The USD/TRY exchange rate reached 38.8040 yesterday, marking its highest level since March 19, 2025, when it touched around 41.00. This spike follows political unrest in Turkey, particularly the imprisonment of Istanbul’s mayor, Ekrem İmamoğlu, on charges related to corruption and supporting terrorist organizations. The pair is currently trading near 38.7500 lira per dollar.

Since the start of the year, the U.S. dollar has appreciated by approximately 10% against the Turkish lira, and forecasts suggest continued weakness in the lira in the coming period.

Recent Turkish economic data highlights persistent signs of slowdown, including:

- The Consumer Price Index (CPI) slowed on a yearly basis to 37.86% in April, slightly below expectations (38.00%) and the previous reading (39.10%).

- The Producer Price Index (PPI) declined to 22.50% in April from 23.50% in the previous month.

- The Manufacturing PMI contracted to 47.30 in April, unchanged from the previous reading.

- The Consumer Confidence Index fell to 83.9 in April, down from 85.9 previously.

- Retail sales shrank by 1.4% month-over-month, a deeper contraction than the prior -1.2% reading.

- The trade balance continued to show a deficit, recording 4 billion lira in March.

Technical Analysis:

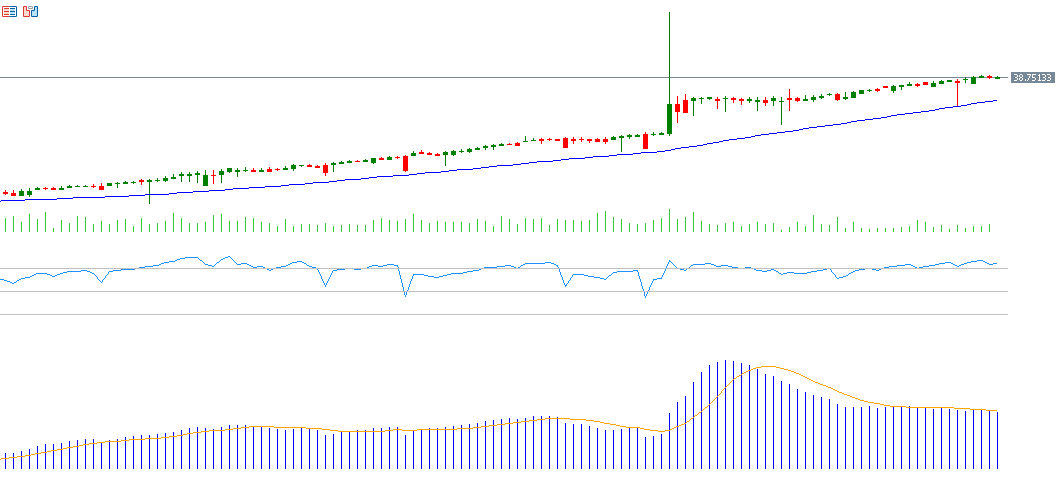

The upward trend in USD/TRY appears to remain dominant, with bullish momentum persisting. The Relative Strength Index (RSI) currently stands at 78, indicating the pair has entered overbought territory.

Additionally, the 20-day, 50-day, and 200-day moving averages show a clear upward alignment: the 20-day average is above the 50-day, which in turn is above the 200-day average.

The MACD indicator also confirms bullish momentum, as the blue MACD line has crossed above the orange signal line, reinforcing expectations of further upward movement in the pair.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.