By Camilo Botia

U.S. stocks closed sharply higher on Thursday as investors cheered the strong performance of chipmakers and tech giants, driven by the growing demand for artificial intelligence applications.

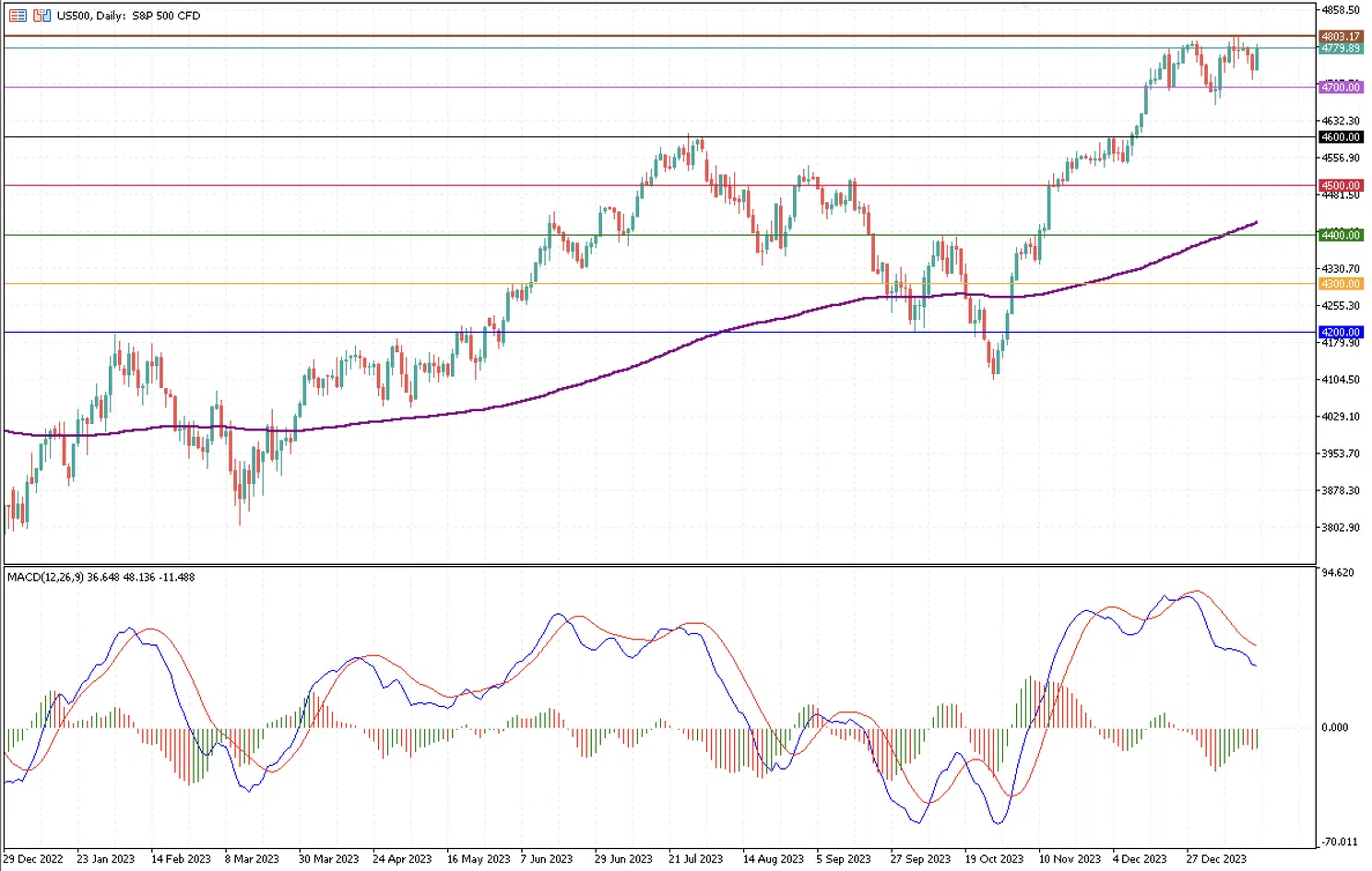

The S&P 500 index rose 0.88% to 4,779.89 points, nearing its monthly high of 4,803.17 points earlier this month. The Nasdaq composite index gained 1.35% to 15,055.65 points, while the Dow Jones industrial average added 0.54% to 37,468.61 points.

The semiconductor sector led the rally, which soared 3.4% and approached its all-time high in December 2023. The sector benefited from the upbeat outlook of Taiwan Semiconductor Manufacturing (TSMC), the world’s largest contract chipmaker, which projected a revenue growth of more than 20% in 2024, thanks to the booming demand for high-end chips used in artificial intelligence applications.

TSMC’s U.S.-listed shares surged nearly 10%, lifting the shares of its customers and rivals, such as Nvidia, Advanced Micro Devices, Broadcom, Qualcomm, and Marvell Technology. The heavyweight chipmaker Nvidia rose 1.9% to a record high and was the most-traded company on Wall Street, with almost $28 billion worth of shares exchanged.

The tech sector also got a boost from Apple, which jumped 3.3% after BofA Global Research upgraded the iPhone maker’s stock to “buy” from “neutral.” The bank cited the company’s strong growth prospects, loyal customer base, and innovation pipeline. Apple’s gain helped the S&P 500 information technology index rise 2% and hit a record high.

However, some uncertainty remained over the timing and pace of the Federal Reserve’s interest rate cuts, as the central bank faces the challenge of balancing inflation risks and slowing growth. According to the CME Group’s FedWatch Tool, traders now see a 56% chance for a 25-basis-point rate cut in March, compared with a probability above 80% a month ago. The Fed’s next policy meeting is scheduled for January 25-26.

The S&P500 has been losing momentum in the last couple of weeks, as shown on the MACD indicator. The price is in a tight range since December 14, 2023, between $4,700 and $4,800. Despite the rally caused by AI and Apple on Thursday, the expectation that the Fed will not cut rates in their next policy meeting is limiting stocks to reach new highs. The S&P will need to reach its record high of $4,803.17 first to achieve new records.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice.

Taurex is the trading name of Zenfinex Global Limited, Stochastic Africa SL Ltd, Zenfinex Global LLC, and Zenfinex Limited.

Zenfinex Global Limited is registered in the Republic of Seychelles with registration number: 8428731-1 and is regulated by the Financial Services Authority of Seychelles (license number SD092). Its registered office address is F20, 1st Floor, Eden Plaza, Eden Island, Seychelles.

Stochastic Africa (SL) Limited is a company registered in Sierra Leone with Company Number: SL270319STOCH05271 and is licensed by the Bank of Sierra Leone under license number BSL/SAL/2023 and with the registered office at 148D Wilkinson Road, Freetown, Sierra Leone.

Zenfinex Global LLC is a company registered with the Financial Services Authority in Saint Vincent and the Grenadines under registered number 138 LLC 2019. Its registered office is Hinds Building, Kingstown, Saint Vincent, and the Grenadines.

Zenfinex Limited is a company registered in England and Wales under registered number: 11077380. Authorised and regulated by the Financial Conduct Authority under firm reference number 816055. Its registered office is 4th Floor, 4 Eastcheap, London, EC3M 1AE, United Kingdom.

*All trading involves risk.