The UK’s FTSE 100 index continues its upward trend, recording 9,229 points on Friday, August 15, 2025, its highest level on record. The index has risen by about 23% since the low of April 7, 2025, at 7,533 points, reaching the peak achieved on Friday at 9,229 points. It has also gained around 13% year-to-date, outperforming major U.S. indices such as the S&P 500 and Nasdaq 100, though still lagging behind Germany’s DAX index (22%). The FTSE 100 is currently hovering near the 9,200-point level.

The significant rally in the FTSE 100 can be attributed to several factors:

- Stronger-than-expected UK economic data, such as GDP growth of 0.3% in Q2 2025 (vs. 0.1% expected) and monthly industrial production growth of 0.7% (vs. 0.3% expected).

- Increased investor optimism over a potential resolution to the Russia–Ukraine war following the Trump–Putin summit in Alaska last Friday, and the Trump–Zelensky meeting with European leaders at the White House yesterday.

- Expectations of continued monetary easing or potential interest rate cuts by the Bank of England in the coming period.

- Foreign investment inflows into UK equities, which remain attractive and undervalued compared to indices such as the S&P 500 and Stoxx 600.

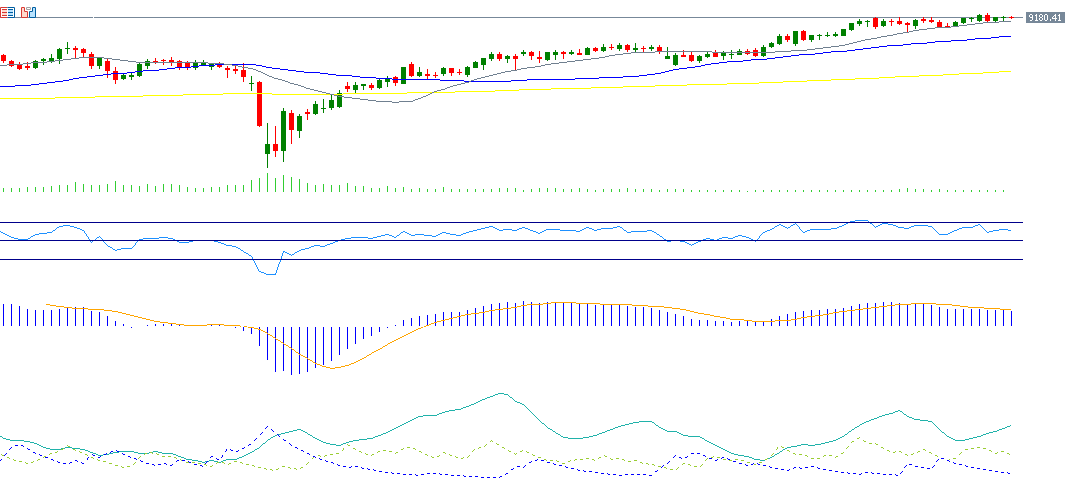

From a technical perspective, indicators remain supportive of the FTSE 100’s upward momentum:

- Moving averages (20, 50, 200 days) are aligned in a bullish formation, with the 20-day average above the 50-day, and the 50-day above the 200-day.

- The Relative Strength Index (RSI) is currently at 60, signaling positive momentum.

- The MACD indicator shows a bullish crossover between the blue MACD line and the orange signal line, reinforcing the positive outlook.

- The Directional Movement Index (DMI+) stands at around 22, compared to 10 for the DMI-, indicating strong buying pressure. More importantly, the Average Directional Index (ADX) is at 31, confirming the strength of the current uptrend.

The main challenge for the FTSE 100 lies in breaking through the all-time high of 9,229 points recorded on August 15, 2025, which could pave the way for new record levels around 9,500 points.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.