Yesterday, the Bank of Canada lowered interest rates by 25 basis points, from 3.25% to 3.00%, in line with market expectations. This marks the sixth consecutive rate cut.

The USD/CAD exchange rate continues its upward trend, reaching 1.4516 on January 21, 2025, the highest level since March 24, 2020. It is currently hovering near the 1.4500 level. The pair has risen by approximately 8% since its low of 1.3419 on September 25, 2024, up to the peak recorded on January 21, 2025, at 1.4516. Additionally, it has gained around 1% since the beginning of the year.

Recent Canadian economic data suggests a weakening economy, as indicated by the following key figures:

- Retail sales (MoM) remained flat at 0.0% in November, below both expectations (0.2%) and the previous reading (0.6%).

- Building permits (MoM) declined by 5.9%, falling short of expectations (1.3%) and the previous reading (-4.1%).

- The Ivey Purchasing Managers Index (PMI) for December recorded growth at 54.7 points, below expectations (55.4).

- The Producer Price Index (PPI) (MoM) decreased to 0.2%, missing expectations (0.5%) and the prior reading (0.6%).

- The Consumer Price Index (CPI) (YoY) dropped to 1.8%, aligning with expectations but falling below the previous reading (1.9%) and the Bank of Canada’s target rate of 2%.

A key factor contributing to the USD/CAD’s bullish momentum is the strength and resilience of the U.S. economy, in addition to remarks from President Donald Trump regarding the imposition of a 25% tariff on Canadian imports, effective February 1, which has pressured the Canadian dollar.

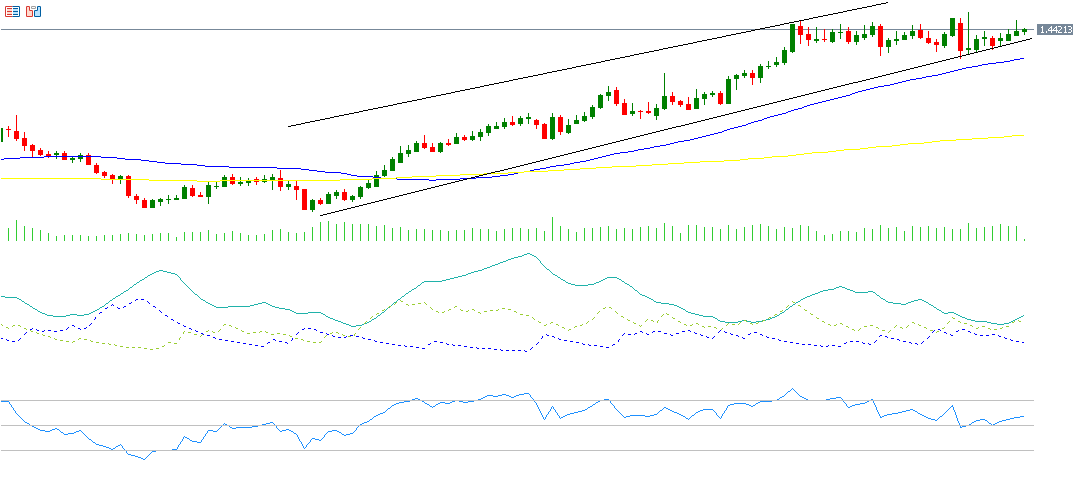

Technical Analysis:

- If the pivot point at 1.4420 for USD/CAD is broken, the pair could target support levels at 1.4367, 1.4338, and 1.4285.

- Conversely, if it surpasses the pivot point, it could aim for resistance levels at 1.4449, 1.4502, and 1.4531.

The Relative Strength Index (RSI) currently stands at 58 points, signaling positive momentum for USD/CAD.

The Positive Directional Movement Index (DMI+) is around 22 points, compared to the Negative Directional Movement Index (DMI-) at 13 points, indicating strong buying pressure on the USD against the CAD. More importantly, the Average Directional Index (ADX) is around 27 points, confirming that the bullish trend remains strong.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.