By Samir Al Khoury,

The USD/JPY price continues its downward trend for the fourth consecutive day, reaching 152.23 today, its lowest level since 3 May 2024. However, it remains up about 8% year-to-date. The key challenge lies in reaching the strategic support level of the 200-day moving average, which stands at 151.56.

Japan’s headline consumer price index (CPI) on an annual basis recorded 2.8% in June, consistent with the previous reading. The core CPI, excluding food, recorded 2.6% annually, which is lower than the expected 2.7% but higher than the previous reading of 2.5%. These figures suggest that the Bank of Japan will raise interest rates by 10 basis points at its meeting on 31 July 2024.

Analysts are closely monitoring tomorrow’s release of the consumer price indexes in Tokyo and the core personal consumption expenditures prices in the United States. Caution is advised, as any reading higher than expected for the consumer price index in Tokyo and lower than expected for the core personal consumption expenditures index in the United States could negatively impact the dollar versus the yen pair, indicating continued positive momentum for the Japanese currency.

There appears to be a positive relationship between the Nikkei 225 index and the dollar against the Japanese yen. The current strength of the yen against the dollar (i.e., the decline in the price of the dollar against the yen) reduces the attractiveness and demand for Japanese stocks among investors holding foreign currencies. After the Japanese Nikkei 225 index reached an all-time high of 42,426 points on 11 July 2024, it is currently under selling pressure, closing yesterday at 37,869.

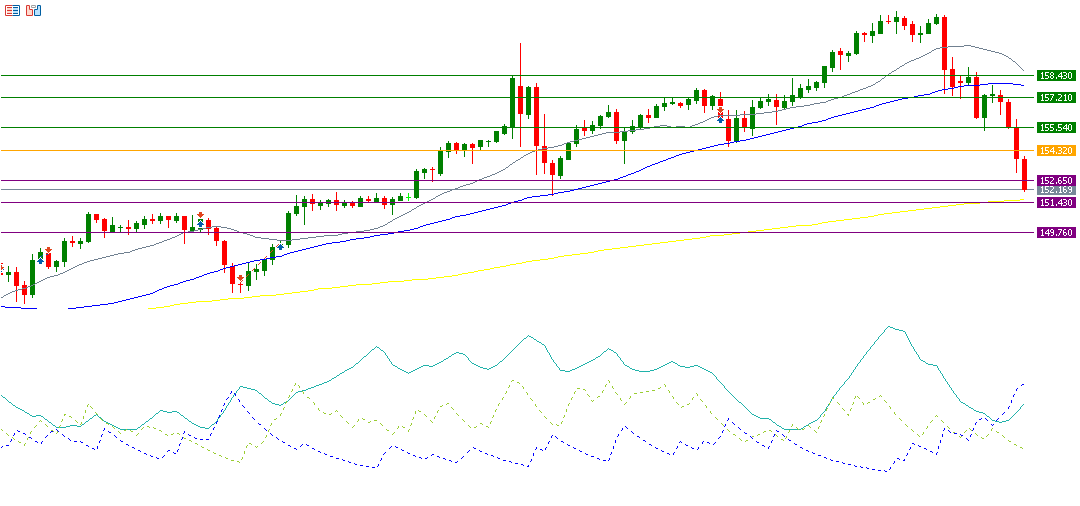

The dollar against the yen is hovering around the 152.50 levels, and the technical outlook appears discouraging. For example, the positive movement index (DMI+) is about 10 points compared to the negative movement index (DMI-), which records approximately 42 points. The large gap between these indicators signifies strong selling pressure on the dollar against the yen. More importantly, the ADX trend strength index is around 35 points, indicating strong downward momentum. If the pivot point of 154.32 is broken, the dollar against the yen may target support levels of 152.65, 151.43, and 149.76. If it surpasses the pivot point, it could target resistance levels of 155.54, 157.21, and 158.43.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice.

Taurex is the trading name of Zenfinex Global Limited, Stochastic Africa SL Ltd, Zenfinex Global LLC, and Zenfinex Limited.

Zenfinex Global Limited is registered in the Republic of Seychelles with registration number: 8428731-1 and is regulated by the Financial Services Authority of Seychelles (license number SD092). Its registered office address is F20, 1st Floor, Eden Plaza, Eden Island, Seychelles.

Stochastic Africa (SL) Limited is a company registered in Sierra Leone with Company Number: SL270319STOCH05271 and is licensed by the Bank of Sierra Leone under license number BSL/SAL/2023 and with the registered office at 148D Wilkinson Road, Freetown, Sierra Leone.

Zenfinex Global LLC is a company registered with the Financial Services Authority in Saint Vincent and the Grenadines under registered number 138 LLC 2019. Its registered office is Hinds Building, Kingstown, Saint Vincent, and the Grenadines.

Zenfinex Limited is a company registered in England and Wales under registered number: 11077380. Authorised and regulated by the Financial Conduct Authority under firm reference number 816055. Its registered office is 4th Floor, 4 Eastcheap, London, EC3M 1AE, United Kingdom.

*All trading involves risk.