By Camilo Botia,

The Japanese Yen experienced a brief surge on Wednesday after government officials warned currency traders that they would be forced to take action to halt the Yen’s decline. Earlier in the day, the Yen had plunged to a 34-year low against the dollar, sparking concerns about potential intervention from Japanese authorities.

Finance Minister Masato Kanda issued the warning after the Yen neared 152 per dollar. This level is seen as a potential trigger for intervention. News of an unscheduled meeting by economic authorities also helped to reverse the Yen’s decline.

The Yen ended the day slightly stronger but remains vulnerable due to several factors. Despite the BoJ tightening its Policy for the first time in 17 years last week, the Yen continues to weaken compared to the strengthening dollar.

Another factor is Japan’s heavy reliance on imports. A weak yen can lead to higher prices for consumers and businesses. Additionally, the Yen has been a popular target for short sellers who bet on its continued decline.

Despite the warnings, some market watchers believe intervention is unlikely unless the Yen declines rapidly. Others see the current level as less important than the overall trend.

The situation highlights the challenges faced by Japanese policymakers. They are caught between balancing inflation and growth. While a weak yen can stimulate economic growth, it also risks triggering inflation.

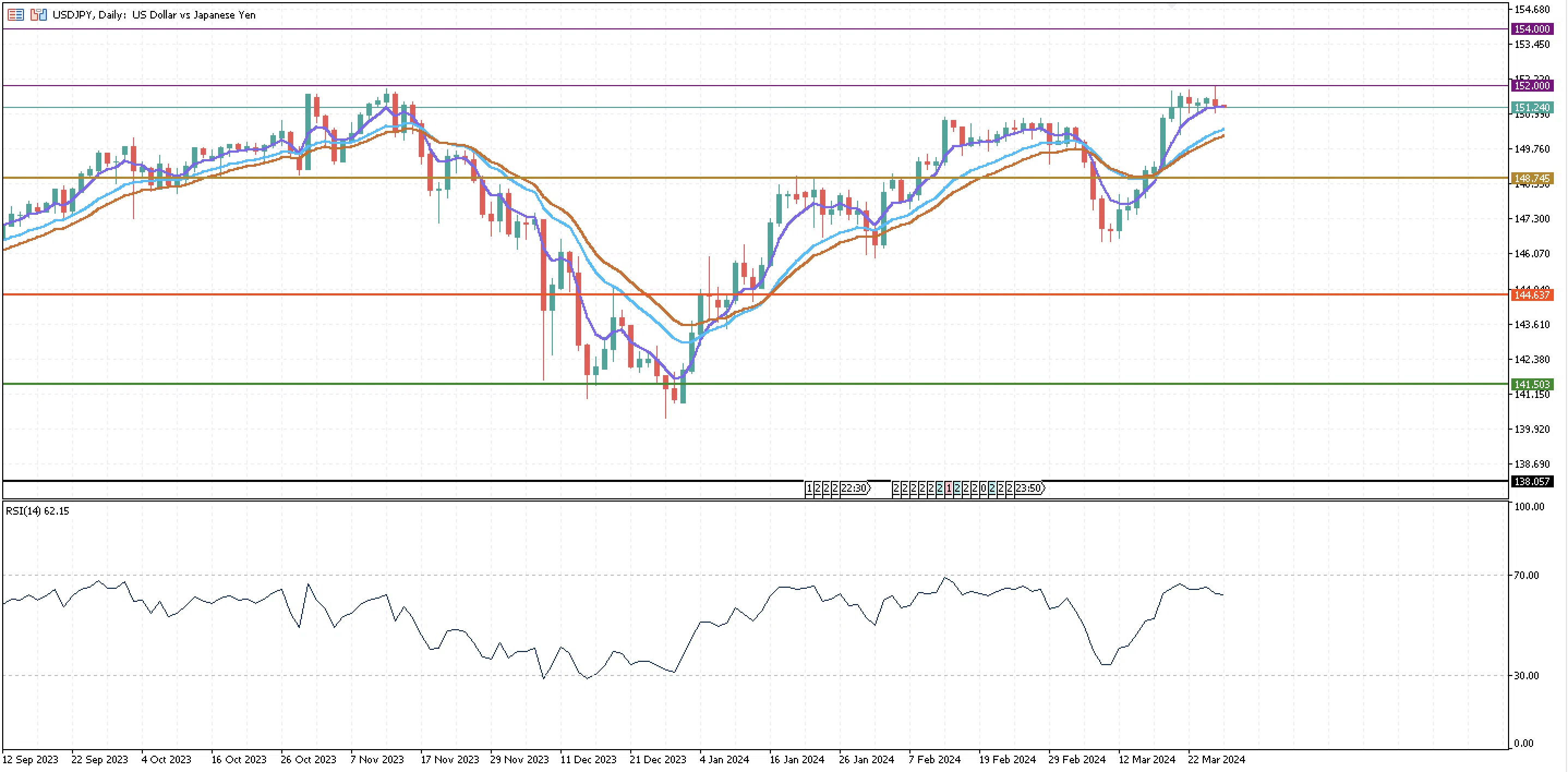

Some investors see intervention from the BoJ between $152 and $154; however, the Yen’s future remains uncertain. The battle between Japanese policymakers and currency traders will likely continue when more economic data is available in the coming weeks and months. So far, in the upcoming days, Core PCE data will be released, and NFP numbers will be available next week, shedding more light on the Fed’s path to interest rate cuts and affecting the USDJPY.

So far, the price of the Yen has yet to reach $152, which is its closest and most significant resistance. The USDJPY traded at $151.96 on Wednesday and is up 7% during the first quarter of 2024. There are three exponential moving averages that are currently supporting the price, 5, 15, and 20-day, and there was a golden cross on March 19 that signalled a bullish trend on the USDJPY that helped the price reach higher highs around $152. At the top, the $154 level is the upper boundary of the range the BoJ is considering to intervene in the market and bring the pair down. Beyond the three exponential moving averages is a monthly support at $148.74.

So far, the RSI indicator is not showing any signals of an overbought market and has had a negative slope, showing exhaustion in the bullish movement on the currency pair in the last trading sessions.