We are witnessing strong positive momentum in U.S. stock indices, particularly the S&P 500 and Nasdaq 100, both of which continue to reach record highs.

For example, the S&P 500 rose approximately 39% from its low of 4,835 points on April 7 to its recent peak of 6,718 points as of yesterday.

Similarly, the Nasdaq 100 has climbed nearly 50% from its April 7 low of 16,542 points to its high of 24,817 points.

Meanwhile, the Volatility Index (VIX), also known as the “fear gauge,” remains around 16 points, indicating a high level of investor comfort toward U.S. equities.

All major U.S. indices posted gains in September and during Q3 2025.

Notably, the Russell 2000, which tracks small and mid-cap stocks, outperformed all other indices with a gain of approximately 12% in the third quarter.

This performance suggests a rotation in investor portfolios, driven by the ongoing environment of declining interest rates in the U.S. As is well known, small-cap and mid-cap companies benefit more from lower interest rates due to their typically weaker liquidity positions and heavier reliance on debt financing.

As borrowing costs fall, these companies gain better access to capital, which positively impacts their profit and loss (P&L) statements.

Market outlook

I expect this positive momentum in U.S. equities to continue in the near term, despite elevated valuations, supported by several key factors, including:

- Continued strength in major AI-related technology stocks, led by Nvidia, which recorded a new all-time high yesterday. Nvidia’s market capitalization reached $4.56 trillion.

- The Magnificent Seven (MAGS) index posted a new record on Tuesday and is now up about 20% year-to-date.

- The Philadelphia Semiconductor Index (SOX) also hit record highs on Monday, with a 31% gain YTD, signaling sustained demand for AI-related products and large-scale investment flows into the infrastructure powering this sector.

In this context, we’ve seen:

- Nvidia invests 100 billion dollars in OpenAI to support AI-focused data centers.

- OpenAI planning a 400-billion-dollar investment to build five major data centers in the U.S., in collaboration with Oracle and SoftBank.

Corporate earnings in focus

Markets are now looking ahead to Q3 earnings reports, with the spotlight on major tech companies. Expectations are broadly positive, but more important than the actual results will be forward guidance from company CEOs.

Take Oracle, for example: While its recent earnings came below expectations in terms of revenue and profit, the company’s strong forward outlook led to a 36% surge in the stock on September 10.

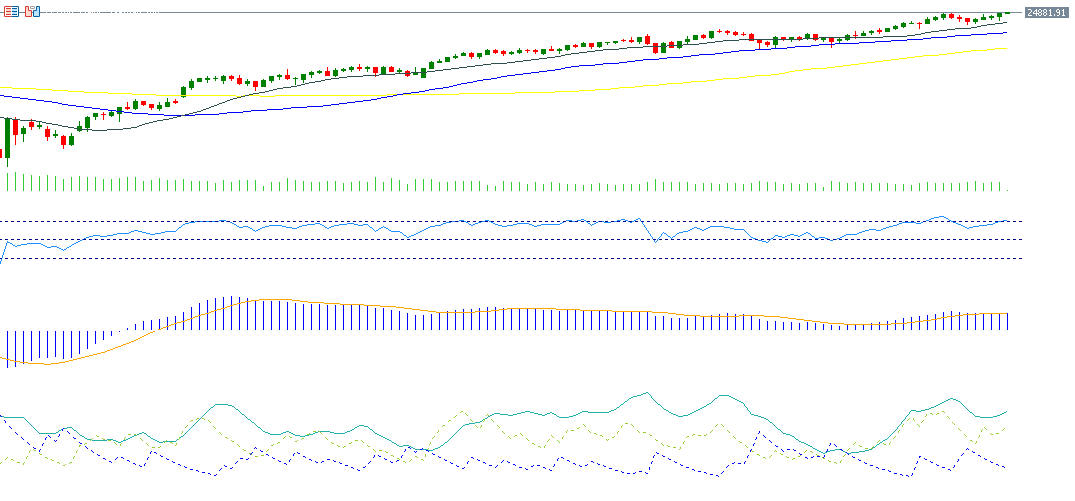

Technical view – Nasdaq 100

From a technical standpoint, indicators continue to support a bullish outlook for the Nasdaq 100, based on the following:

- The 20-day, 50-day, and 200-day moving averages are well aligned, with shorter-term averages trading above longer-term ones – a classic bullish configuration.

- The Relative Strength Index (RSI) is currently at 70, reflecting strong upward momentum.

- The Directional Movement Index (DMI) shows a +DMI reading of 34 versus -DMI at 20, indicating a wide gap and strong buying pressure.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.