Oil prices dropped to $62.40 today, marking their lowest level since April 10, 2025, and are currently trading near $62.50. Prices have declined by around 16% since the beginning of the year, amid ongoing uncertainty in the oil market, which is being driven by several conflicting factors. Notably, crude oil prices reached as low as $58.44 on April 9, 2025—the lowest level since February 2021.

This decline is attributed to several key factors, including:

• OPEC+’s decision to return 411,000 barrels per day to the market—significantly higher than expectations of just 135,000 barrels.

• Uncertainty surrounding tariffs imposed by Trump on various countries, especially China, and the retaliatory measures.

• Concerns over a potential economic recession in the United States.

• Oversupply in the global oil market.

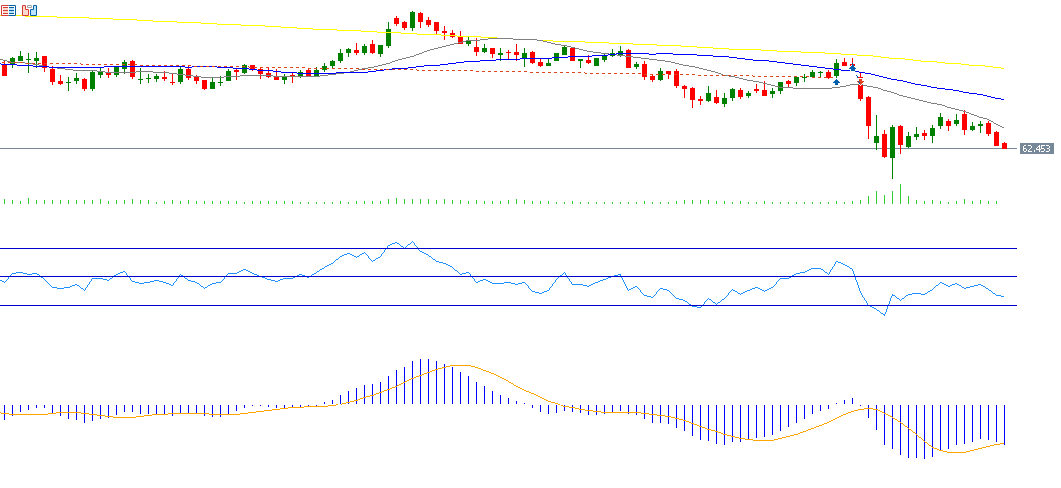

From a technical perspective, indicators suggest continued bearish momentum for oil prices due to the following:

- The 200-day, 50-day, and 20-day moving averages are aligned in a downward trend, with the 200-day above the 50-day, and the 50-day above the 20-day average.

• The Relative Strength Index (RSI) is currently at 37, indicating bearish momentum.

• The MACD line (blue) is converging with the Signal Line (orange), and any downward crossover between the two could further reinforce the negative momentum in crude oil prices.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.