The USD/TRY exchange rate reached 36.5325 on Friday, February 21, 2025, marking its highest level ever. The price is currently hovering around 36.5000 lira per dollar. The Turkish lira has depreciated by approximately 4% since the beginning of the year, and forecasts indicate continued weakness in the coming period.

Recent economic data from Turkey suggest some economic slowdown, as:

• The annual Consumer Price Index (CPI) in Turkey slowed to 42.12% in January, higher than expectations (41.25%) but lower than the previous reading (44.38%).

• The annual Producer Price Index (PPI) declined to 27.20% in January, lower than the previous reading (28.52%).

• The Manufacturing Purchasing Managers’ Index (PMI) dropped to 48.00 in January, indicating contraction and falling below the previous reading (48.10).

• Exports declined to 21.20 billion Turkish lira, below both expectations (23.46 billion) and the previous reading (22.25 billion).

• Retail sales growth slowed to 0.4% on a monthly basis, down from the previous reading of 1.9%.

Expectations suggest that the Turkish central bank will continue cutting interest rates in the coming period, having already reduced them by 50 basis points from December 2024 to January 2025, bringing the rate down from 50% to 45%.

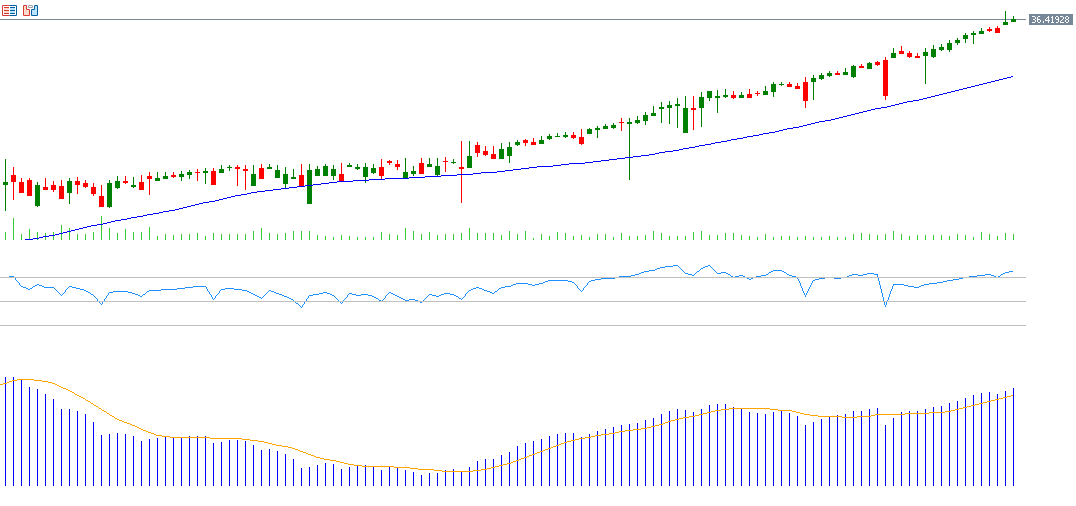

From a technical perspective, the upward trend for USD/TRY appears dominant in the near term, especially with continued positive momentum. The Relative Strength Index (RSI) currently stands at 77, indicating overbought conditions. Additionally, the 20-day, 50-day, and 200-day moving averages are aligned in an upward direction, with the 20-day average surpassing the 50-day average, and the 50-day exceeding the 200-day. Furthermore, a bullish crossover recently occurred between the MACD indicator (blue) and the Signal Line (orange), reinforcing the upward momentum of the USD/TRY pair.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.