We witnessed a decline in Bitcoin prices to around $98,000 on Sunday, June 22, 2025, which was the lowest level since May 8, 2025 — due to escalating geopolitical tensions and a shift away from high-risk assets.

However, following the easing of these tensions, Bitcoin saw a notable rebound of approximately 10%, from Sunday’s low to a peak recorded yesterday at around $108,000. The major challenge now lies in breaking through the strong resistance at $110,000, followed by surpassing the record level of $112,000 set on May 22, 2025.

Since the start of the year, Bitcoin has gained about 15%, outperforming major U.S. stock indices.

Several key factors are currently supporting Bitcoin’s price momentum, including (but not limited to):

- The de-escalation of geopolitical tensions between Israel and Iran, which has boosted risk-on sentiment and supported assets like Bitcoin.

- The state of Texas has established the first government-funded Bitcoin reserve in the U.S., allocating $10 million from the state budget to purchase Bitcoin.

- Increased risk appetite among investors, particularly large institutions such as pension funds, which have begun adding Bitcoin to their portfolios for diversification, driven by strong optimism toward the sector.

- Ongoing inflows into Bitcoin-related Exchange-Traded Funds (ETFs).

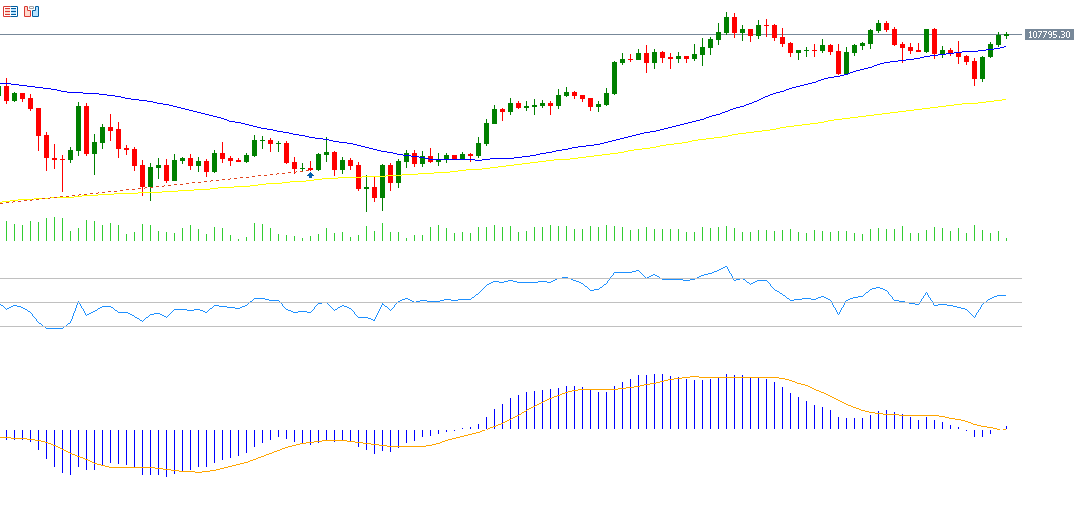

From a technical perspective:

- The golden cross pattern remains in place between the 20-day and 50-day moving averages, reinforcing the bullish trend.

- The Relative Strength Index (RSI) currently stands at 57, indicating positive momentum.

- Additionally, a bullish crossover occurred on the MACD yesterday, as the blue MACD line crossed above the orange signal line — further supporting the upward trend.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.