Disclaimer: The products or services discussed in this article may not be offered by Taurex and may only be listed here for educational purposes.

Ethereum is a rapidly rising platform in the cryptocurrency world, with nearly 17 million active users worldwide as of 2022 and over 120 million ETH currently circulating as of June 2023.

Not bad at all for a cryptocurrency with humble beginnings.

No one would have guessed that a millennial who had to resort to crowdfunding in 2013 to make his vision a reality could be able to launch Ethereum only after two years.

Today, Ethereum buzzes with financial activity, achieving over one million transactions daily. ETH’s rapid growth and activity continue to attract traders and investors to this crypto platform.

The platform is currently the second most valuable cryptocurrency platform and the foundation for many emerging blockchain-based technological advances.

But what makes Ethereum unique, and how does it differ from Bitcoin? What drives investors to put their faith in this growing cryptocurrency platform?

This article dives into Ethereum’s history and how it stacks up with Bitcoin. It will also discuss the current state of the Ethereum network and its performance in the crypto market.

About Ethereum: What Is Ethereum?

Ethereum is a decentralised global platform that runs on blockchain technology. The native cryptocurrency of this network is Ether.

Ether is designed to be a programmable cryptocurrency that’s secure, scalable, and decentralised. Hence, the Ethereum blockchain is preferred by many developers, creating technology based on it.

A blockchain is an online ledger or shared database that lists all cryptocurrency transactions. It’s a way to certify and validate transactions by every member of a blockchain network.

Ether and Gas

Ether is the token or digital asset of the Ethereum blockchain network. ETH is the fuel that fires this decentralised finance system.

“Gas” refers to the amount of ETH needed to start activities on the Ethereum network, like sending transactions (swapping, trading, or moving ETH-based tokens).

Activities you can do in Ethereum include:

- Interacting with other decentralised applications

- Minting of non-fungible tokens or NFTs

- Creating smart contracts

Gas cost and price determine the amount of ETH you must pay to initiate a transaction in Ethereum.

- Gas cost: The price you must pay or transaction fees to execute an operation on the Ethereum network.

- Gas price: This represents the conversion rate of gas to ETH units, usually denominated in “gwei” units.

Note that a “gwei” is one billionth of one ETH or equivalent to 0.000000001 ETH.

To calculate operation costs in Ethereum, use this formula:

(Gas cost) x (Gas price) = Operation cost

Smart Contracts

Smart contracts are automated digital agreements, or deals people make on Ethereum.

A smart contract works similarly to how a vending machine operates. You put money into the machine, which automatically dispenses items you’ve selected.

Smart contracts allow people to create programs that allow automatic monetary transactions on Ethereum that don’t require any third-party intermediary.

These contracts are created using Solidity, a programming language created by Gavin Wood, a British programmer and one of Ethereum’s founders.

When you create a smart contract, it goes through the Ethereum virtual machine (EVM). The EVM software runs smart contracts and calculates the Ethereum network’s state after adding a block.

Ethereum Token Standards

Tokens are different from coins.

Coins are digital currencies with blockchains like Bitcoin and Ether. Tokens are digital assets or deeds created on an existing blockchain like Ethereum.

People use tokens to represent assets or access available services on the network. Imagine you’re entering a gaming arcade. You exchange real money for tokens to access different arcade games.

Tokens in the crypto world work in the same manner. You create “tokens” through smart contracts and use them in different decentralised apps built on Ethereum.

However, you must follow specific “token standards” to create tokens. Token standards refer to the set of rules, requirements, and functions that determine how a crypto token works.

Here are examples of token standards:

- ERC-20: This token standard is the guideline for creating a fungible token, which is a medium of exchange or digital money.

- ERC-721: This is used to make unique tokens like NFTs (non-fungible tokens) or digital assets representing ownership of real-world assets.

- ERC-1155: This is used to make both or a combination of NFTs and fungible tokens.

With Ethereum, users can create custom tokens and set their token parameters, such as authorisation codes and maximum supply.

