Gold prices reached a new record level of $4,059 yesterday. Today, they have retreated to around $4,000 and are currently hovering near $4,040. The yellow metal has risen by about 54% since the beginning of the year until now, marking its best annual performance since 1979, outperforming high-risk assets such as Bitcoin and global stock indices.

Despite Trump’s announcement of an agreement on the first phase of the plan to end the war in Gaza, this did not have a significant negative impact on gold. However, several factors continue to support the positive momentum in gold prices, notably:

- The ongoing government shutdown in the United States, as no agreement has yet been reached between Republicans and Democrats.

- Purchases by central banks, with global central banks, led by the People’s Bank of China, continuing to increase their gold reserves, which boosts demand and supports prices.

- The accommodative monetary policy environment: the US Federal Reserve cut interest rates by 25 basis points in September, and the “dot plot” forecasts indicate two additional cuts totaling 50 basis points by the end of this month and December. Even if these cuts do not occur, it is important to remember that Jerome Powell’s term ends in May next year, and it is likely that a Trump-aligned governor will be appointed, which could lead to a significant interest rate cut, possibly down to 1% or 2%. Naturally, this would increase demand for gold, which yields no return.

- Continued political pressure from US President Donald Trump on the Federal Reserve (such as appointing Stephen Moore and pressuring Lisa Cook).

- Inflation risks in the US, where the inflation rate remains near 3%, higher than the target of 2%, making gold a hedge against inflation. Additionally, a slowdown in the US labor market is observed, increasing the likelihood of the economy entering a stagflation phase.

- Ongoing geopolitical tensions, such as the Russia-Ukraine war, which remains far from any final resolution.

- Continued trade tensions between the Trump administration and other countries, with tariffs remaining a major feature of his policies.

Notably, gold mining stocks have shown positive momentum, outperforming major technology stocks, such as Barrick Gold (up about 116%), Newmont (up about 135%), and Agnico Eagle (up about 113%).

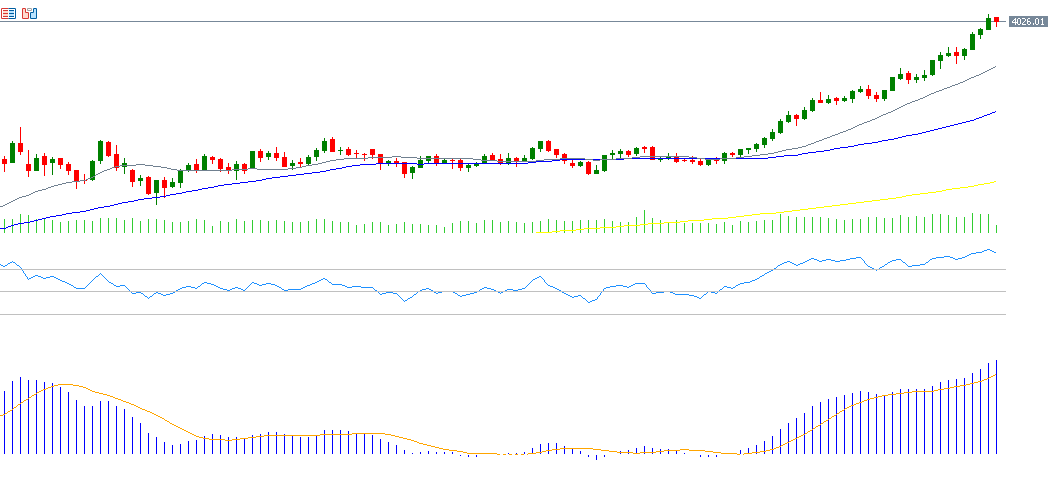

From a technical perspective:

- The 20-, 50-, and 200-day moving averages are well-aligned and trending upward, with the 20-day average crossing above the 50-day, which in turn is above the 200-day average.

- The Relative Strength Index (RSI) currently stands at 87 points, the highest level since August 7, 2020 — during the COVID-19 pandemic when gold reached a record price of $2,075. This indicator is in overbought territory, so a profit-taking phase might occur, which is healthy for the market.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.