The Reserve Bank of Australia (RBA) held interest rates steady at 4.10% during its meeting on April 1, 2025, for the second consecutive time. Recent Australian economic data indicate a weakening performance, as shown by the following:

- Retail sales declined by 0.2% month-over-month in February, falling short of expectations and the previous reading of 0.3%.

- Building permits dropped by 0.3% month-over-month, significantly below the previous reading of 6.9%.

- The trade balance fell to AUD 2.968 billion in February, below both the forecast of AUD 5.380 billion and the previous figure of AUD 5.156 billion.

- The Manufacturing PMI declined to 51.7, down from the previous reading of 52.1.

- The Services PMI also decreased to 51.4, compared to 51.6 previously.

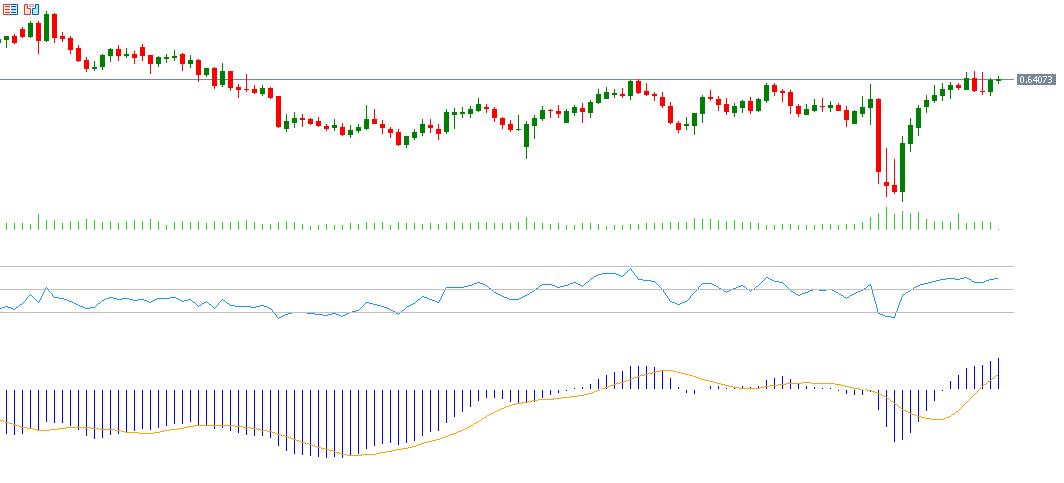

Despite this soft economic data, the Australian dollar (AUD) reached 0.6439 against the US dollar on Tuesday, April 22, 2025, marking its highest level since December 10, 2024. The AUD/USD pair has risen by about 9% since hitting a low of 0.5913 on April 9, 2025, and has gained roughly 3% year-to-date.

From a technical perspective, if the pivot point at 0.6386 is broken to the downside, the pair could target support levels at 0.6357, 0.6314, and 0.6285. Conversely, if it breaks above the pivot, it may target resistance levels at 0.6429, 0.6458, and 0.6501.

The Relative Strength Index (RSI) currently stands at 58, indicating positive momentum for the AUD/USD pair. Additionally, the MACD line (blue) is above the Signal Line (orange), further supporting the bullish momentum.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.