By Camilo Botia

Oil prices experienced a boost on Monday, driven by two main factors: strengthening physical markets in the US and signs of recovering demand from China.

In the US, a combination of factors is pushing crude prices higher:

1. Strong refinery margins incentivize refineries to actively buy crude, driving domestic prices.

2. Issues with Red Sea shipping are prompting foreign buyers to seek alternative sources, turning to US crude to meet their needs.

3. Recent events like a brief shutdown in Libyan oil exports and increased military activity in the Red Sea region have added further support to prices due to potential supply disruptions.

While the situation in the US paints a positive picture for oil prices, the future may be less certain. The market is awaiting key data releases, particularly US inflation data, which will influence expectations for the Federal Reserve’s interest rate decisions – a factor that can significantly impact energy demand. The overall market sentiment is tempered by a strong US dollar and weakness in other commodities.

Despite these uncertainties, the near-term outlook for oil prices appears stable. Production cuts implemented by OPEC+ and its allies are expected to continue offsetting the increase in production from outside the group. Furthermore, the cartel and its partners will likely extend their current production curbs at their meeting, further contributing to price stability.

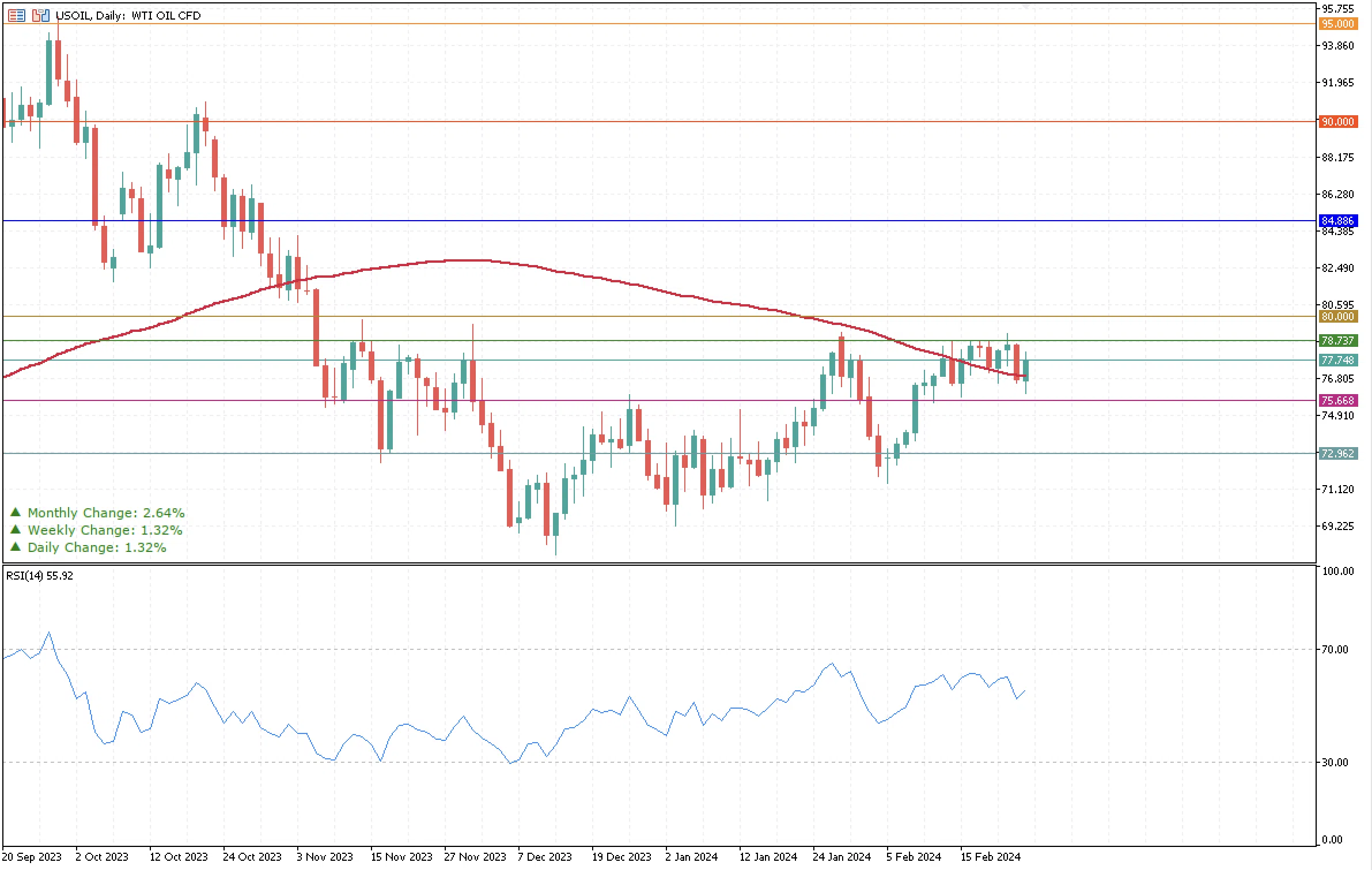

In conclusion, the oil market navigates a complex landscape with positive and negative factors. While the US market and potential Chinese demand growth provide some upward pressure on prices, broader economic uncertainties and ongoing production management by OPEC+ add a layer of complexity to the future outlook. The price so far has been trading along its 100-day moving average for the last two weeks. The trend continues to be sideways with two resistances, one at $78.73 and the second at $80.0, a critical reference level for WTI. Aside from the 100-day moving average at $76.95, there are two more levels to consider on the bearish side of the chart: support at $75.66 and further down $72.95. The RSI indicator so far does not show the market is close to getting into an overbought/oversold condition.