The Reserve Bank of Australia (RBA) cut interest rates by 25 basis points in its meeting two days ago, lowering the rate from 4.35% to 4.10%—the first reduction in four years. The RBA is the only central bank among major developed economies, including the US Federal Reserve, the European Central Bank, the Swiss National Bank, the Bank of Canada, and the Bank of England, that has delayed adopting an easing policy (i.e., cutting interest rates), unlike what has been observed in these countries.

The Australian dollar (AUD) has risen by approximately 5% against the US dollar (USD) since its low on February 3, 2025, when it hit 0.6087, climbing to a peak of 0.6374 on Monday, February 17. Currently, the AUD/USD pair is hovering around the 0.6350 level.

Recent Australian economic data indicate that the economy remains resilient:

• The Services PMI increased to 51.2, surpassing expectations (50.4) and the previous reading (50.8).

• The Manufacturing PMI rose to 50.2, exceeding the previous reading (47.8).

• Consumer Confidence grew by 0.1%, higher than the previous reading (-0.7%).

However, several factors impact the Australian dollar, including:

• Chinese economic data: Due to strong trade ties between Australia and China, any negative economic data from China generally has an adverse effect on the Australian economy and currency, and vice versa.

• Trade tensions and tariffs: The potential tariffs imposed by US President Donald Trump on imported goods could also impact the Australian dollar.

Technical Outlook

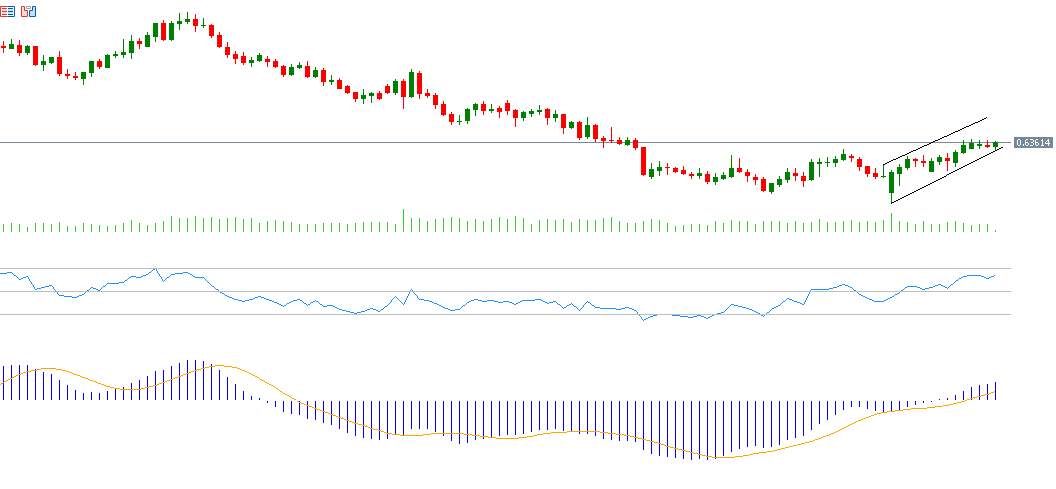

If the AUD/USD pair breaks below the pivot level of 0.6350, it could target support levels at 0.6328, 0.6314, and 0.6292. On the other hand, if it surpasses the pivot level, it may aim for resistance levels at 0.6364, 0.6386, and 0.6400.

The Relative Strength Index (RSI) is currently at around 64, indicating continued bullish momentum for the AUD/USD pair. Additionally, the MACD indicator shows that the blue line is above the orange signal line, reinforcing the ongoing upward momentum of the Australian dollar against the US dollar.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.