Disclaimer: The products or services discussed in this article may not be offered by Taurex and may only be listed here for educational purposes.

Finance and utility stocks are more likely to rise during the early stages of a recession because, at this time, investors prefer assets that offer some safety. Owning these assets involves less risk and pays higher dividends.

Consequently, many investors seeking safer investment options turn to precious metals, like gold and silver, to hedge their funds.

Suppose you’re a private investor or trader wanting to participate in the bullion market (a market where buyers and sellers deal in gold, silver, and associated derivatives).

In that case, you should know the basics of buying and selling gold and silver. One essential factor is the gold-silver (gold/silver) ratio.

Experienced investors track the changes in the gold/silver ratio over a specific period to estimate the relative valuations of the precious metals.

They use the information they get to make informed investment and trading decisions, such as when to buy or sell gold bars and silver and gold coins.

This article discusses the gold/silver ratio, what it is and how to use it when trading in the precious metals industry.

Gold/Silver Ratio Guide

Read the sections below to understand how gold/silver investments can work for your trading and financial goals.

Gold/Silver Ratio Data

The long-term daily average gold/silver ratio is approximately 65. The ratio fluctuated from 16 in January 1980 to 126 in March 2020.

Still, the ratio only intermittently reached 65:1 on average, around seven times since 1972. This fact means the price ratio does not necessarily mirror the stated average.

As of July 2023, the current ratio may be around 71, roughly 8.5% away from the average.

What Is the Gold-Silver Ratio?

The gold/silver ratio describes the relative strength of gold versus silver prices. This standard shows how many ounces of silver you need to purchase an ounce of gold.

To get this number, divide the current price of gold by the silver’s price.

Relevance

Some say that the difficulty of determining the gold/silver ratio makes this factor irrelevant in today’s market.

Still, others argue that while it’s challenging to state the ratio “must”, it can help investors know when and which precious metals to buy.

For instance, a high ratio usually means the silver is “cheap”. On the other hand, a low ratio often leads to investors exchanging silver to invest in gold.

History

In history, silver-to-gold ratios have been a crucial metric to ensure coins had their appropriate value, and they remain so today.

Long before the gold-to-silver ratio could move freely, governments and empires constrained it to control the prices of their currencies and coins.

The first recorded use of the gold/silver ratio may have happened in 3200 B.C., when Menes, Ancient Egypt’s first king, set a ratio of 2.5:1.

The ratio grew as gold’s value increased, and countries and dynasties became more familiar with the metals’ scarcity and production challenges.

Silver Can Be a Good Investment

Despite gold’s increasing value, here are three reasons why silver can be an excellent investment:

- Silver as a hedge for fiat money: You can use this precious metal to hedge against inflation.

For example, the silver exchange rate reflects the U.S. dollars (USD). Consequently, the silver price and the primary U.S. currency are inversely proportional.

Opening a USD trade before opening an opposite silver trade for hedging is sensible.

- Silver preserves wealth: Investing in silver assets lets investors outpace inflation over the medium term.

Additionally, during geopolitical unrest or global crises, the demand for silver as an investment surges, increasing its price.

- Silver is known for its high volatility: Silver exhibits wide price fluctuations like any precious metal. This feature lets investors achieve the desired profit percentage sooner than trading low-volatility instruments.

Accounting for VAT

When investing in bullion, it is crucial to understand the VAT (Value Added Tax) implications of your purchase.

VAT is a consumption tax applied to the value generated during the production of a service or good.

Investment gold is presently exempt from VAT. This classification includes all gold bullion bars and coins purchased in the U.K. and E.U. (European Union). In contrast, silver bullion is subject to VAT, currently at 20% in the U.K.

Bullion is the physical gold and silver that comes in the form of coins, ingots, and bars.

Putting Our Money Where Our Mouth Is

Reputable bullion dealers prioritise their customers’ financial well-being and long-term market objectives. Therefore, they also invest strategically in silver, complementing existing gold positions.