Ethereum’s feature for new token issuance is one of the reasons many in the cryptocurrency community are interested in this cryptocurrency.

What Makes Ethereum Unique?

Ethereum’s uniqueness lies in its programmability, which is different from BTC.

Bitcoin’s “use case” is an alternative currency or medium of exchange. On the other hand, Ethereum focuses on providing a platform for many smart contracts or applications using the Ethereum virtual machine.

How Does Ethereum Work?

Ethereum is a platform for Ether, which you can program to automate tasks using smart contracts and decentralised applications or dApps.

Decentralised applications work in blockchain and P2P (peer-to-peer) networks. DApps don’t need banks to facilitate crypto transactions.

A typical Ethereum transaction goes like this:

- A user sends ETH from their crypto wallet to another address. This activity starts the transaction.

- The sender gets a transaction hash or ID (TXHASH). This hash also works as a reference number.

- The transaction gets broadcasted to the Ethereum network and waits for a miner to pick it up and verify it. A miner is a node or a user with a blockchain or online ledger volunteering to act as a transaction validator.

- Once verified by a miner, the transaction is considered successful.

How Are New ETH Created?

ETH is created when miners or validators confirm groups of transactions on Ethereum. Because miners receive ETH after each validated transaction, there’s an infinite supply of ETH.

You can both mine BTC and ETH, but the similarities end there.

Ethereum doesn’t have a limited supply. On the other hand, Bitcoin’s alleged creator, Satoshi Nakamoto, set the total supply limit at 21 million BTC.

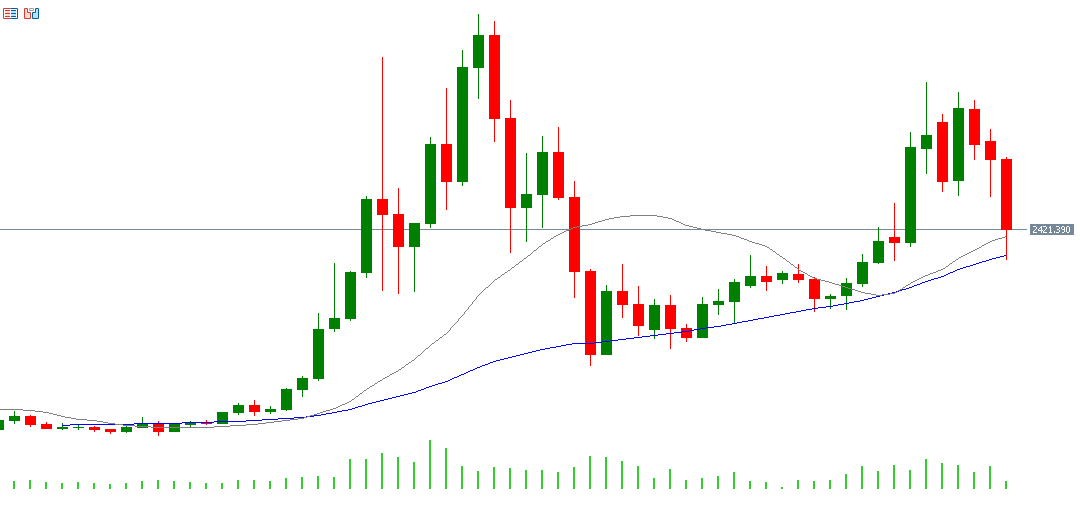

Ether Price

As of May 2023, the price of ETH in the market is $1,905.91. However, analysts predict that due to the enormous potential of Ethereum, prices may rise to $4,000 by the year’s end.

Furthermore, if the network upgrades and improves efficiency by 2030, this cryptocurrency may reach a high of $40,000.

Why Does the Price of Ethereum Fluctuate?

Supply and demand are the main drivers of Ethereum price fluctuations. However, geopolitical issues like wars and economic tension also have an impact.

