Global markets experienced several significant economic developments last week. In the United States, the jobless claims index rose to 242,000, while the Consumer Price Index (CPI) showed a 2.7% growth, and the Producer Price Index (PPI) increased by 3.0%. In the Eurozone, the European Central Bank decided to cut interest rates by 25 basis points. In the UK, GDP contracted by 0.1% on a monthly basis, while Canada reduced its interest rates by 50 basis points. In Australia, the Reserve Bank of Australia kept interest rates unchanged at 4.35% for the eighth consecutive month, and the country saw an improvement in the labor market, adding 35.6 thousand jobs. Additionally, the Swiss National Bank unexpectedly reduced interest rates by 50 basis points. In China, economic indicators showed weak data, with a decline in consumer price and export growth, while Japan experienced strong GDP growth on a quarterly basis.

Market Analysis

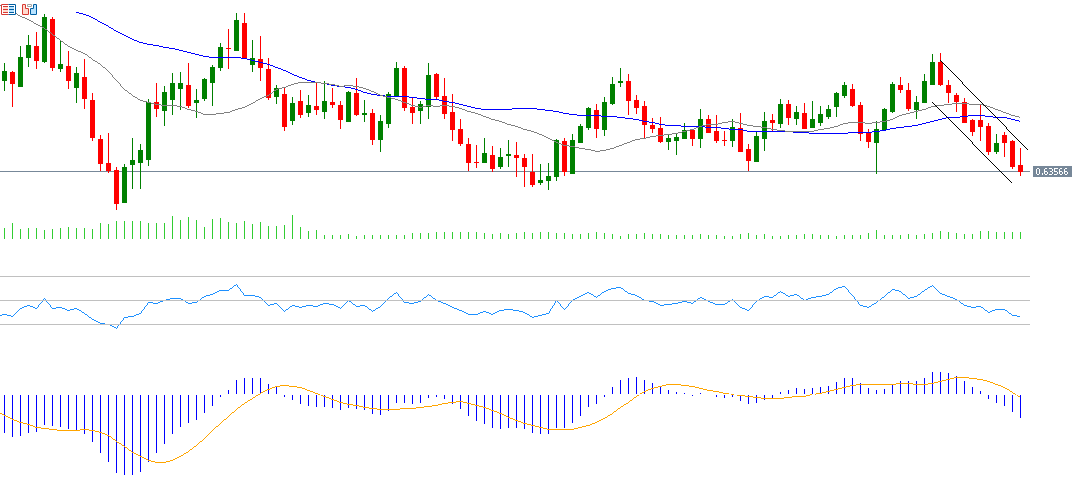

- Australian Dollar / US Dollar Pair The Reserve Bank of Australia kept interest rates at 4.35% for the eighth consecutive month, in line with expectations. The Australian Dollar to US Dollar (AUD/USD) pair continues its downward trend, reaching 0.6336 on Wednesday, December 11, 2024, the lowest level since November 1, 2023. The pair is currently hovering around 0.6350. The Relative Strength Index (RSI) is currently at 35 points, indicating negative momentum for the AUD/USD pair.

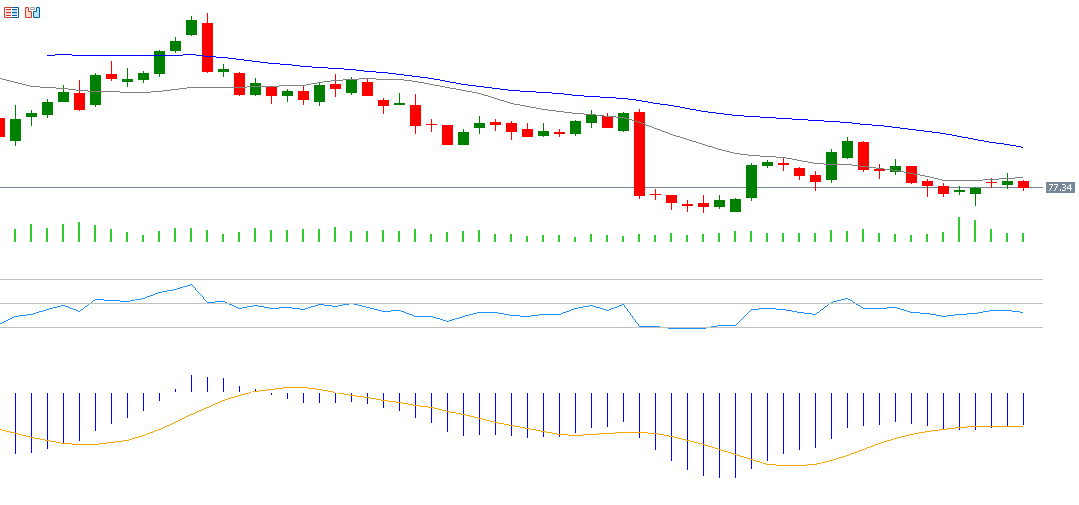

- Nike Nike’s stock has fallen by approximately 28% since the beginning of the year. The stock closed at $77.25 on Friday, December 13, 2024. The market is anticipating Nike’s third-quarter earnings announcement on Thursday, December 19, 2024, with expectations of earnings per share reaching $0.65, down from $1.03 in the previous quarter. For revenue, markets expect it to reach $12.18 billion, compared to $13.4 billion in the prior reading.

