Last week featured a range of mixed global economic data. In the United States, crude oil inventories rose more than expected, and the Empire State Manufacturing Index showed improvement, while the Philadelphia Fed Index dropped sharply. In the Eurozone, annual inflation data came in at or above expectations, though industrial production declined on a monthly basis. In the UK, retail sales slowed, and unemployment rose, but wages, industrial production, and GDP showed slight growth. Australia reported weaker-than-expected employment growth and a rise in the unemployment rate to 4.5%. In Japan, industrial production shrank more than anticipated. Meanwhile, in China, both exports and imports posted strong year-over-year growth, exceeding forecasts, while price indices continued to contract, albeit at a slower pace compared to previous readings.

Market Analysis

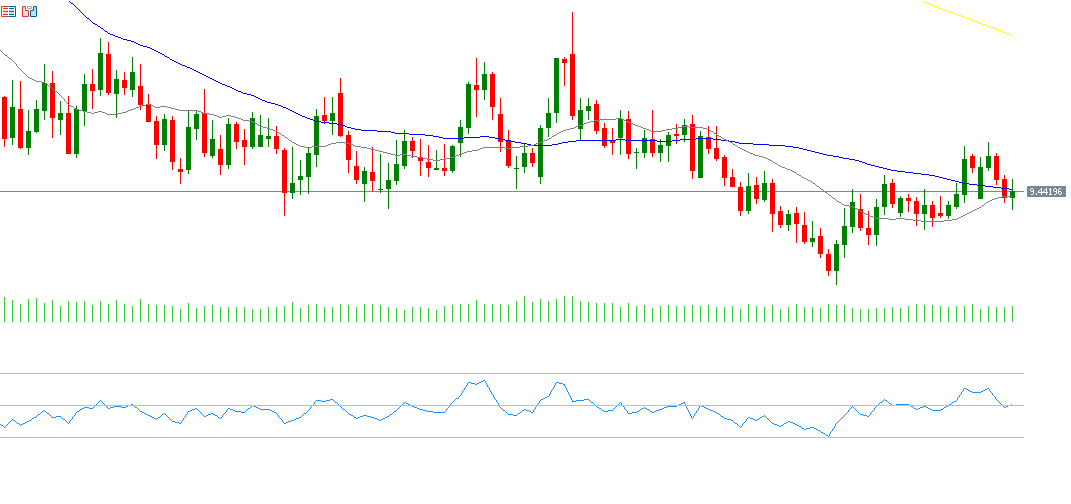

USD/SEK

The USD/SEK pair has been trading sideways over the past month within a range between 9.1900 and 9.5700, lacking clear directional momentum. The pair reached a low of 9.1925 on September 17, 2025 — its lowest level since February 10, 2022 — and has declined about 15% year-to-date, closing Friday at 9.4400. The Swedish krona continues to outperform among the G10 currencies against the US dollar, followed by the euro, Swiss franc, Norwegian krone, British pound, Australian dollar, Japanese yen, New Zealand dollar, and finally the Canadian dollar. Sweden’s latest economic data shows strong resilience, and the RSI currently stands at 50, indicating a neutral outlook for the pair.

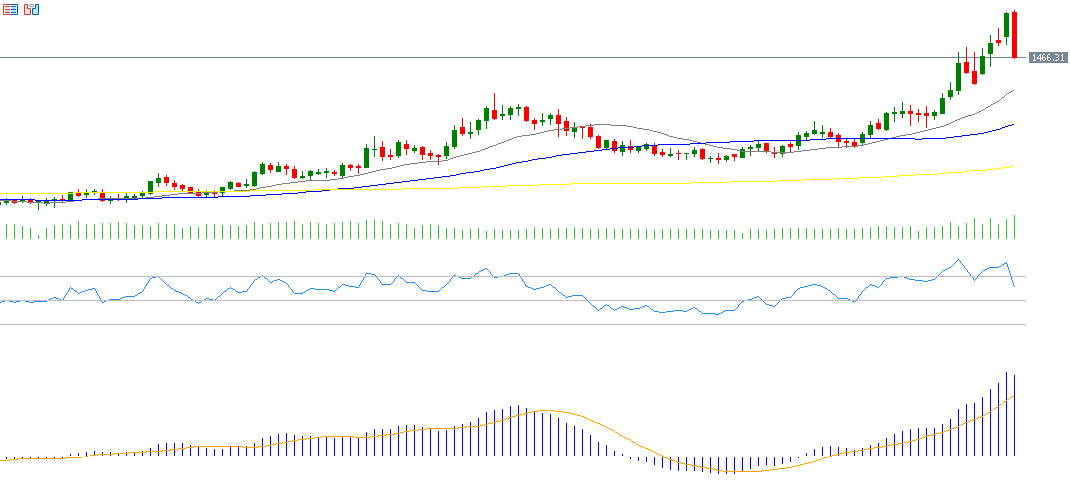

Palladium

Palladium continues its bullish trend, reaching $1,629 on Friday — its highest level since April 21, 2023 — before closing at $1,469. The metal has surged approximately 63% year-to-date, outperforming most other assets including Bitcoin and global equity indices. The upward momentum is supported by several factors: constrained supply, robust industrial demand, Western sanctions on Russia, and expectations of further US rate cuts. The RSI is currently at 62, signaling strong bullish momentum, and the MACD indicator shows a bullish crossover, reinforcing the upward trend.