Another interesting factor that influences ETH prices is the strength or weakness of Bitcoin. When BTC increases in value, so do other cryptocurrencies, including ETH. The same happens to ETH when BTC’s value decreases.

How Can I Buy Ethereum?

You can purchase ETH from the following services:

- Decentralised exchanges or DEXs: The DEX is a peer-to-peer exchange you can access directly from your digital wallet. You don’t need to go through any intermediaries.

- Centralised exchanges or CEXs: These are exchanges where you can buy cryptos like ETH using traditional currencies.

- Crypto wallets: These are apps where you can buy ETH using credit or debit cards.

Ethereum Supply and Demand

To understand how supply and demand determine ETH prices, you must know how supply and demand are created in the crypto market.

- ETH supply comes from the number of verified transactions validated by miners in the network. Each validated transaction group results in the creation of an ETH token.

- ETH demand comes from the number of transactions initiated in the network. Most of these transactions come from DeFi (decentralized finance) and NFT (non-fungible token) ecosystems.

It’s important to remember that:

- Decentralised finance platforms allow crypto users to transact directly without third-party financial intermediaries.

- NFT (non-fungible token) is a digital version of any asset with value. Examples are NFTs to represent artwork, collectables, or real estate.

What Is Ethereum Name Service?

ENS (Ethereum Name Service) makes life easier for ETH users by assigning a readable name to represent the long-stringed Ethereum addresses, making transactions efficient.

Instead of remembering addresses with a long string of numbers and letters, you can use ENS to convert this long chain into something like “CyptoPay.eth.” It makes crypto transactions accessible to more people.

What Is an Ethereum Killer?

The long-stringed addresses can be intimidating for people and might “kill” or dampen their enthusiasm to journey into cryptocurrency. However, real Ethereum “killers” are the new crypto platforms that can replace the ETH network.

Examples of potential “ETH killers” include Cardano, Tezos, Solana, Fantom, Avalanche, and Binance Smart Chain.

Ethereum London Hard Fork

Forks in Ethereum’s roadmap are pivotal moments where the entire network makes vital decisions to improve the whole network.

The London Hard Fork was a big event for the ETH network, where Ethereum enthusiasts and supporters decided to transition from mining using PoW (proof of work) to PoS (proof of stake).

There’s a huge difference between PoW and PoS systems.

The Bitcoin blockchain uses a PoW algorithm to confirm new coins entering the network. BTC miners use computers with powerful computing capacity to solve mathematical problems to mine bitcoins.

On the other hand, the PoS algorithm doesn’t rely on brute force. Instead, validators stake their funds to validate or confirm transactions. In return, they receive ether as a reward.

What Is EIP-1559?

One of the changes ushered by the London Hard Fork is the implementation of EIP-1559 or Ethereum Improvement Proposal 1559.

The proposal focuses on changing how gas fees are determined to reduce volatility. EIP-1559 proposed a change from an auction-type setup to an automated bidding system with a base fee.

Ethereum 2.0

The next phase in Ethereum’s roadmap is Ethereum 2.0. This version introduces upgrades like the PoS consensus model and the beacon chain + shard chain infrastructure.

In sharding, you divide large databases into smaller ones (shards) to improve efficiency.

The Ethereum Merge

In 2022, the Ethereum network transitioned from Ethereum 2.0 to The Merge, which combined Ethereum’s Mainnet with the beacon chain proof-of-stake algorithm.

Mainnet is the result of a blockchain project made accessible to the public. Mainnet can be altered by open-source groups when updates and revisions are needed.

A beacon chain is a system that rewards people responsible for creating new blocks with ETH as an incentive through proof of stake.

Key Events and Management: Who Are the Founders of Ethereum?

In 2013, Vitalik Buterin, a Russian-Canadian cryptocurrency enthusiast, released the Ethereum white paper, an article detailing the groundwork for Ethereum.

Afterwards, seven other co-founders joined him in this idea, which eventually resulted in Ethereum going live on July 30, 2015.