This decision is often influenced by the difficulty of obtaining physical gold in the current market.

Supply Problems (2008)

Global credit, banking, mortgage, and liquidity crises influence many people worldwide. During this period, there could be a drastic demand for physical silver and gold in bars and coins.

For example, in 2008, intense financial stress caused a spike in default premiums, contributing significantly to increased gold prices.

Best Buys

Bullion dealers buy and sell precious metal products, often offering competitive prices based on existing market rates. They can also directly access the supply chain and leverage their buying power to negotiate favourable rates.

Researching and purchasing from a credible bullion dealer with a solid track record, honest pricing, and good customer feedback is crucial.

Volatility

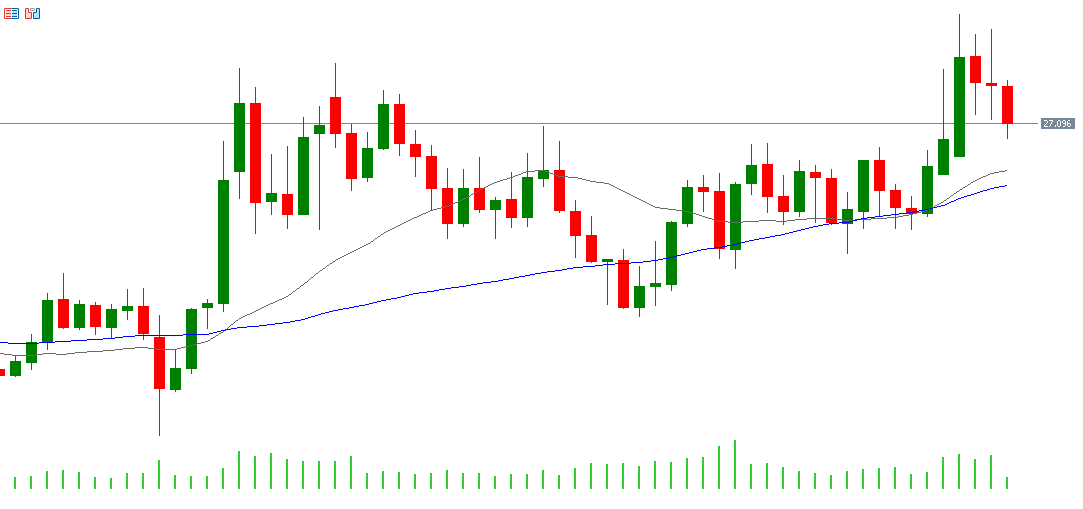

The movement of gold and silver prices throughout history indicates that silver prices fluctuate more frequently than gold. This tendency represents volatility.

When silver prices go down, they tend to fall by a more significant percentage than gold prices.

In contrast, when silver prices increase, they usually rise by a greater percentage than gold.

Consequently, some investors are “silver bugs” and constantly dip into the silver market. Many traders profit from this strategy in the short- to medium-term.

5 Year Ratio

The five-year gold/silver ratio compares the average price of gold over five years with the average cost of silver over the same period.

This ratio provides insights into silver and gold’s relative value and performance over the medium-term timeframe, allowing investors to assess possible trends.

Gold Platinum Price Ratio

The gold/platinum price ratio is a valuable tool for investors seeking to compare the relative prices of gold and platinum.

Some brokers show an updated ratio graph where you can compare the ratio of gold prices to that of platinum.

However, it is crucial to note that determining the “ideal” ratio is challenging, if not impossible, as it is a unitless metric that does not depend on particular weights or currencies.

What Is the Premium on Silver Coins and Bars?

When traders inquire about the percentage premium on silver coins and bars, bullion dealers usually avoid calculating this figure.

The product costs depend on the silver price, the dollar amount, and additional expenses, including shipping and insurance.

The dealer incorporates percentage increases based on these factors when calculating selling prices.

