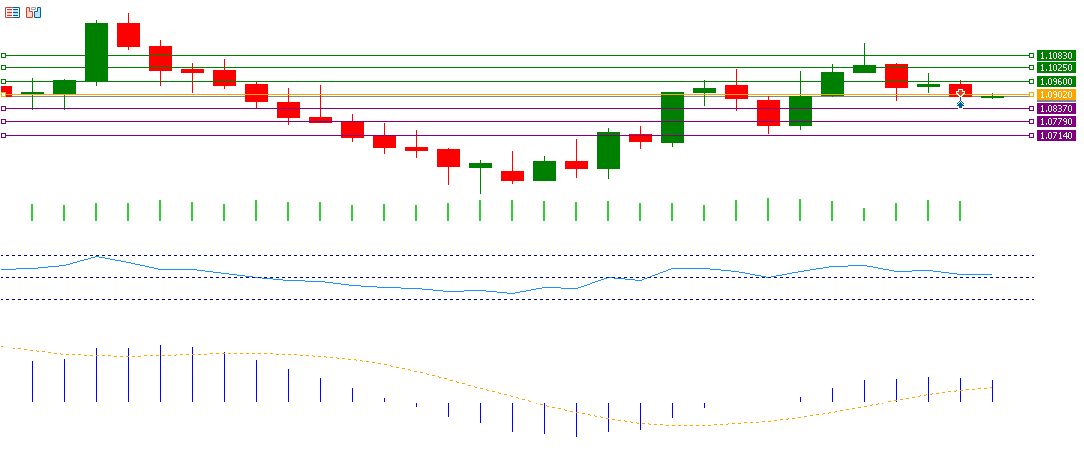

EUR/USD:

If the euro against the dollar breaks the pivot point of 1.0902, it may potentially target and test the support levels of 1.0837, 1.0779, and 1.0714. Conversely, if it surpasses the pivot point, it is likely to test resistance levels of 1.0960, 1.1025, and 1.1083.

EURUSD

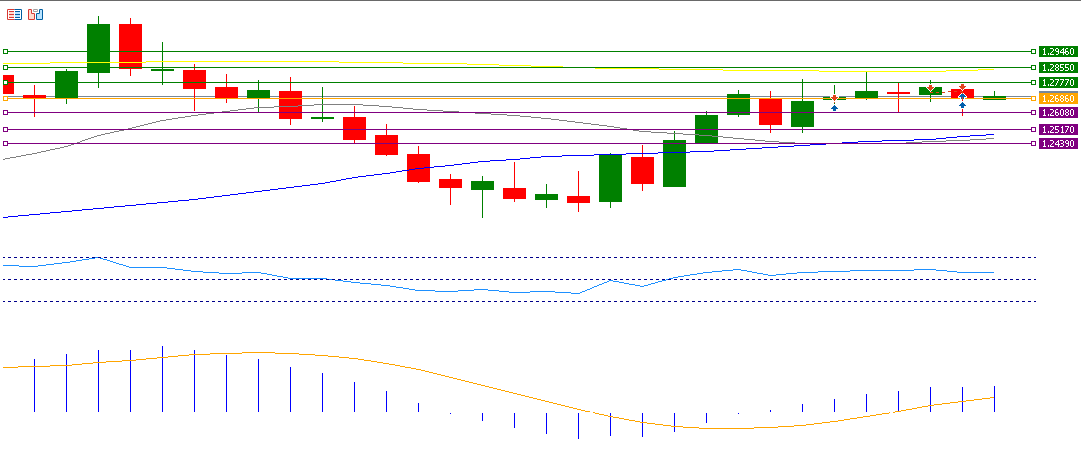

GBP/USD:

If the pound against the dollar breaks the pivot point of 1.2686, it has the potential to test the support levels of 1.2608, 1.2517, and 1.2439. However, if it exceeds the pivot point, it may test resistance levels of 1.2777, 1.2855, and 1.2946.

