Last week saw several important global economic developments. In the United States, jobless claims fell to 217,000, lower than expected, while crude oil inventories dropped by approximately 3.169 million barrels. New home sales came below expectations but slightly higher than the previous reading. Meanwhile, PMI data showed a divergence, with the manufacturing sector contracting and the services sector expanding. In the Eurozone, the European Central Bank held interest rates steady at 2.00%, and both manufacturing and services PMIs showed slight improvement. In the UK, manufacturing data showed modest improvement, while the services sector weakened, and retail sales came in below expectations despite monthly growth. In Australia, both manufacturing and services PMIs recorded growth, indicating economic resilience. New Zealand’s annual inflation ticked up to 2.7%. Japan saw a decline in manufacturing activity, an improvement in the services sector, and a slight slowdown in inflation. In China, the central bank left lending rates unchanged, in line with expectations, maintaining a supportive monetary policy stance to bolster economic growth.

Market Analysis

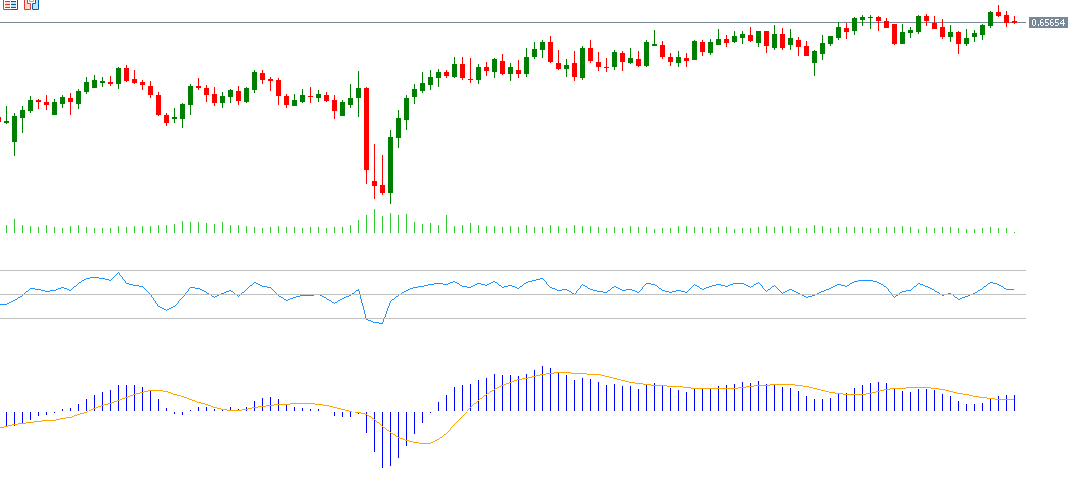

AUD/USD

The Australian dollar rose to 0.6625 against the US dollar on Thursday, July 24, marking its highest level since November 8, 2024. The AUD/USD pair has gained approximately 12% from April 9, 2025, low of 0.5913 to last week’s high, and about 6% year-to-date. Recent Australian economic data reflects resilience. The RSI currently stands at 54, indicating positive momentum. The MACD also shows a bullish crossover, with the MACD line (blue) crossing above the signal line (orange), reinforcing the positive momentum.

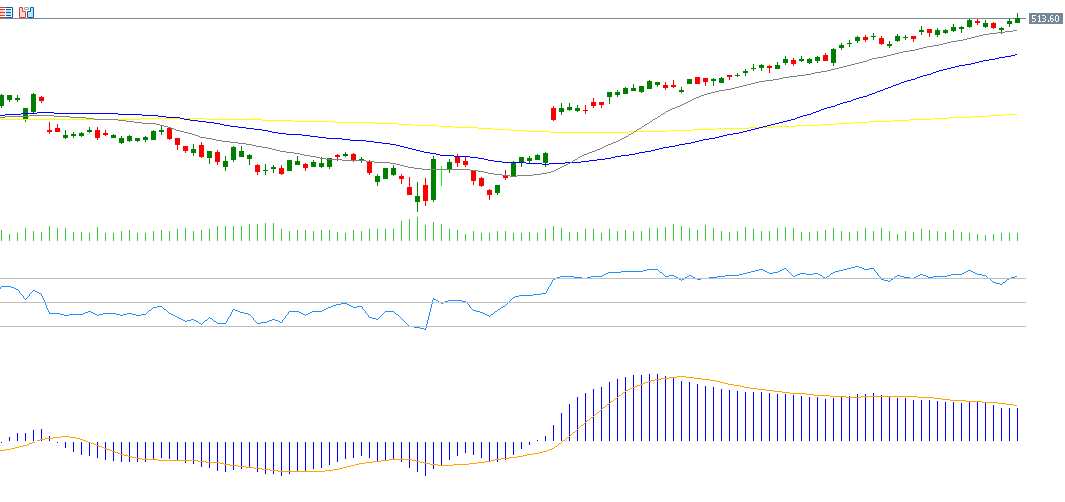

Microsoft

Microsoft’s stock has risen by about 22% year-to-date. Markets are awaiting the company’s financial results on Wednesday, July 30, 2025, with expectations of earnings per share (EPS) at $3.37, up from $2.95 in the previous quarter. Revenue is expected to reach $73.69 billion, up from $64.7 billion previously. The RSI is currently at 72, indicating overbought conditions and strong bullish momentum.