VAT also applies to the selling prices for E.U. buyers. Consequently, the actual percentage premium varies due to market dynamics.

What Is a Good Gold to Silver Ratio?

Again, there is no ideal gold/silver ratio, although history suggests what has worked in the past.

Others believe the ratio depends on quantity. Many “silver bugs” (silver investors) place the balance at 16:1, primarily because silver is 16 times more abundant in the Earth’s crust than gold.

What Is the Gold and Silver Ratio Likely to Do in the Future?

Goldcorp Inc., a New York Stock Exchange-listed gold company, suggests one gram of silver per 12.5 metric tons of land. Meanwhile, there’s one gram of gold per 250 metric tons.

Assuming this estimate is accurate, the actual ratio of gold to silver may be closer to the historical average.

While the gold/silver ratio appears high now, prices of silver bars and coins will likely increase due to changing perceptions and growing demand.

How Is the Ratio Worked Out?

You can use any currency to price gold or silver, provided you use the same currency for the same weight. Therefore, the USD per troy ounce will work similarly to pounds per ounce or euros per kilogram.

A high gold/silver ratio indicates that gold is more expensive than silver.

What Are Some of the Benefits of the Gold/Silver Ratio?

The gold/silver ratio’s benefits manifest during fluctuations. Trading opportunities still exist when ratios widen or narrow to extreme levels.

You can also rely on the gold/silver ratio to manage risk. The high ratio suggests that gold is overvalued relative to silver, signalling a potential opportunity to sell gold and buy silver to rebalance holdings.

This option can help diversify and reduce risk in precious metals portfolios.

What Are Some Limitations of Using the Gold/Silver Ratio?

The difficulty with the gold and silver trade is accurately identifying extreme relative valuations (ratios) between the metals.

If the ratio reaches 100, an investor sells gold for silver, and the ratio expands between 120 and 15 for the next five years. This scenario leaves the investor in a bind.

A new trading trend is emerging, and trading back into gold during that period would reduce the investor’s metal holdings.

Why Does the Gold/Silver Ratio Matter to Investors?

Even without a fixed value, the gold/silver ratio is a popular indicator for precious metals traders.

Investors can and often hedge their bets in both metals, taking a long position in silver (or gold) while shorting the other.

When the ratio is high, and investors expect it will fall along with gold’s price compared to silver, they may purchase silver while taking a short position in (sell) gold.

Which Factors Influence the Gold-to-Silver Ratio?

Here are three factors that might affect the gold-to-silver ratio:

- Economic conditions: Economic aspects, including inflation or market perception, can change the relative value of gold and silver.

- Supply and demand: The gold/silver ratio depends on changes in both metals’ supply and demand dynamics.

- Industrial need: Changing demand for silver, particularly in the electronics and solar energy industries, can modify the gold-silver ratio.

How to Trade the Gold-Silver Ratio

Trading the gold/silver ratio involves switching holdings when the ratio swings to extreme levels. Here’s an example to give you an idea:

- When a trader owns one ounce of gold, and the ratio reaches 100, the trader sells the gold ounce to buy 100 ounces of silver.

- When the ratio falls below the historical extreme of 50, traders might exchange 100 ounces of silver for two ounces of gold.

- This way, the trader builds up precious metal, seeking extreme ratios to trade with and maximise holdings.

Using the Gold/Silver Ratio to Trade

There are various options to execute a gold/silver ratio trading strategy, each with risks and rewards. Below are five trading prospects to consider.

Futures Investing

This option involves purchasing either gold or silver futures contracts or acquiring one to sell the other if you believe the ratio will widen or narrow.

Exchange Traded Funds (ETFs)

Exchange-traded funds (ETFs) offer an easy and convenient method of trading the gold-silver ratio.

Some investors avoid committing to an all-or-nothing gold/silver trade, holding positions in both ETFs and increasing them proportionally. When the ratio rises, they buy silver. When it falls, they buy gold.