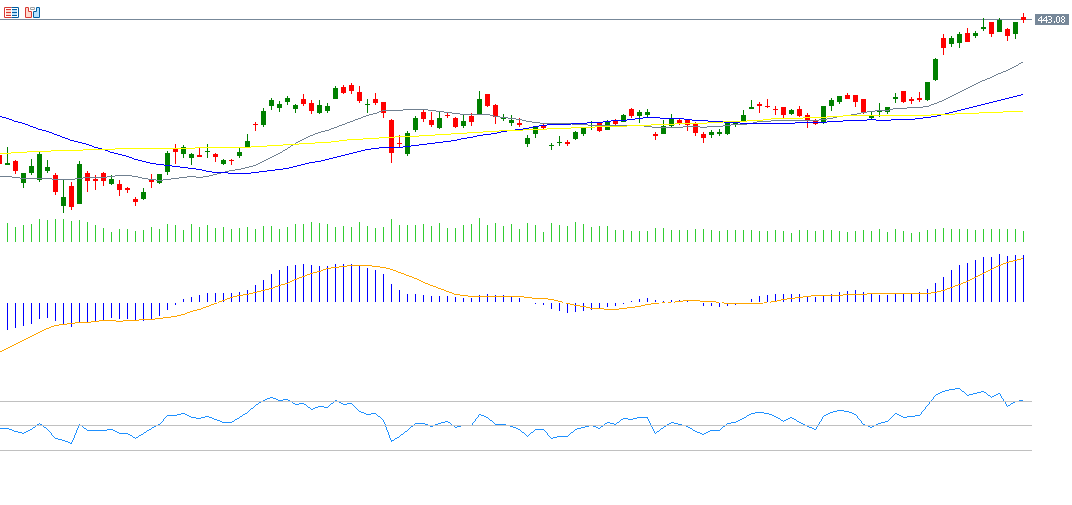

Tesla

Tesla’s stock has gained about 9% year-to-date. Markets are closely watching Tesla’s financial results on Wednesday, October 22, 2025. Analysts expect earnings of $0.48 per share, down from the previous figure of $0.72, and revenue of $24.55 billion, slightly lower than the previous $25.18 billion. The RSI currently stands at 57, reflecting a moderately positive momentum for the stock.

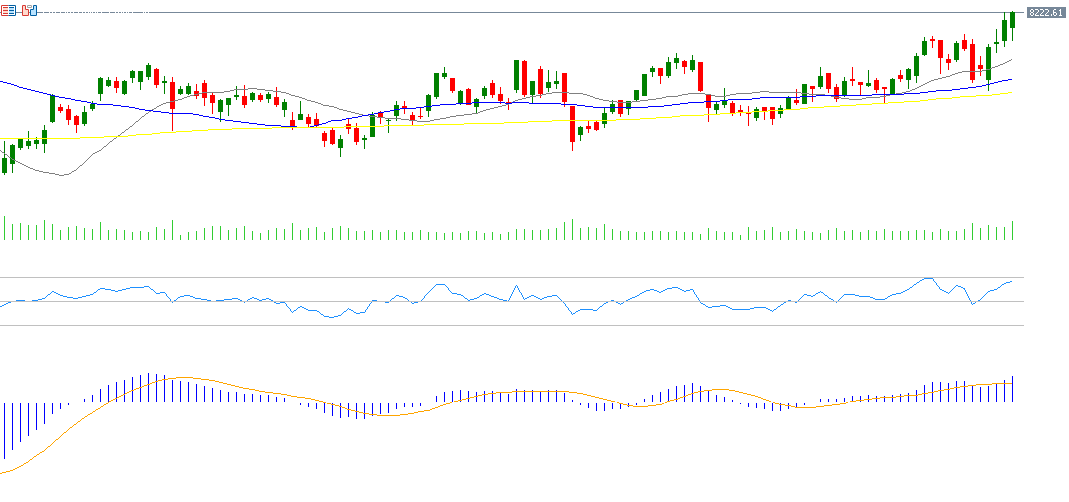

CAC 40

France’s CAC 40 index rose by 3.24% over the past week, reaching an all-time high of 8,225 points on Friday. The index is up around 11% year-to-date. Political uncertainty remains in France with Sébastien Lecornu reappointed as Prime Minister and the controversial pension reform currently on hold. The RSI is at 65, indicating strong bullish momentum, while the MACD also shows a bullish crossover, supporting the positive outlook for the index.

Key Events This Week

Markets are watching several important economic indicators this week:

- Monday: New Zealand CPI data; China’s key releases including the benchmark lending rate, GDP, fixed asset investment, retail sales, industrial production, and unemployment rate.

- Tuesday: Canada CPI figures.

- Wednesday: Japan’s export and import data; UK CPI report; US crude oil inventories.

- Thursday: Canada retail sales; US existing home sales and weekly jobless claims.

- Friday: Manufacturing and services PMIs from Australia, Japan, the UK, the Eurozone, and the US; Japan’s national CPI; UK retail sales; US CPI, University of Michigan consumer sentiment index, and new home sales.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.