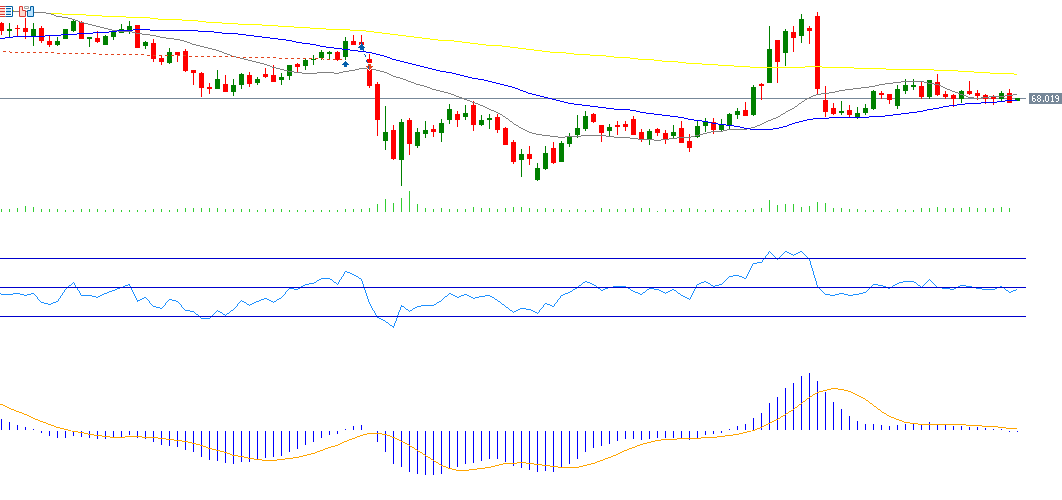

Crude Oil

Crude oil prices have been trading sideways between $66 and $71 over the past month, currently hovering around $68. Prices are down roughly 8% year-to-date. The market remains uncertain, influenced by mixed factors. Downward pressures include ongoing uncertainty around trade negotiations led by President Trump, and supply-side comfort as the EU announced that the refined fuel import ban from Russia will not take effect until January 21, 2026. Additional supply relief comes from OPEC+ easing production cuts, with Saudi crude exports in May hitting a three-month high. The RSI is at 48, indicating weak momentum. A bearish MACD crossover also supports continued downside pressure on oil prices.

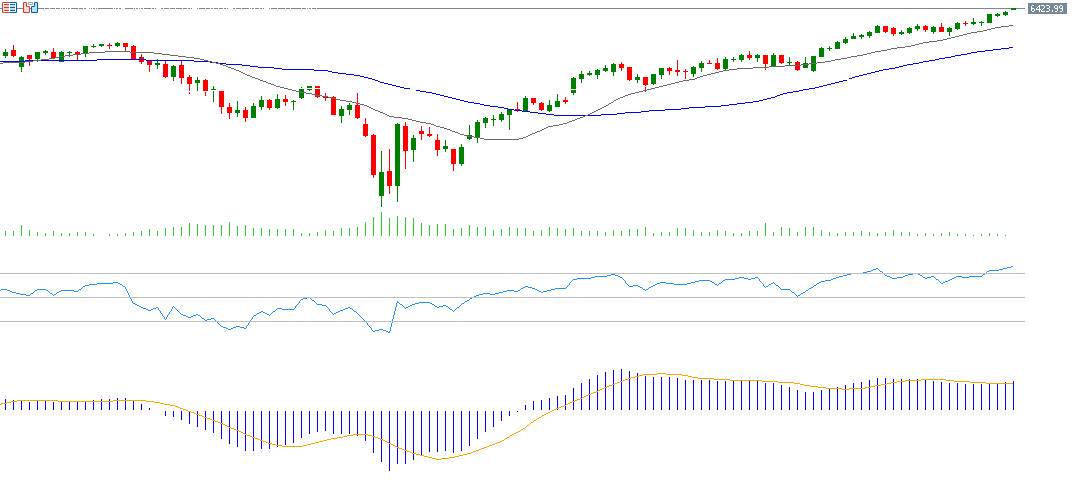

S&P 500

The S&P 500 hit a new all-time high of 6,396 on Friday, closing at 6,389. The index has surged 32% from its April 7 low of 4,835 and is up 9% year-to-date, confirming a bull market. The rally is supported by strong corporate earnings, easing trade tensions—especially after a trade deal between the US and Japan—and indications of a potential agreement with the EU. The RSI is at 76, signaling overbought conditions and strong upward momentum. The MACD shows a bullish crossover, indicating continued strength.

Key Events This Week

- Tuesday: US Consumer Confidence and Job Openings reports.

• Wednesday: Bank of Canada interest rate decision (expected to remain at 2.75%). Federal Reserve interest rate decision (expected to hold between 4.25% and 4.50%), along with Fed Chair Jerome Powell’s speech, which will be closely watched amid ongoing pressure from President Trump to lower rates. Other key releases include Australia’s CPI, Eurozone GDP, US ADP private payrolls, pending home sales, and crude oil inventories.

• Thursday: Bank of Japan interest rate decision (expected to hold at 0.50%). Key US releases include Core PCE Price Index, jobless claims, and Canada’s GDP.

• Friday: Major global manufacturing PMIs including China’s Caixin, as well as PMIs from Australia, Japan, the UK, the Eurozone, and the US. Additional releases include Eurozone CPI, US ISM Manufacturing PMI, construction spending, University of Michigan Consumer Sentiment Index, average hourly earnings, nonfarm payrolls, and the US unemployment rate.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.