The past week witnessed several key global economic developments. The minutes from the U.S. Federal Reserve’s June meeting showed a division among members regarding the inflationary impact of tariffs. Weekly jobless claims dropped to 227,000, and U.S. crude oil inventories rose sharply by over 7 million barrels. In the Eurozone, retail sales contracted by 0.7%. In the UK, monthly GDP shrank by 0.1%, while industrial production fell by 0.9%. Canada’s economy showed strength, with unemployment dropping to 6.9% and employment increasing by 83,100. In Australia, the Reserve Bank held interest rates steady at 3.85%, contrary to expectations of a rate cut. Similarly, the Reserve Bank of New Zealand maintained its policy rate at 3.25%, with a slight improvement in the PMI. In China, the Consumer Price Index rose marginally by 0.1% year-on-year, while the Producer Price Index continued to decline by 3.6%.

Market Analysis

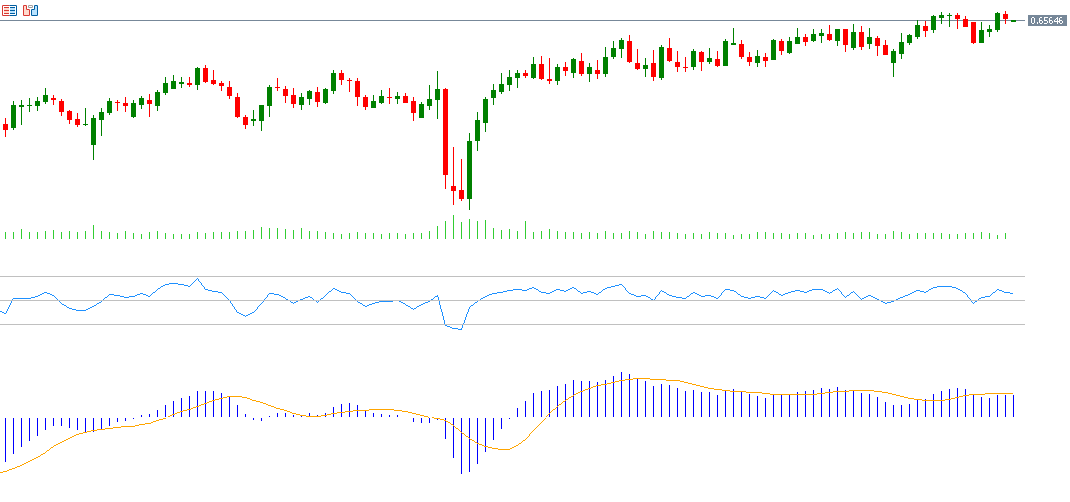

AUD/USD

The Australian dollar rose to 0.6595 against the U.S. dollar on Friday, July 11 — its highest level since November 11, 2024. The pair has gained around 7% since its April 9, 2025 low of 0.5913 and is up about 6% year-to-date. Recent Australian economic data shows resilience, prompting the Reserve Bank of Australia to hold rates steady at 3.85% during its July 8 meeting, defying expectations of a 25-basis-point cut. The Relative Strength Index (RSI) is currently at 57, indicating upward momentum. The MACD also shows a bullish crossover, reinforcing the positive trend.

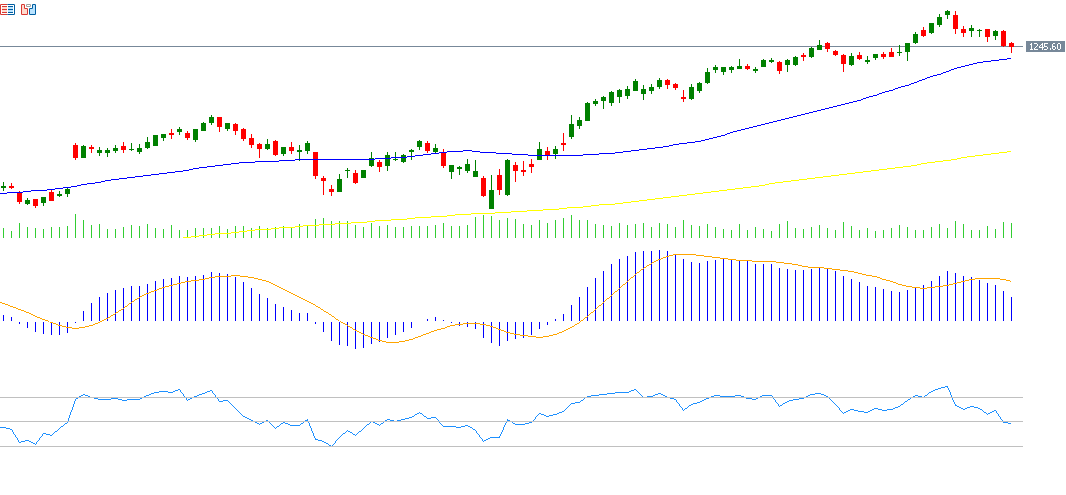

Netflix

Netflix stock has surged around 40% year-to-date. Markets are awaiting the company’s Q2 earnings on Thursday, July 17, 2025. Analysts expect EPS of $7.03, up from $4.88 in the previous quarter. Revenue is forecasted at $11.04 billion, compared to $9.56 billion previously. The RSI currently reads 48, suggesting bearish momentum.

