Last week witnessed several significant economic events globally. In the United States, data showed mixed performance: retail sales rose at the fastest pace since January 2023, while industrial production and the Philadelphia Manufacturing Index declined notably. However, the labor market showed signs of improvement. In the Eurozone, the European Central Bank cut interest rates by 25 basis points amid slowing inflation and improved industrial output. In the UK, inflation fell more than expected, which may support a shift toward monetary easing. In Canada and Australia, inflation and labor market data reflected signs of a slowdown, while inflation in New Zealand rose more than anticipated. In Japan, industrial production improved, but exports slowed, and imports declined notably. On the Chinese front, economic data pointed to strong performance, with GDP, industrial output, and retail sales all exceeding expectations—indicating a gradual economic recovery despite falling imports and continued pressure on the labor market.

Market Analysis

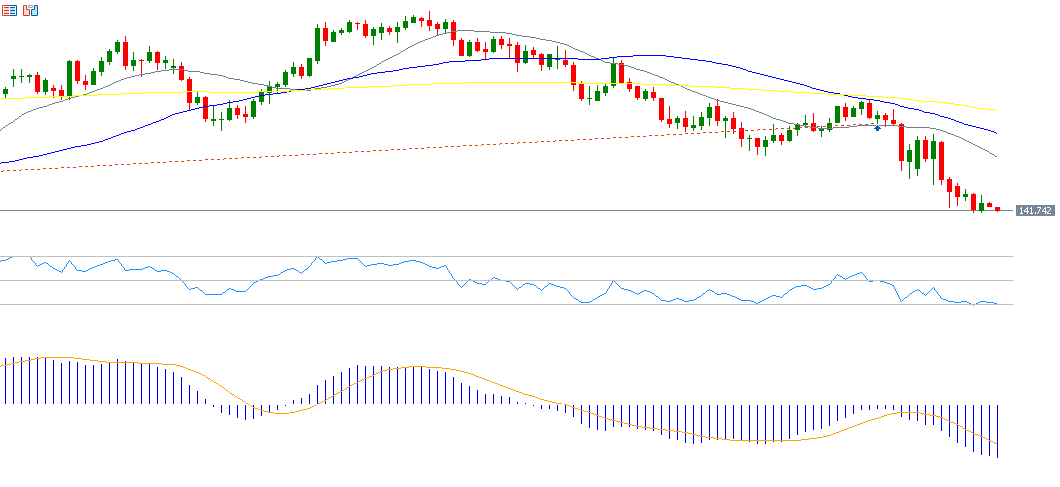

USD/JPY

The USD/JPY pair hit 141.61 on Thursday, April 17, 2025, marking its lowest level since September 18, 2024, and is currently trading near the 142.00 level. The pair has declined approximately 10% since the beginning of the year. Bearish momentum appears to dominate going forward, driven by factors such as the yen’s status as a safe-haven currency during times of uncertainty, and expectations that the Bank of Japan might raise interest rates in the coming period. The RSI currently stands at around 31, indicating bearish momentum. The MACD also shows a bearish crossover, with the MACD line (blue) crossing below the signal line (orange), reinforcing the negative outlook for the pair.

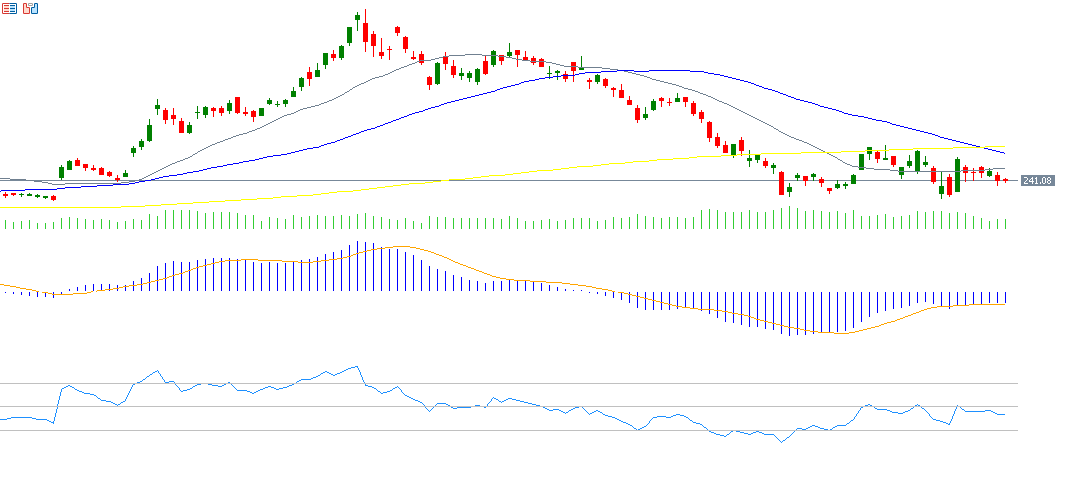

Tesla

Tesla shares have fallen around 40% since the start of the year. Markets are awaiting the company’s Q1 earnings report, with expectations of earnings per share at $0.71, up from the previous figure of $0.45. Revenue is projected to reach $25.81 billion, compared to $21.3 billion previously. The RSI currently reads around 44, indicating continued bearish momentum for the stock.