This strategy keeps the investor from guessing when ratio levels have reached extreme levels.

Options Strategies

Silver and gold options strategies are also available for investors, many of which involve spreading. When the ratio is high, they can buy puts on gold and calls on silver. Meanwhile, when the ratio is low, you can do the opposite.

A call gives you the right to buy a stock, while a put gives you the freedom to sell a stock.

Pooled Accounts

Commodity pools are extensive private holdings of metals offered to investors in various denominations.

The advantage of pool accounts is access to metal whenever the investor desires. Metal ETFs, where very high minimums apply for physical delivery, do not have this feature.

Gold and Silver Bullion and Coins

You can buy and keep these physical gold and silver assets as a long-term investment strategy. Still, it can be very challenging and expensive to exchange them.

How Is the Gold-Silver Ratio Calculated?

Again, the gold/silver ratio can be determined by getting the quotient of the spot price of gold and the spot price of silver.

Suppose gold is $2,500 an ounce and silver costs $25. In that case, the gold-silver ratio is 100 or 100:1 ($2,500 ÷ $25).

This ratio means you must have 100 ounces of silver to acquire an ounce of gold.

What’s Too High?

Again, the average ratio since the 1970s is around 65. If this figure is accurate, you may consider any ratio significantly exceeding 65 “too high.”

It is difficult to determine the “right” ratio. You could review the average ratio over recent years. The mean ratio from this period might help investors forecast where it “should” be in the next few years.

Why Is the Gold-Silver Ratio So High?

The investment trend is one primary reason the gold/silver ratio is higher than usual. Factors like global crises can affect investors’ decisions regarding which assets to buy and hold.

For instance, the gold/silver ratio peaked at an all-time high in 2020. Some estimates suggest that the ratio reached 114.77, the highest since 1915.

What caused this high ratio? The COVID-19 pandemic erupted, resulting in a stock market panic and higher prices, as investors turned to gold for safety. Because the same did not happen to silver, the ratio ballooned.

Thinking of Buying or Selling Gold and Other Precious Metals?

Whether you’re new to gold or a regular investor, you can browse the sites of well-established bullion dealers.

All market participants, including financial institutions, refiners, and mining companies, are governed by different legislation worldwide.

As a global authority, LBMA (London Bullion Market Association) assists its members and the industry in complying with these laws in collaboration with its Regulatory Affairs Committees, proactive advocacy campaigns, and cooperation with law enforcement and regulatory agencies.

It is advisable to transact only with brokers authorised by these regulatory bodies.

How Can Private Investors Buy and Hold Physical Gold and Silver?

Suppose you want to speculate on precious metal prices, including gold and silver, or accumulate a physical gold or silver collection. In that case, reputable bullion dealers offer a safe, hassle-free buying experience.

Key Takeaways

Below are some crucial points to remember from this article:

- Investors use the gold/silver ratio to evaluate the relative value of gold to silver.

- People anticipating the ratio’s movement can profit even if the two metals’ prices rise or fall.

- The gold/silver ratio was previously fixed by governments for monetary stability but is now subject to fluctuations.

- The ratio is a well-known tool for precious metals traders and investors to hedge their positions in gold and silver.

- You can trade the gold/silver ratio using futures, options, ETFs, and pooled accounts.

Disclaimer: The information provided in this article is for general informational purposes only and does not constitute financial advice. It is not intended to be a recommendation to buy or sell any financial instrument or engage in any investment activity.

While we strive to provide accurate and up-to-date information, we do not guarantee its completeness or accuracy. We rely on various sources for the information presented, and we cannot guarantee the reliability or accuracy of these sources.

The information provided here does not necessarily reflect the products or services offered by our company. Any mention of financial products or services is for informational purposes only and should not be considered an endorsement.

All investments involve risk, including the potential for loss of principal.

This information should not be considered as financial advice. You should always seek professional financial advice from a qualified advisor before making any investment decisions.