By Camilo Botia,

Apple Inc. shares saw a significant jump in after-hours trading following the announcement of stronger-than-expected earnings in its fiscal second quarter. The company’s prediction of a return to growth has rekindled investor optimism, suggesting a potential easing of the recent slowdown.

Key Highlights

• Revenue: $90.8 billion in the fiscal second quarter, down 4.3% year-over-year but beating analyst expectations of $90.3 billion.

• Earnings Per Share (EPS): $1.53, surpassing the anticipated $1.50.

• Dividend: Increased by 4% to 25 cents a share.

• Share Buyback: An additional $110 billion approved.

• China Sales: Revenue of $16.4 billion in Greater China exceeded forecasts.

• Outlook: Apple anticipates revenue growth in the low single digits for the coming quarter.

The positive earnings report calmed investors’ nerves, dispelling some of the concerns about Apple’s extended slump. Recent declines in sales over the past few quarters were mainly attributed to a weakened smartphone market and difficulties in the Chinese market.

Apple’s optimism for a return to growth is fueled by several factors:

• New iPad Updates: After a year-and-a-half hiatus, Apple is set to unveil new iPads on May 7th, potentially boosting tablet sales.

• AI Push: The company’s strategy for integrating artificial intelligence (AI) will be revealed at the Worldwide Developers Conference in June.

• iPhone Enhancements: This year’s iPhones will feature larger screens and AI-focused chips. New camera capabilities could further bolster sales.

Despite renewed optimism, Apple acknowledges ongoing challenges:

• China Slowdown: The company’s performance in China continues to be closely watched by investors.

• Innovation Pressure: Apple needs new groundbreaking products to reinvigorate its growth trajectory.

While investors feel relief, Apple’s longer-term outlook depends on its ability to successfully navigate headwinds in China and deliver continued innovation. The company’s upcoming moves will determine whether it can maintain this newfound momentum.

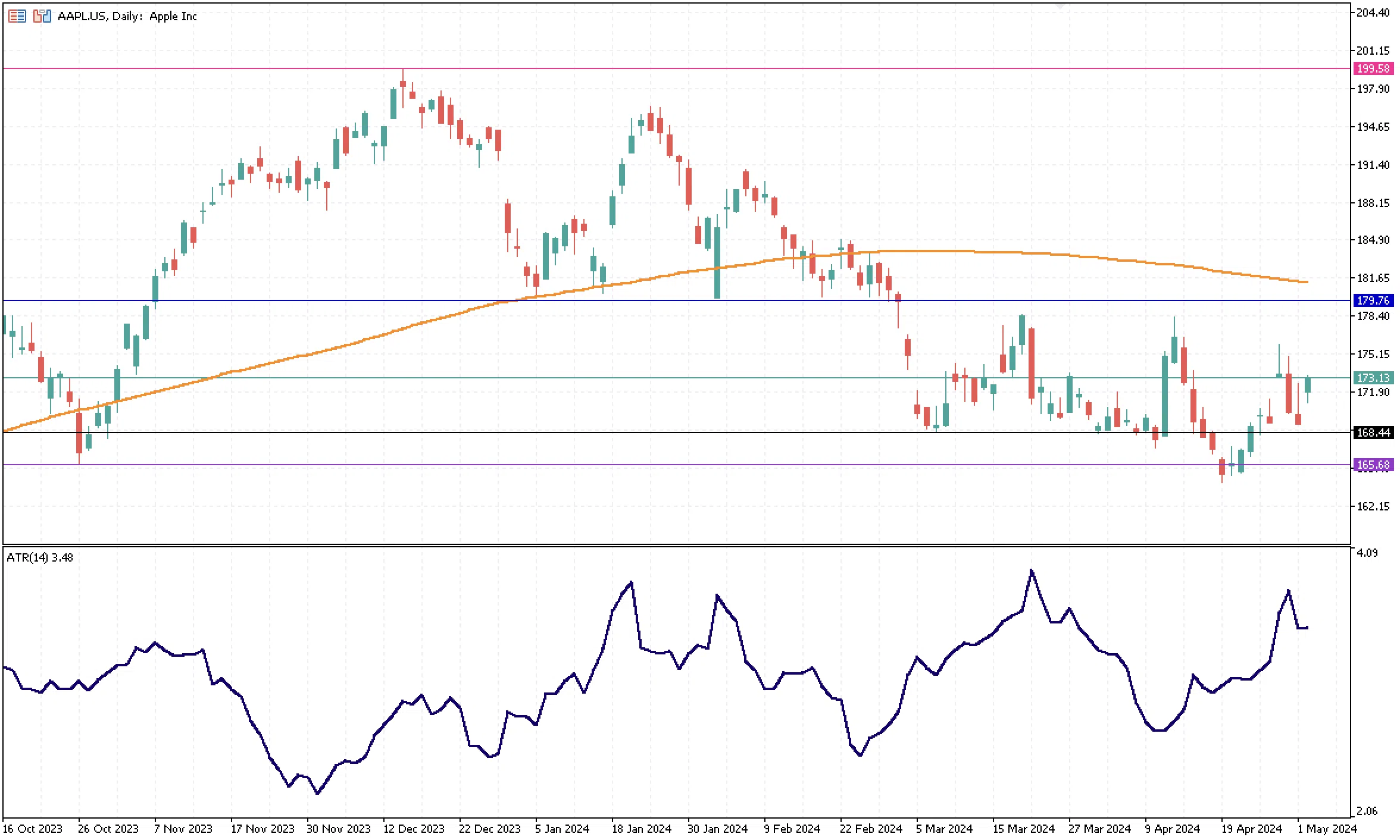

The ATR indicator shows that volatility continues to be high for Apple. The stock keeps trading in a sideways channel between $165.68 as a support and $179.76 as a resistance. There is another support above the lower boundary of the sideways channel, at $168.44 and with the recent corporate results, the expectation now relies on the next Apple event that might push the stock to higher highs that might eventually cause the stock to break above the upper boundary of the sideways channel and reach its 200-day moving average at $181.78.