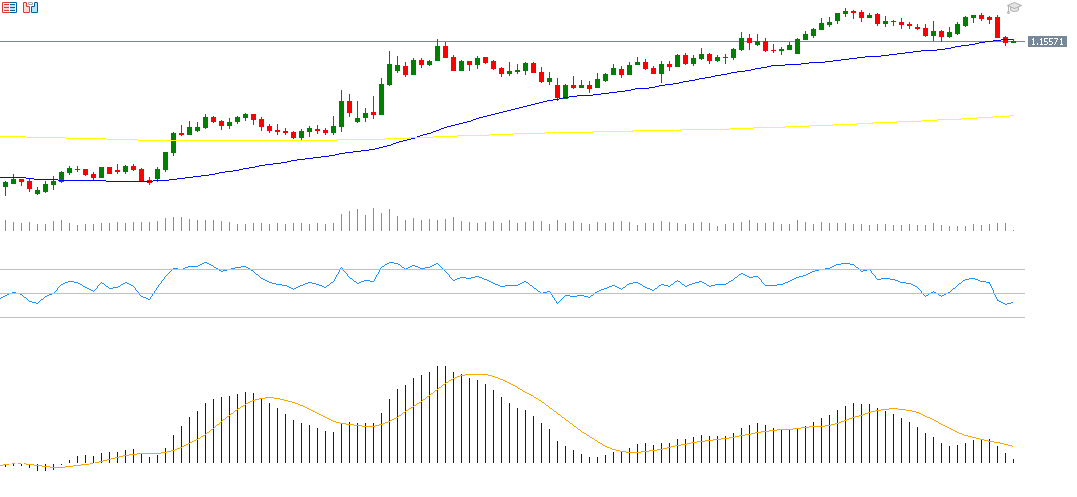

The EUR/USD pair dropped to 1.1519 yesterday, marking its lowest level since June 23, 2025, and is currently trading near the 1.1550 level. Bearish momentum appears to dominate the pair’s outlook in the near term due to a combination of fundamental and technical factors.

Fundamental Factors

- Easing trade tensions: This follows the signing of a trade agreement between the United States and the Eurozone, which includes a 15% tariff on select European goods, alongside mutual exemptions covering key industrial and agricultural sectors. The EU also committed to investing $600 billion in the US economy, purchasing $750 billion worth of U.S. energy products, and acquiring large quantities of U.S. military equipment.

- Widening yield differentials: The yield on 10-year German government bonds stands at approximately 2.701%, while the 2-year U.S. Treasury yield is around 4.388%, creating a yield gap of about 1.687%. This disparity favors the U.S. dollar, especially in the context of carry trade strategies.

Technical Factors

- Bearish crossover: The MACD (blue line) has crossed below the signal line (orange line), indicating continued bearish momentum for the pair.

- Directional indicators: The negative Directional Movement Index (-DMI) is around 27 points, while the positive DMI (+DMI) is at 15 points—signaling strong selling pressure on the euro.

- Relative Strength Index (RSI): The RSI currently stands near 42, suggesting the downtrend is likely to persist.

Investor Sentiment

Traders are closely watching today’s interest rate decision by the U.S. Federal Reserve, with expectations pointing to a rate hold within the 4.25%–4.50% range. Additionally, markets are focused on Fed Chair Jerome Powell’s speech, which could offer clues about future policy direction—especially in light of political pressure from President Donald Trump to lower interest rates.

Support and Resistance Levels

- Support: Breaking below the pivot level at 1.1556 may open the door to further declines toward 1.1512, 1.1473, and 1.1429.

- Resistance: If the pair moves above the pivot level, resistance may be encountered at 1.1595, 1.1639, and 1.1670.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.