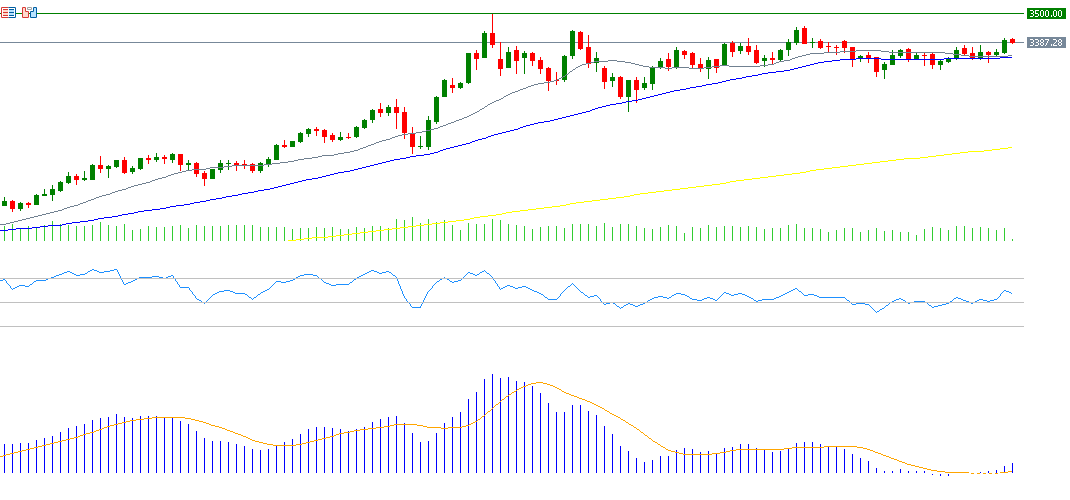

Gold prices rose to $3,403 today, marking their highest level in nearly a month. Since hitting an all-time high of $3,500 on April 22, 2025, gold has been trading in a sideways range between the strong support level at $3,200 and the resistance level at $3,400, seeking a clear directional breakout either upwards or downwards. Despite the consolidation, the yellow metal remains up by approximately 29% since the beginning of the year, outperforming high-risk assets such as equities and Bitcoin. This reflects continued demand for the traditional safe haven—gold. Prices are currently hovering near the $3,400 level.

Fundamentally, several key factors continue to support the bullish outlook for gold:

- Geopolitical tensions

- Trade frictions between the Trump administration and other countries, particularly the European Union, which is planning to respond to U.S. tariffs amid Trump’s increasingly aggressive stance. Notably, the tariffs are set to take effect on August 1, adding to the uncertainty.

- Weakness in the U.S. Dollar Index

- Declining yields on U.S. Treasury bonds across various maturities, which favors gold as a non-yielding asset

- Market expectations of two U.S. interest rate cuts this year

- Continued central bank purchases of gold, led by the People’s Bank of China, which is boosting global demand and supporting prices

Technically, indicators also suggest further upside potential for gold:

- A continued bullish crossover between the 20-day moving average ($3,335) and the 50-day moving average ($3,330), signaling a sustained positive trend

- The Relative Strength Index (RSI) is currently at 58, indicating ongoing bullish momentum

- A positive crossover on the MACD indicator, where the blue MACD line has moved above the orange signal line, reinforcing the upward momentum

Gold appears to be well-supported both fundamentally and technically, with potential for further gains in the near term.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.