The U.S. dollar traded at 146.22 against the Japanese yen yesterday, its lowest level since July 24, 2025, and is currently hovering near 147.00. The pair has declined by around 6% since the beginning of the year. Negative momentum appears to dominate the coming phase, driven by several fundamental and technical factors.

Fundamental Factors:

- Rising Japanese government bond yields across different maturities. For instance, the 10-year yield stands at around 1.57%, its highest level in two weeks.

- Weakness in the U.S. dollar index, with U.S. economic indicators showing notable softness such as the decline in ISM manufacturing and non-manufacturing PMIs, along with a drop in the core CPI.

- Interest rate expectations: The Bank of Japan is likely to raise rates in the coming phase, while uncertainty prevails over U.S. monetary policy, with expectations of two additional rate cuts this year.

- Investor preference for safe-haven currencies like the yen amid heightened uncertainty over trade, monetary, and fiscal policies, particularly in the United States.

Technical Factors:

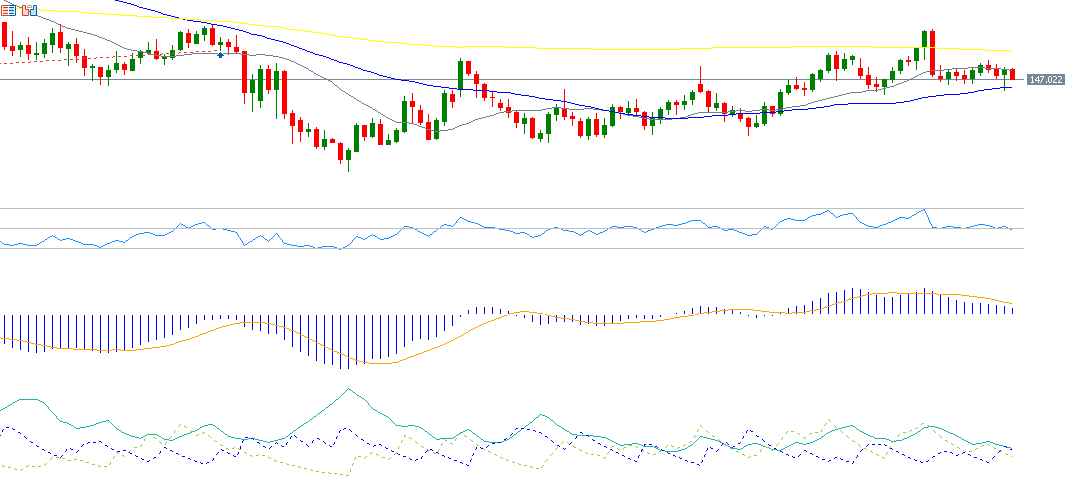

- MACD: The blue line is below the signal (orange) line, indicating continued negative momentum for USD/JPY.

- Directional Movement Index (DMI): +DMI is around 18 points while –DMI is about 21 points, reflecting strong selling pressure on the dollar versus the yen.

- Relative Strength Index (RSI): Currently at 48, pointing to sustained bearish pressure.

Support and Resistance Levels:

- Support: If the pivot point at 147.28 is broken, the pair could move toward 146.59, then 145.51, and eventually 144.88.

- Resistance: If the pivot point is breached on the upside, the pair may target 148.36, then 149.05, and finally 150.13.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.