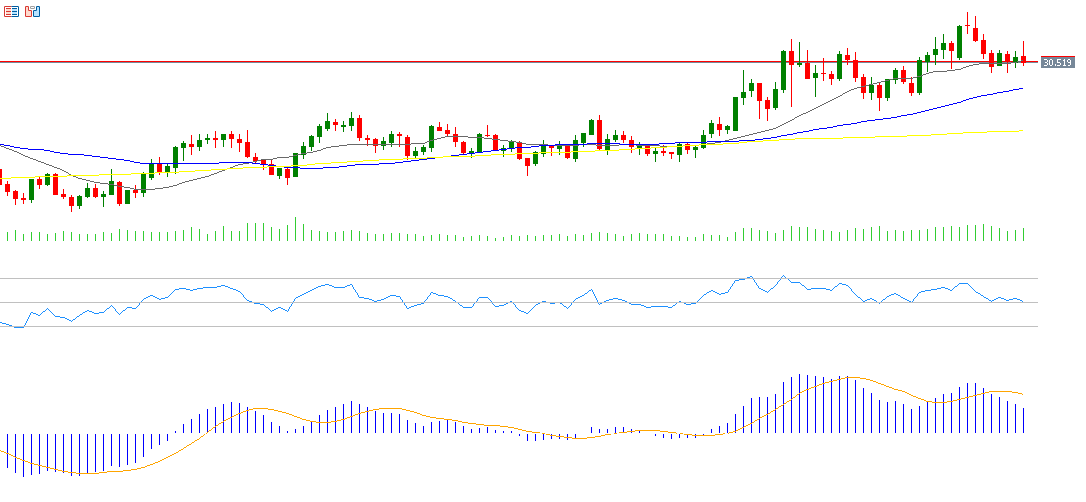

- Silver Silver prices dropped by around 1% last week, closing at $30.55 on Friday, December 13, 2024. Several factors are affecting silver, notably the drop in gold prices and the expected slower pace of US interest rate cuts next year. If the pivot level at $31.38 is broken, support levels could be targeted at $30.70, $29.82, and $29.14. On the upside, resistance levels could be seen at $32.26, $32.94, and $33.82.

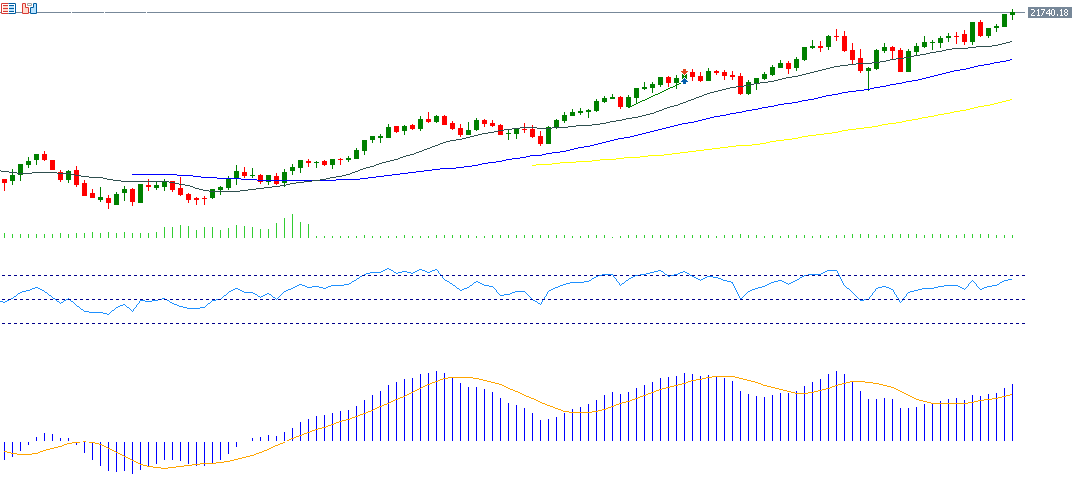

- Nasdaq 100 The Nasdaq 100 index reached a new record level of 21,887 points on Friday, December 13, 2024. The index has risen by 31% since the beginning of the year, driven particularly by the “Magnificent 7” stocks, as well as Broadcom, whose financial results exceeded expectations, surpassing a market capitalization of $1 trillion. The Relative Strength Index (RSI) is currently at 66 points, indicating positive momentum for the Nasdaq 100 index.

Key Events This Week

Markets are looking ahead to several important economic indicators and data this week:

- Today, the PMI for manufacturing and services will be released for Australia, Japan, the Eurozone, the UK, and the United States, alongside the Eurozone’s hourly wage index, fixed asset investment data, retail sales, industrial production, and unemployment rate in China.

- On Tuesday, markets will await income and unemployment data from the UK, retail sales and industrial production data from the US, and the Consumer Price Index (CPI) in Canada.

- On Wednesday, markets will focus on the US Federal Reserve’s interest rate decision, with expectations of a 25 basis point rate cut from 4.75% to 4.50%. Other data to be released include Japan’s exports and imports, CPI for the UK and the Eurozone, US building permits and crude oil inventories, and New Zealand’s GDP.

- On Thursday, markets expect the Bank of Japan to keep interest rates unchanged at 0.25%, while the Bank of England is expected to hold rates at 4.75%. Other data to be released include GDP, jobless claims, Philadelphia manufacturing index, and existing home sales in the US.

- Finally, on Friday, markets will watch for Japan’s CPI, China’s PBOC lending rate, and UK and Canadian retail sales. In the US, key indicators include the core personal consumption expenditures (PCE) price index and the Michigan Consumer Sentiment Index.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.