By Camilo Botia

Apple Inc. (AAPL) reported its first revenue growth in five quarters on Thursday. Still, the results were overshadowed by a deepening slump in China, its second-largest market, and the looming launch of its new virtual reality headset, the Vision Pro.

Apple said its sales in China dropped 13% to $20.8 billion in the fiscal first quarter, which ended Dec. 30, missing analysts’ expectations of $23.5 billion. The decline was the worst for Apple in the Asian nation since the first period of 2020 when the COVID-19 pandemic hit the region hard.

Apple blamed the weak performance on cooling consumer spending and increasing government restrictions on foreign technology in China, where it faces fierce competition from local rivals such as Huawei and Xiaomi. The company also said it was affected by supply chain issues and currency fluctuations.

The China woes weighed on Apple’s shares, which fell 2% in after-hours trading following the earnings release. The stock had closed at $186.82 in New York on Thursday, down 2.9% this year.

Despite the challenges in China, Apple managed to return to revenue growth overall, thanks to solid demand for its flagship product, the iPhone. The company said its iPhone revenue rose 8% to $69.7 billion in the quarter, beating analysts’ estimates of $68.6 billion.

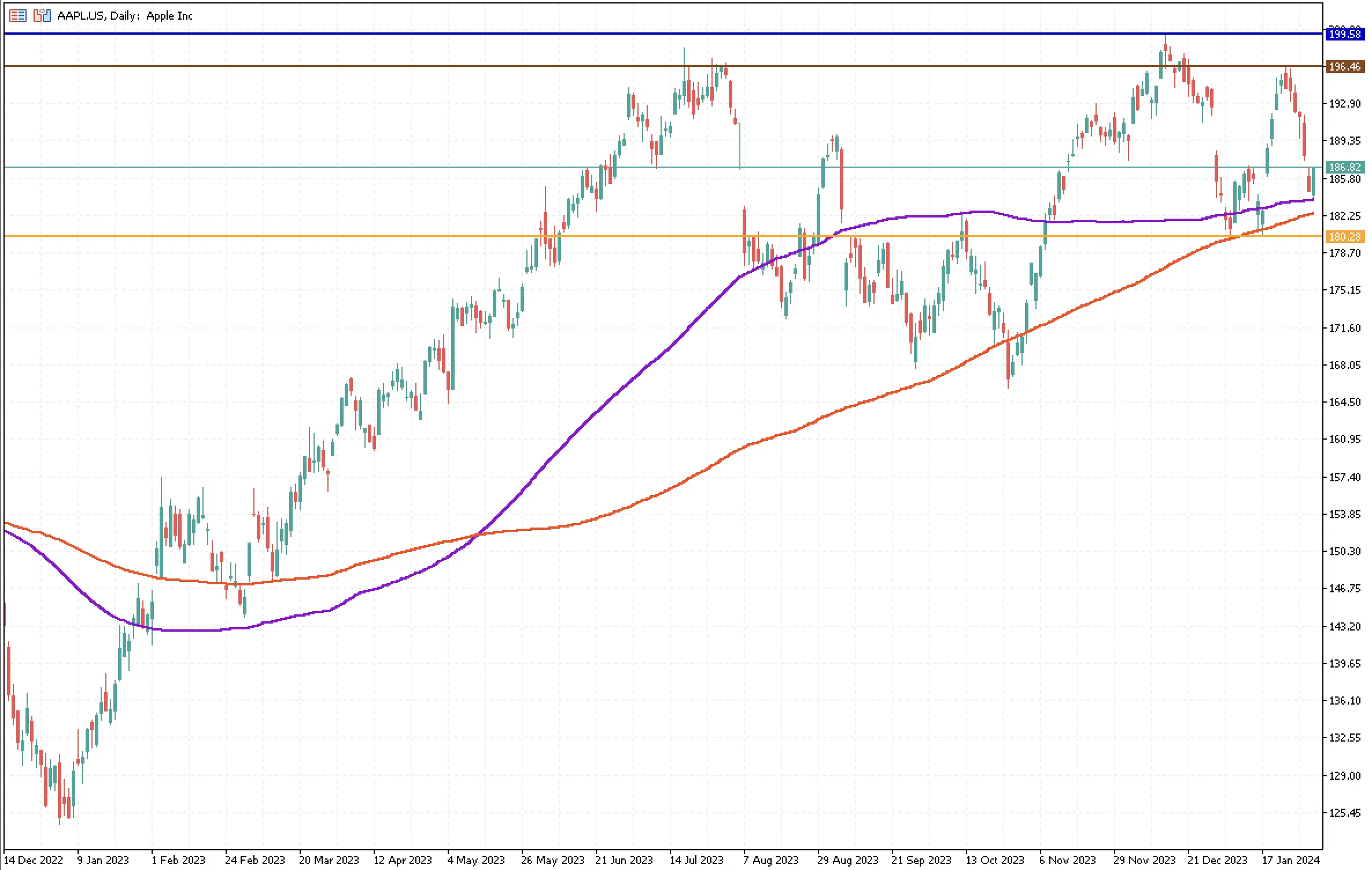

Apple’s stock price recovered on Thursday after six days of bearish movements. The price found support on the 100-day moving average at around $183.79 and has a second one in its 200-day moving average at $182.40. The 200-day moving average has been a significant support, as it was tested twice during January. At the top are two significant resistance levels, the first at $196.46 and the second at $199.58.