By Camilo Botia,

Alphabet, Google’s parent company, delivered a blockbuster earnings report on Thursday that sent its shares surging in after-hours trading. Beating analyst expectations on earnings per share and revenue, the company announced its first-ever dividend and impressive profitability gains in its cloud division. This news propelled Alphabet’s market value beyond the $2 trillion mark.

Key Results

• Earnings per share (EPS): $1.89 (actual) vs. $1.51 (expected)

• Revenue: $80.54 billion (actual) vs. $78.59 billion (expected)

• YouTube advertising revenue: $8.09 billion (actual) vs. $7.72 billion (expected)

• Google Cloud revenue: $9.57 billion (actual) vs. $9.35 billion (expected)

• Traffic acquisition costs (TAC): $12.95 billion (actual) vs. $12.74 billion (expected)

Dividend Debut and Share Buyback

Alphabet made a significant stride in its financial strategy by announcing a cash dividend of 20 cents per share, payable on June 17th. This landmark move not only marks Alphabet’s entry into the ranks of dividend-paying tech giants, following Meta’s similar announcement in February, but also signals the company’s commitment to rewarding its shareholders. The company further bolstered this confidence with a $70 billion share repurchase authorization.

Alphabet’s revenue growth accelerated to 15% year-over-year, the fastest pace since early 2022, indicating a rebound in its core advertising business. However, the real star of the show was Google Cloud, which delivered a significant profit boost, with operating income quadrupling to $900 million. This remarkable performance underscores the success of Alphabet’s strategic investments in building a competitive cloud offering against industry leaders Amazon Web Services and Microsoft Azure, reassuring stakeholders about the company’s diversification strategy.

CEO Sundar Pichai emphasized Alphabet’s leadership position in Artificial Intelligence (AI) research and infrastructure. The company’s focus on incorporating generative AI features into search and other products underscores its commitment to staying ahead of the curve in a rapidly evolving technological landscape.

Alphabet’s robust earnings report, the introduction of a dividend, and the impressive growth of its cloud business paint a positive picture of the company’s future. Investors will be keenly watching the continued development of its AI capabilities and potential growth within its cloud division.

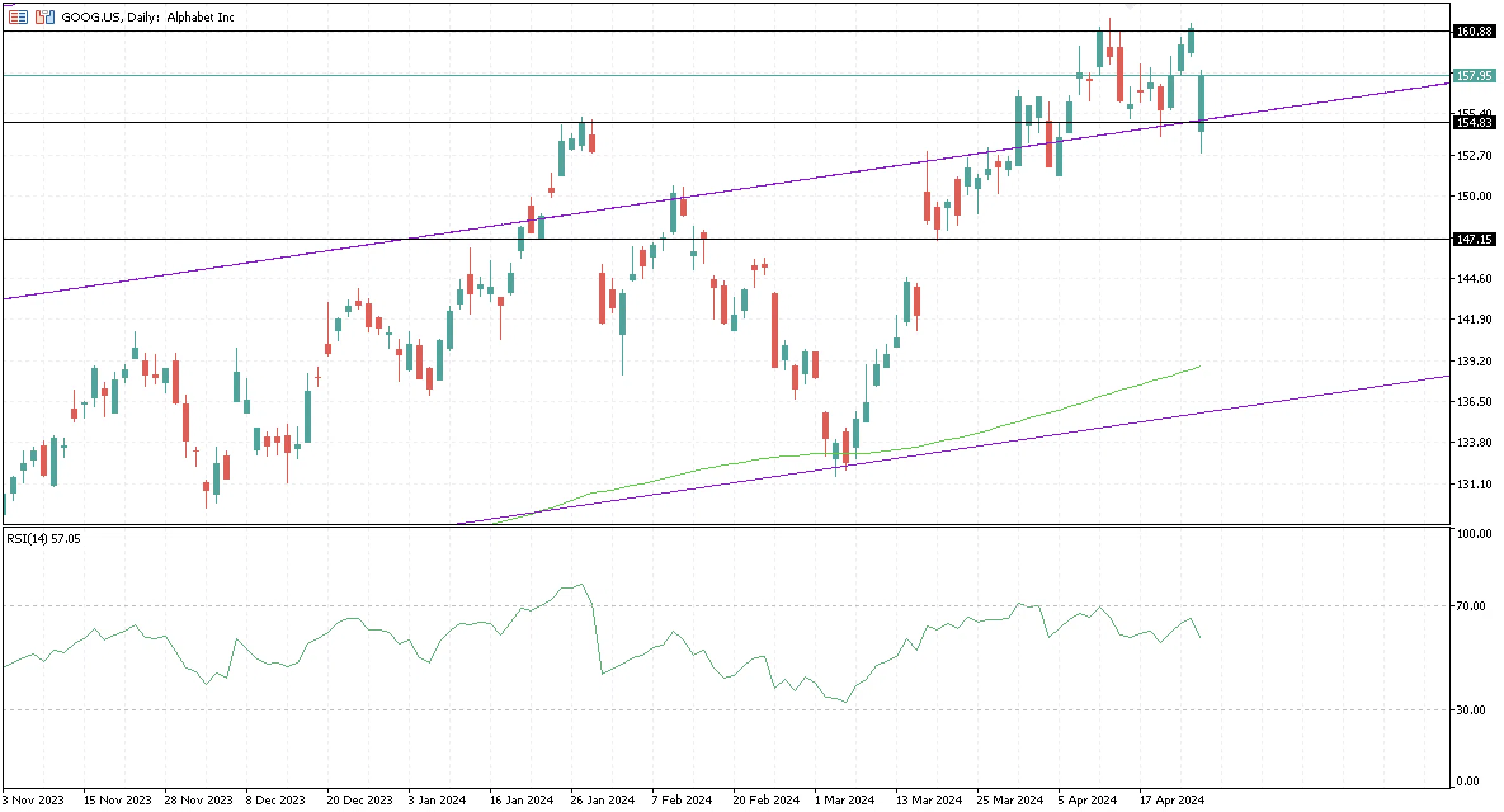

As a result, the stock shows significant bullish momentum, testing the $154.83 support as a critical level that has limited the price to reaching lower lows in the last two weeks and trading above the initial bullish channel the stock traded since July last year until this month when there was a bullish breakout. The next significant resistance for the price is at $160.88.