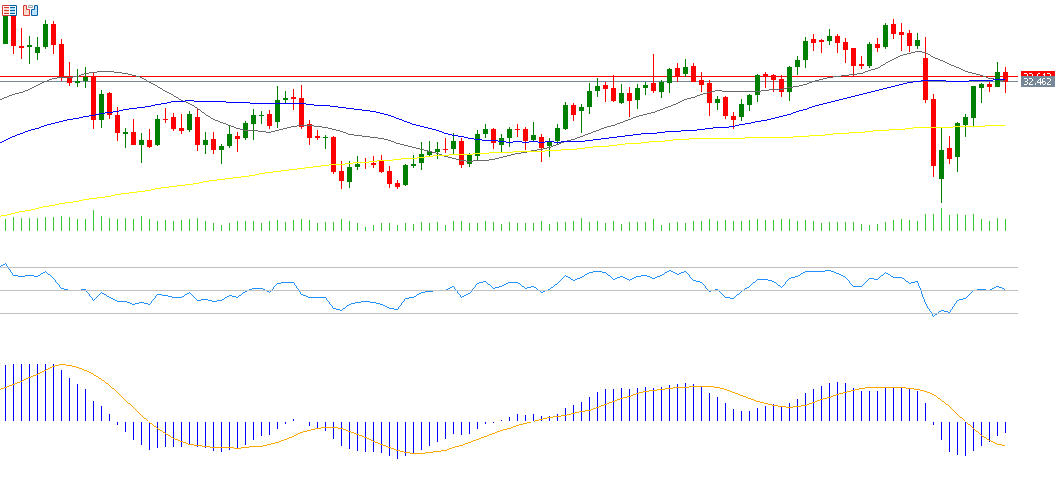

Silver

Silver prices reached $33.12 on Wednesday, April 16, 2025—the highest level since April 3—driven by record-high gold prices, expectations of U.S. interest rate cuts, ongoing geopolitical tensions in the Middle East, and trade conflicts. The RSI currently stands at about 52, suggesting mildly positive momentum for silver.

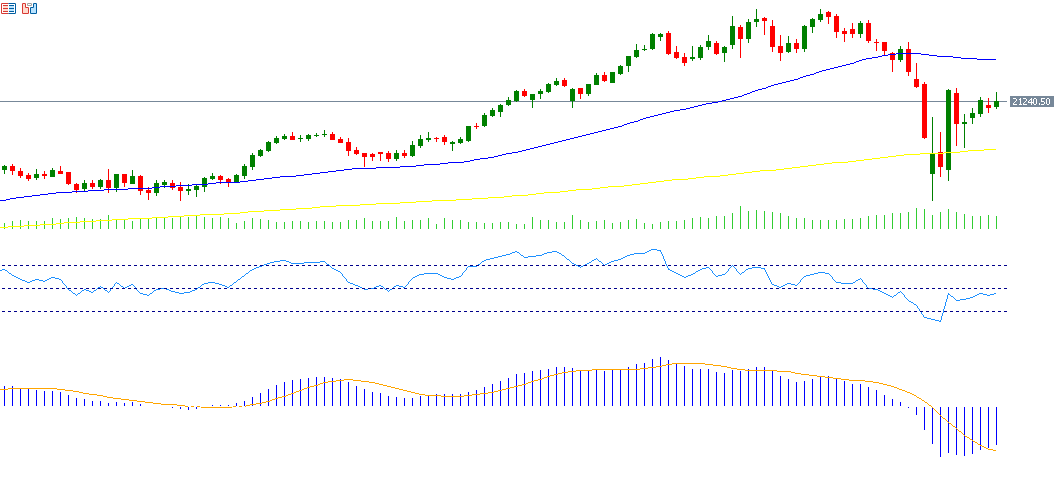

German DAX Index

The German DAX index has risen approximately 7% year-to-date. Despite this upward trend, uncertainty remains, particularly due to the ongoing trade war between the Trump administration and various countries, especially the European Union. The RSI is currently around 47, indicating a slight bearish bias in momentum.

Key Events This Week

Markets are anticipating several important economic indicators and events this week:

- Monday: China’s loan prime rate decision.

- Wednesday: PMI data for both manufacturing and services sectors from Australia, Japan, the Eurozone, the UK, and the U.S. Additionally, the U.S. will release data on new home sales and crude oil inventories.

- Thursday: The U.S. will publish data on durable goods orders, jobless claims, and pending home sales.

- Friday: Key releases include Tokyo’s Consumer Price Index (Japan), retail sales data from the UK and Canada, and the University of Michigan Consumer Sentiment Index (U.S.).

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.