European stock indices declined collectively and significantly yesterday, including France’s CAC 40, Germany’s DAX, the UK’s FTSE 100, and Europe’s STOXX 600, despite their strong performance since the beginning of the year. The decline was mainly driven by the political crisis in France, after Prime Minister François Bayrou’s call for a confidence vote on September 8 raised fears of a government collapse.

In contrast, French government bond yields surged, with the 10-year yield reaching 3.53% yesterday, the highest since March 18, 2025. Meanwhile, the spread over German government bonds widened to its highest level since April, as the German 10-year yield stood at 2.75%. Markets believe that rising political risks in France are weighing on French assets, especially given already weak economic conditions.

The CAC 40 index closed yesterday at 7,837 points, its lowest level since August 14, 2025. The index is still up about 6% year-to-date, but it lags behind Germany’s DAX (up about 21%), the UK’s FTSE 100 (up about 14%), and Europe’s STOXX 600 (up about 9%).

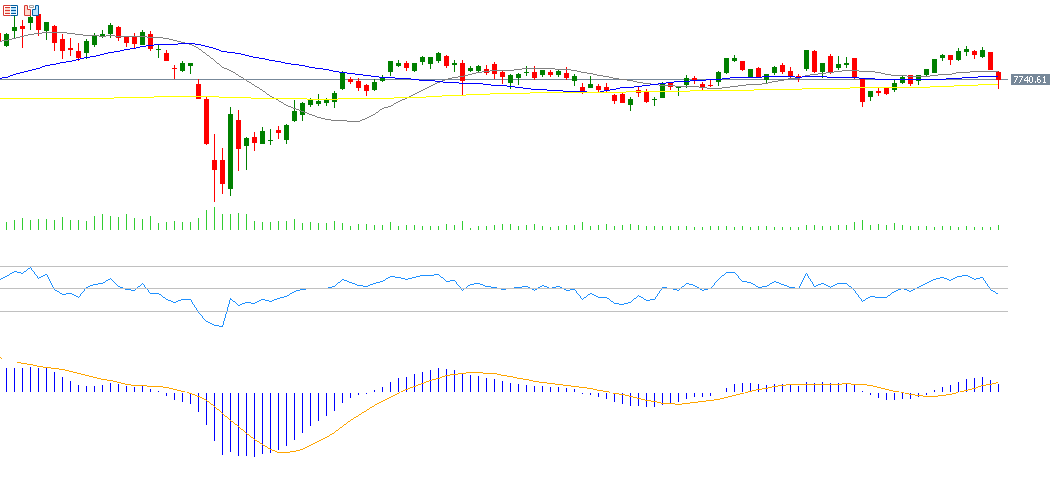

From a technical perspective, the 20-, 50-, and 200-day moving averages remain aligned in a bullish trend, with the 20-day average above the 50-day, and the 50-day above the 200-day.

A key support level lies at the 20-day moving average (gray) near 7,800 points, followed by the 50-day moving average (blue) at 7,757 points. Any bearish crossover between them could indicate the start of a downward trend in the CAC 40.

As for the Relative Strength Index (RSI), it currently stands at 51 and is trending downward. A break below the 50 level could signal continued downside momentum for the CAC 40.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.