GBPUSD

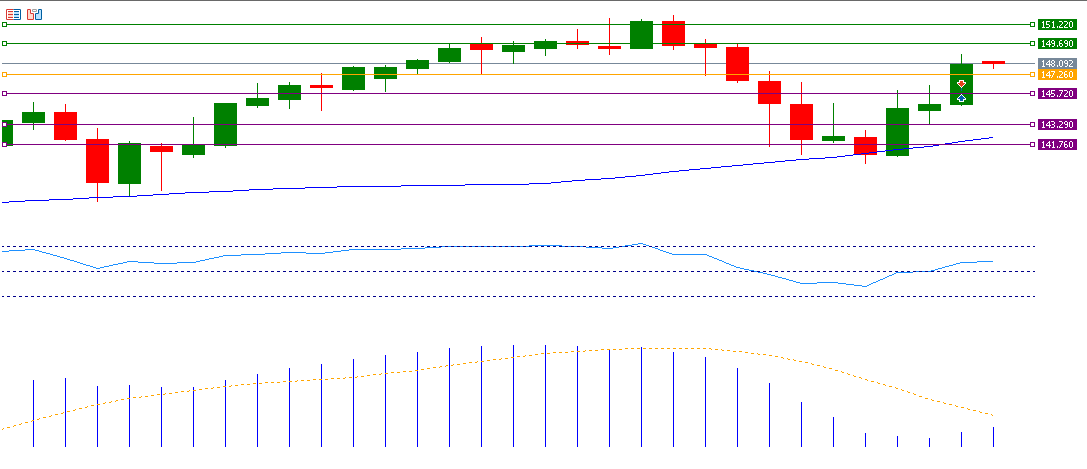

USD/JPY:

If the pivot point of 147.26 is broken for the dollar against the yen, there is a possibility that it will target the support levels 145.72, 143.29, and 141.76. But if it exceeds the pivot point, it is likely to target the resistance levels 149.69, 151.22, and 153.65.

USDJPY

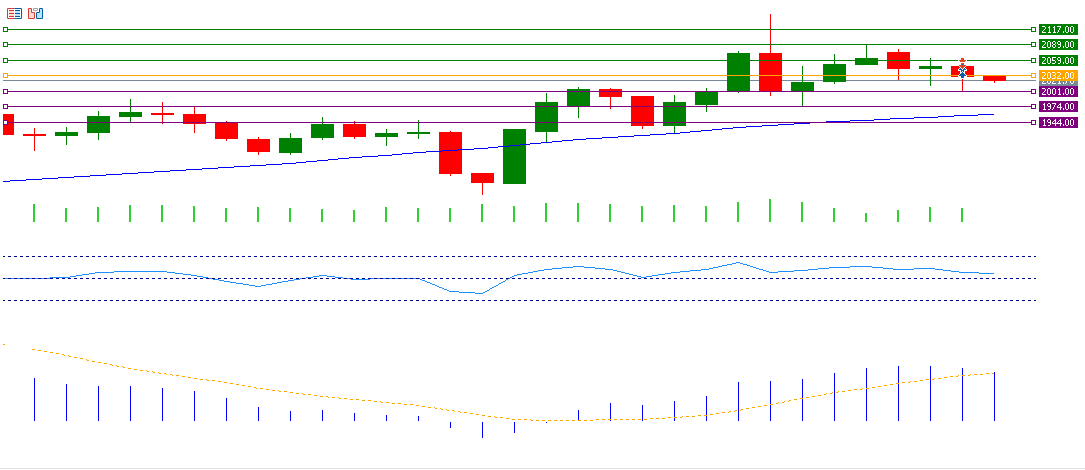

GOLD:

If the pivot point of 2032 is broken for gold, there is a possibility that it will target the support levels 2001, 1974, and 1944. But if it exceeds the pivot point, it is likely to target the resistance levels 2059, 2089, and 2117.