As Ethereum expanded, ETH users formed a non-profit called Ethereum Foundation that supports the platform and educates people about Ethereum.

The rapid rise of Ethereum and its potential didn’t go unnoticed. Goldman Sachs, a global investment bank, considers Ethereum a popular smart contract app platform with the highest real-use potential and believes it can become a dominant store of value.

In April 2023, Ethereum went into a rally, resulting in a nine-month high. Traders and potential investors are enthusiastic about Ethereum’s recent performance, which can signal continued growth.

FAQs

-

What is the market cap of Ethereum?

As of May 2023, ETH’s market capitalisation is 223.27 billion USD.

-

What is the all-time high of Ethereum?

Ethereum experienced an all-time high of $4,815.01 on November 9, 2021.

-

What’s the 24-hour trading volume of Ethereum?

ETH volume changes in real time, and it’s constantly evolving. As of May 2023, the trading volume of Ethereum is $5,187,476,979.

Since cryptocurrencies operate 24/7, the crypto world basically runs on UTC (coordinated universal time).

-

What other assets are similar to Ethereum?

Assets similar to Ethereum’s ETH in terms of being decentralised digital assets are Bitcoin, BNB, Tether, Ripple (XRP), and other cryptocurrencies gaining market traction.

-

How many Ethereum are there?

As of the first quarter of 2023, the total number of Ethereum coins in circulation is 121,826,163.06. You can find these coins spread out in different cryptocurrency exchanges, both centralised and decentralised, and personal crypto wallets.

-

What is the typical holding time of Ethereum?

The holding time of Ethereum depends on the platform you’re working on. In Coinbase, the median holding time before ETH users sell or send to another account is 128 days.

-

What is the relative popularity of Ethereum?

Ethereum ranks second as the most popular and trending cryptocurrency in the market, next to Bitcoin. ETH is often regarded as digital silver, while Bitcoin is digital gold.

-

Is it a good investment to buy Ethereum?

The Investment bank Goldman Sachs believes it is. They view Ethereum as a solid investment because of its potential for real-world uses. ETH’s programmable language makes it adaptable to crypto-incorporated projects. However, all investing involves financial risk and there are never any sure investments.

-

How much will Ethereum cost in 2030?

If the trend continues, ETH can experience a rally of up to $40,000 by 2030. But be aware, while analysts can speculate about market growth, it cannot be predicted for certain.

-

What’s the difference between Bitcoin and Ethereum?

The main difference between Bitcoin and Ethereum lies in their supply. BTC has a limited supply of 21 million, which attracts investors who anticipate an eventual increase in its value.

In contrast, Ethereum has an unlimited supply. However, users still invest in ETH because of the platform’s utility and scalability.

Disclaimer: The information provided in this article is for general informational purposes only and does not constitute financial advice. It is not intended to be a recommendation to buy or sell any financial instrument or engage in any investment activity.

While we strive to provide accurate and up-to-date information, we do not guarantee its completeness or accuracy. We rely on various sources for the information presented, and we cannot guarantee the reliability or accuracy of these sources.

The information provided here does not necessarily reflect the products or services offered by our company. Any mention of financial products or services is for informational purposes only and should not be considered an endorsement.

All investments involve risk, including the potential for loss of principal.

This information should not be considered as financial advice. You should always seek professional financial advice from a qualified advisor before making any investment decisions.

References

- What Is Ethereum and How Does It Work?

https://www.investopedia.com/terms/e/ethereum.asp

- Blockchain Facts: What is it, how it works, and how it can be used

https://www.investopedia.com/terms/b/blockchain.asp

- Bitcoin vs. Ethereum: What’s the Difference?

- Non-Fungible Token (NFT): What It Means and How It Works

https://www.investopedia.com/non-fungible-tokens-nft-5115211

- What Is Ethereum 2.0?

https://www.investopedia.com/ethereum-2-0-6455959

- What Is Gwei? The Cryptocurrency Explained

https://www.investopedia.com/terms/g/gwei-ethereum.asp