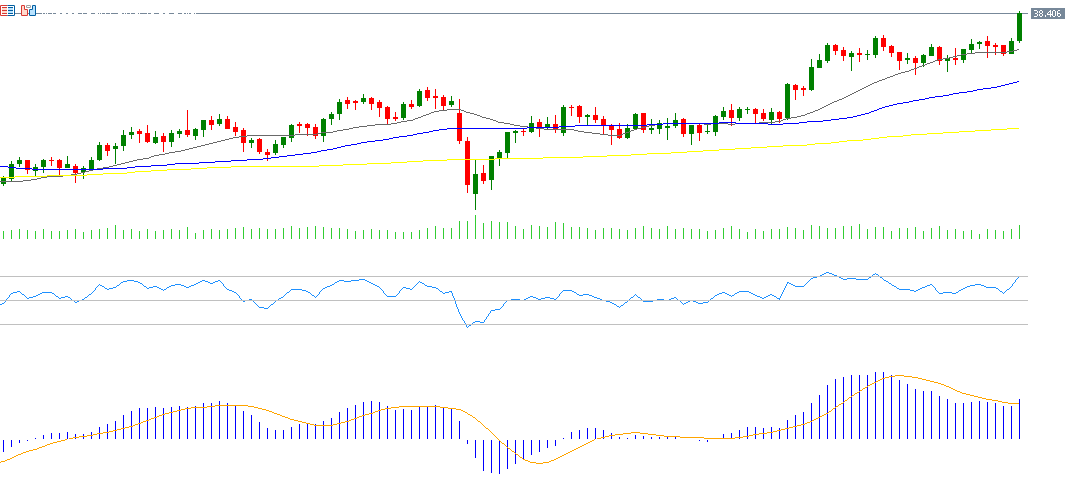

Silver

Silver prices climbed 4% last week, reaching $38.54 on Friday, July 11 — the highest level since September 2011. Prices have risen approximately 36% from the April 7 low of $28.36 and are up 33% year-to-date. Silver has outperformed high-risk assets like Bitcoin and major equity indices (U.S., European, Chinese, Japanese), as well as gold, which is up 28% YTD. The RSI is at 71, indicating overbought conditions and sustained bullish momentum. The MACD also shows a bullish crossover, confirming the upward trend.

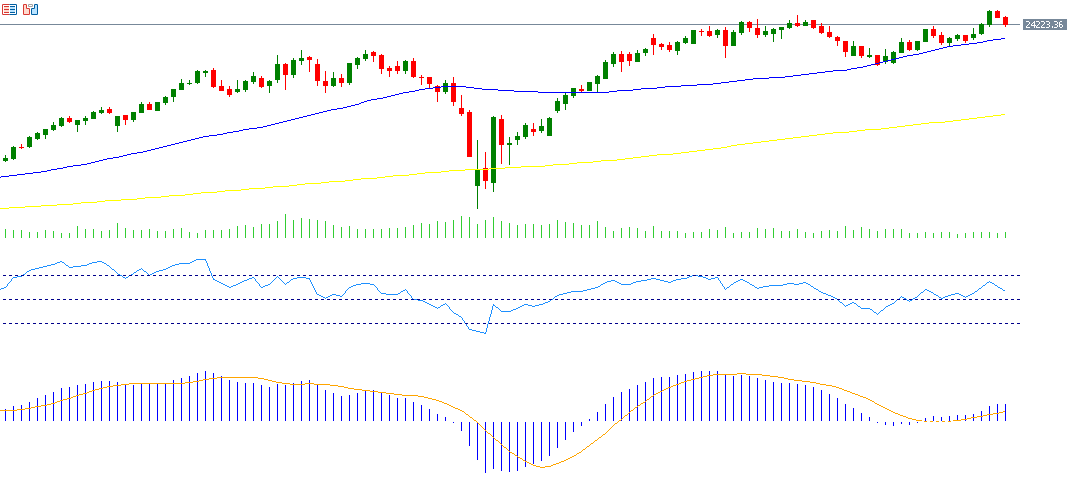

DAX Index

Germany’s DAX index hit a new record high of 24,639 on Thursday, July 10. The index has surged nearly 33% from its April 7 low of 18,490 and is up 22% YTD, outperforming other European indices such as France’s CAC 40, the UK’s FTSE 100, and the STOXX Europe 600, as well as U.S. indices like the S&P 500 and Nasdaq 100. The RSI stands at 58, indicating bullish momentum, while the MACD shows a bullish crossover, supporting the uptrend.

Key Economic Events This Week

- Monday: Export and import data from China, industrial production from Japan, and producer prices from Switzerland.

- Tuesday: China’s retail sales, fixed asset investment, unemployment rate, industrial production, and GDP; Eurozone industrial production; U.S. Empire State Manufacturing Index and CPI; Canadian CPI.

- Wednesday: UK CPI; U.S. PPI, industrial production, and crude oil inventories.

- Thursday: Japan’s trade balance; Australian employment and unemployment rates; UK wage growth and unemployment rate; Eurozone CPI; U.S. retail sales, jobless claims, and Philadelphia Fed Manufacturing Index.

- Friday: Japan’s CPI; U.S. University of Michigan consumer sentiment and building permits.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.