GOLD

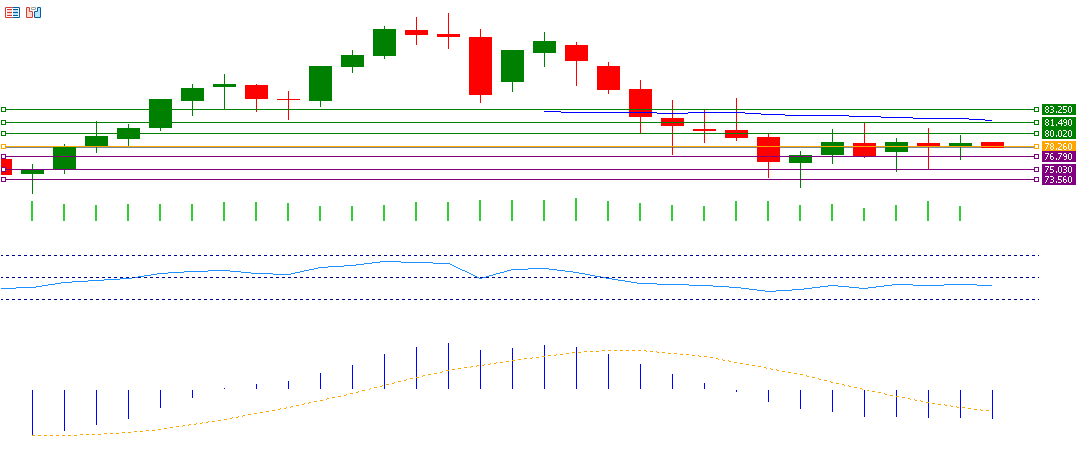

BRENT CRUDE OIL:

If the pivot point of 78.26 for crude oil is broken, there is a possibility that it will target the support levels of 76.79, 75.03 and 73.56. If it exceeds the pivot point, it is likely to target the resistance levels 80.02, 81.49, and 83.25.

CRUDE OIL

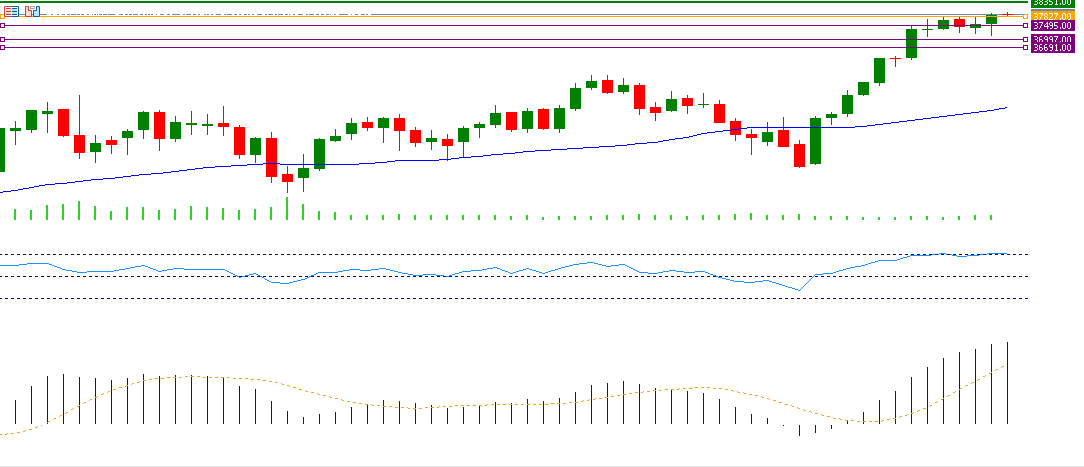

US30:

If the pivot point of 37,827 for the Dow is broken, there is a possibility that it will target the support levels 37,521, 36,997 and 36,691. If it exceeds the pivot point, it is likely to target the resistance levels 38,351, 38,657, and 39,181.

US30

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice.

Taurex is the trading name of Zenfinex Global Limited, Stochastic Africa SL Ltd, Zenfinex Global LLC, and Zenfinex Limited.

Zenfinex Global Limited is registered in the Republic of Seychelles with registration number: 8428731-1 and is regulated by the Financial Services Authority of Seychelles (license number SD092). Its registered office address is F20, 1st Floor, Eden Plaza, Eden Island, Seychelles.

Stochastic Africa (SL) Limited is a company registered in Sierra Leone with Company Number: SL270319STOCH05271 and is licensed by the Bank of Sierra Leone under license number BSL/SAL/2023 and with the registered office at 148D Wilkinson Road, Freetown, Sierra Leone.

Zenfinex Global LLC is a company registered with the Financial Services Authority in Saint Vincent and the Grenadines under registered number 138 LLC 2019. Its registered office is Hinds Building, Kingstown, Saint Vincent, and the Grenadines.

Zenfinex Limited is a company registered in England and Wales under registered number: 11077380. Authorised and regulated by the Financial Conduct Authority under firm reference number 816055. Its registered office is 4th Floor, 4 Eastcheap, London, EC3M 1AE, United Kingdom.

*All trading involves risk.