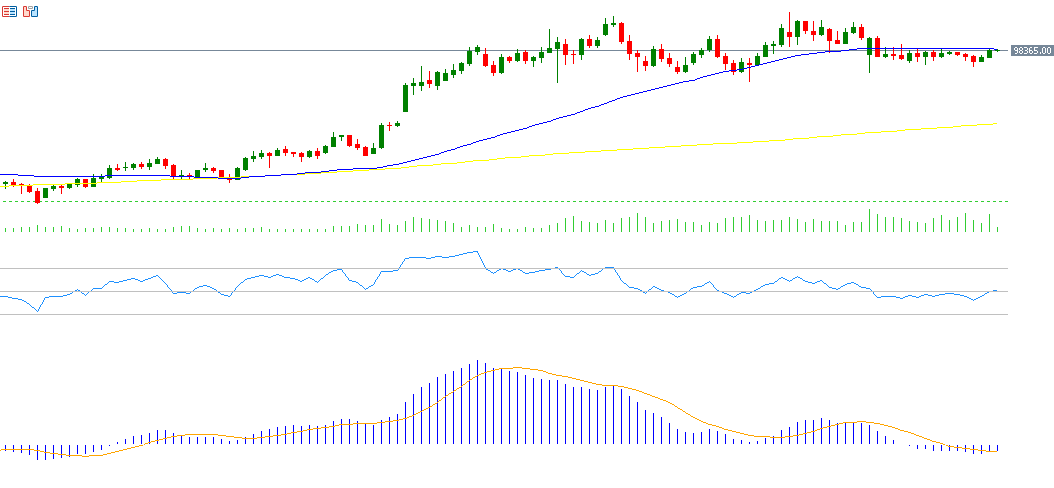

After reaching a record high of $109,356 on January 20 this year, Bitcoin later declined to $90,000 on February 3, 2025, and is currently hovering around the $98,000 level.

Current Bitcoin Movement

Bitcoin has been trading sideways for the past two weeks, fluctuating between $93,000 and $100,000, searching for a clear direction, whether upward or downward.

Possible Scenarios

- If Bitcoin maintains the key psychological level of $90,000, this could be a positive indicator, potentially leading to new gains, especially if supportive news emerges. The biggest challenge lies in surpassing the $100,000 level to reach new record highs.

- However, if Bitcoin breaks below $90,000, it could decline to $80,000 or even $70,000.

Factors Supporting Positive Market Sentiment

- Anticipation of Trump’s Policies, especially his commitment to making the U.S. the capital of cryptocurrencies, along with his plans to establish a strategic Bitcoin reserve.

- Increased risk appetite among investors, particularly large institutions, as they incorporate Bitcoin into their investment portfolios for diversification and due to strong optimism toward the industry.

- Capital inflows into Bitcoin-related ETFs, with the potential for more ETFs to be introduced for other cryptocurrencies.

Technical Factors

Notably, the Relative Strength Index (RSI) has surpassed the neutral 50-point threshold and currently stands at 52 points, which could further strengthen Bitcoin’s positive momentum. Additionally, a bullish crossover has been observed between the MACD indicator (blue line) and the Signal Line (orange line), reinforcing the positive trend for Bitcoin.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.