By Samir Al Khoury

The GDP index in Germany contracted by -0.3% in the fourth quarter of last year, and both manufacturing and services purchasing managers’ indices continue to show contraction. Most German economic data remains weak, and inflation, recorded at 3.7% in December 2023, is far from the European Central Bank’s 2% target, raising concerns about stagflation.

During the last stages, the German economy – the largest economy in Europe – faced several crises, the most notable of which were:

· Weak Export Activity: A slowdown in global demand, coupled with disappointing Chinese economic data, has adversely affected Germany’s crucial export activity. China stands as Germany’s most important trading partner.

· Energy Challenges: The energy sector has posed challenges for Germany, contributing to its economic difficulties.

· High Interest Rates: Tight monetary policies adopted by the European Central Bank since 2022 to combat inflation have resulted in high borrowing costs for Germany.

In addition, there are other negative factors, such as geopolitical tensions in the Red Sea, which have implications for rising shipping and shipping insurance costs, which may once again fuel inflation numbers. There is also an important political factor within Germany, which is the rise of the far right and the rise in popularity of the Alternative for Germany party, which will have a direct impact on several issues, such as the possibility of Germany leaving the European Union and others.

It is worth noting that the International Monetary Fund indicated that the German economy recorded the worst performance among advanced economies last year.

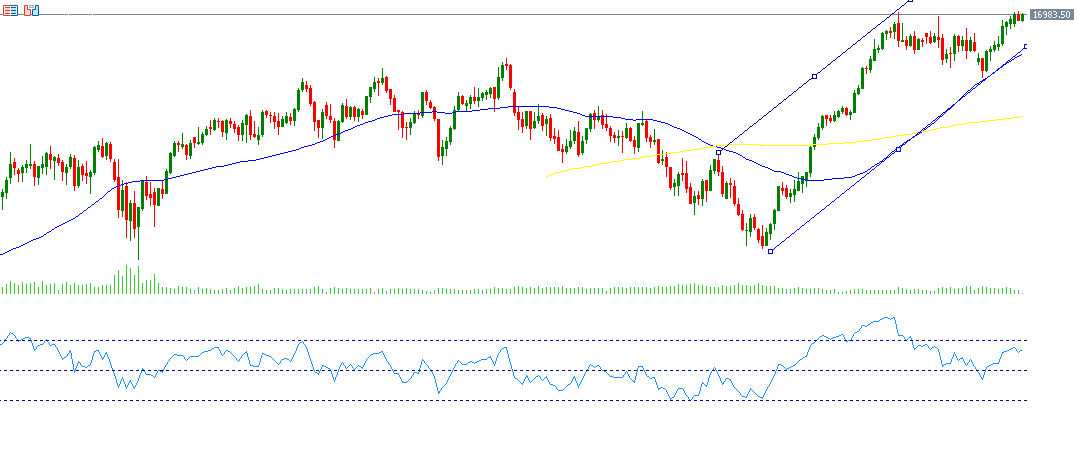

Despite these economic challenges, the German stock market, particularly the DAX30 index, has shown remarkable resilience. The DAX30 index surged by about 20% last year, and this positive momentum has continued into the current year. In a surprising turn of events, the DAX30 recorded historic highs of 17,000 points recently, presenting a stark contrast to the economic downturn.

From a technical standpoint, it appears that the upward trend is prevailing, and the GOLDEN CROSS is still in place between the 50-day moving average in blue at 16,551 points and the 200-day moving average in yellow at 15,935 points, indicating upward momentum for the German DAX index. As for the Relative Strength Index (RSI), it recorded approximately 65 points, which exceeds the level of 50 points, which indicates positive momentum for the DAX index.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice.

Taurex is the trading name of Zenfinex Global Limited, Stochastic Africa SL Ltd, Zenfinex Global LLC, and Zenfinex Limited.

Zenfinex Global Limited is registered in the Republic of Seychelles with registration number: 8428731-1 and is regulated by the Financial Services Authority of Seychelles (license number SD092). Its registered office address is F20, 1st Floor, Eden Plaza, Eden Island, Seychelles.

Stochastic Africa (SL) Limited is a company registered in Sierra Leone with Company Number: SL270319STOCH05271 and is licensed by the Bank of Sierra Leone under license number BSL/SAL/2023 and with the registered office at 148D Wilkinson Road, Freetown, Sierra Leone.

Zenfinex Global LLC is a company registered with the Financial Services Authority in Saint Vincent and the Grenadines under registered number 138 LLC 2019. Its registered office is Hinds Building, Kingstown, Saint Vincent, and the Grenadines.

Zenfinex Limited is a company registered in England and Wales under registered number: 11077380. Authorised and regulated by the Financial Conduct Authority under firm reference number 816055. Its registered office is 4th Floor, 4 Eastcheap, London, EC3M 1AE, United Kingdom.

*All trading involves risk