Bitcoin’s price continues its upward trajectory, reaching $89,643 yesterday, a new all-time high, and is currently trading near the $88,500 level. Bitcoin has risen by about 52% since its low on October 10, 2024, when it hit $58,867, reaching the peak achieved yesterday at $89,643.

Bitcoin’s price has also increased by about 109% since the beginning of the year, outperforming both the Nasdaq 100 Index (which rose by about 26%), the S&P 500 Index (which rose by about 26%), and gold (which rose by about 26%).

Factors supporting Bitcoin’s price include, but are not limited to:

• The election of Donald Trump as president, with his support for cryptocurrencies during his campaign, and the potential for a crypto-friendly Congress.

• The 75 basis point cut in U.S. interest rates this year, with expectations for further cuts in December 2024 and into the next year, which could positively affect cryptocurrencies, particularly Bitcoin priced in U.S. dollars.

• Fear of missing out (FOMO).

• Increased risk appetite among investors, especially large institutions, as they add Bitcoin to their investment portfolios for diversification purposes and due to strong optimism about the industry.

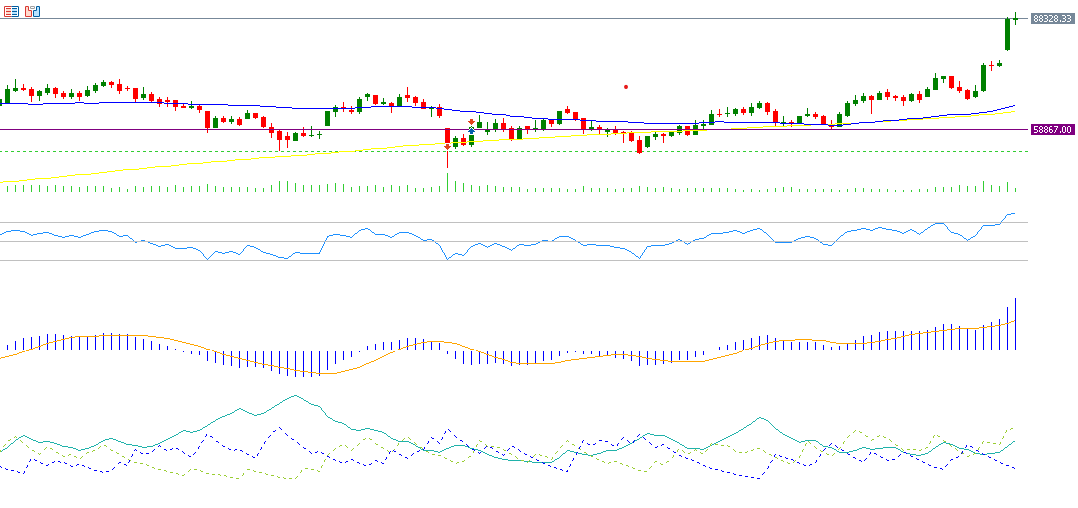

From a technical perspective, the indicators suggest that Bitcoin’s price will continue to rise for the following reasons:

- The alignment of the 20, 50, and 200-day moving averages with an upward trend, where the 20-day moving average crosses above the 50-day, and the 50-day crosses above the 200-day.

- The Relative Strength Index (RSI), which currently stands at 83, indicating that Bitcoin is in the overbought zone, signaling strong bullish momentum.

- The Positive Directional Indicator (DMI+) is at around 48, while the Negative Directional Indicator (DMI-) stands at around 9. The large gap between these two indicators suggests strong buying pressure on Bitcoin. Moreover, the Average Directional Index (ADX) is at around 32, indicating that the bullish momentum remains strong.

- A bullish crossover between the MACD (blue line) and the Signal Line (orange line) in the positive zone on Wednesday, November 6, 2024, signaling continued upward momentum for Bitcoin.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.