By Camilo Botia,

Apple shares experienced a significant boost on Thursday, climbing 4.3% to $174.99. This marks the company’s best single-day performance since May 5, 2023. The surge aligns with a broader rally in technology stocks, particularly those focused on artificial intelligence (AI). The tech-heavy Nasdaq Composite saw an increase of 1.77%.

Despite a year-to-date decline of over 5%, JPMorgan analysts believe sentiment around Apple shares is changing. Spurred by the company’s recent stock slide, hedge fund investors are becoming more optimistic.

While there have been setbacks, like declining iPhone sales in China and the reported cancellation of its car project, analysts see AI as a critical factor driving investor confidence. Apple’s current valuation, coupled with its potential to capitalize on the AI revolution, could signal the start of an upswing.

Adding fuel to the fire, JPMorgan analysts predict a major iPhone sales cycle in 2026 propelled by innovative AI features. This aligns with Apple CEO Tim Cook’s recent statement hinting at major AI announcements from the company later this year, likely during the Worldwide Developers Conference (WWDC) in June.

Furthermore, Bloomberg reports that Apple is developing a new generation of Mac laptops and desktops powered by “M4” chips, emphasizing cutting-edge AI capabilities. Apple declined to comment, further amplifying market anticipation.

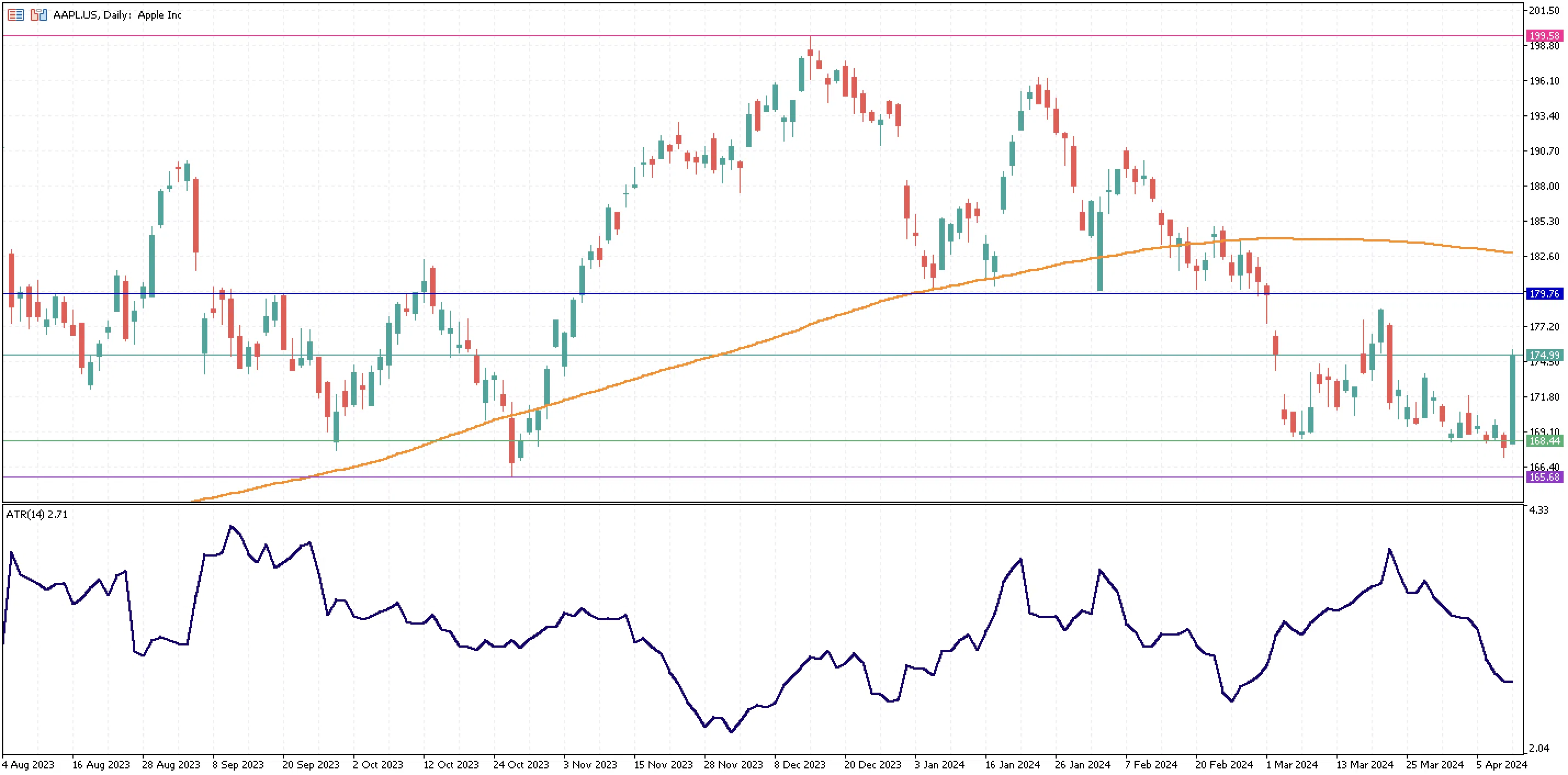

The stock was trading around the weekly support of $168.44 earlier on Thursday, unable to break it, confirming the level as significant support for the price. Volatility has decreased in the last weeks, as shown by the ATR indicator, which has a negative slope, but the recent boost could spur volatility in the upcoming weeks, especially during the first week of May when Apple announces its quarterly results. If the stock gains more bullish momentum, it could eventually reach its closest support at $179.76, and above, its 200-day moving average is the next critical level to monitor.