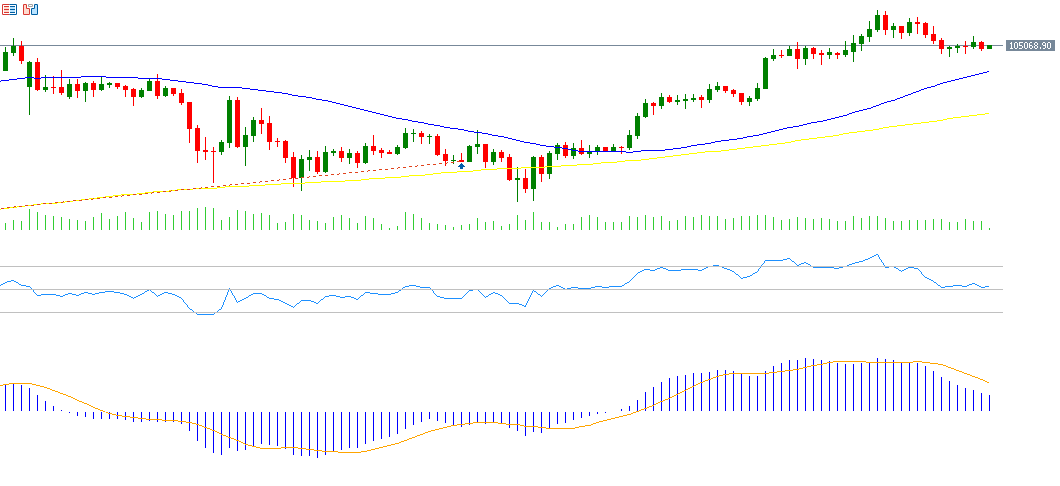

Bitcoin prices reached a new all-time high of $112,000 on May 22, 2025. The cryptocurrency has surged by approximately 40% since the low of $75,000 recorded on April 7, reaching current levels around $105,000 — signaling entry into a bull market. Since the beginning of the year, Bitcoin has gained around 13%, outperforming Ethereum, Ripple, and Solana. Prices are currently trading above the $105,000 mark. The major challenge now lies in breaking through the strong resistance at the 20-day moving average, which stands at $106,764. On the downside, a key support level is found at $100,311, corresponding to the 50-day moving average.

The main factors supporting Bitcoin’s price include, but are not limited to:

- Last week’s Bitcoin conference in Las Vegas, which called for a clear regulatory environment for cryptocurrencies. U.S. Vice President J.D. Vance also stated that Bitcoin should be adopted as a strategic asset and does not pose a threat to the strength of the U.S. dollar.

- Ongoing investment inflows into cryptocurrency exchange-traded products (ETPs) for the seventh consecutive week.

- In contrast, there have been net outflows from Bitcoin-related ETFs for the second week in a row, following six straight weeks of inflows.

From a technical perspective, indicators continue to support the bullish outlook for Bitcoin:

- The 20-, 50-, and 200-day moving averages are in an upward trend, with the 20-day average above the 50-day, and the 50-day above the 200-day.

- The Relative Strength Index (RSI) currently stands at 53, indicating ongoing bullish momentum.

- The Directional Movement Index (DMI+) is around 20, while the DMI– is at 18, suggesting buying pressure outweighs selling pressure.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.