Bitcoin prices reached $109,356—a record high registered on January 20 of this year—before retreating to around $75,000 on April 7. Currently, Bitcoin is trading above the key psychological level of $100,000, having recorded $104,159 yesterday, marking its highest level since January 31, 2025. This represents a 39% increase from the April 7 low to yesterday’s high, indicating that Bitcoin has entered a bull market.

The main factor that pressured Bitcoin in the previous phase was the trade war and the tariffs imposed by the Trump administration on several countries, in addition to retaliatory tariffs. These developments drove many investors away from high-risk assets and toward safe havens, led by gold, amid heightened uncertainty linked to the trade conflict.

However, with trade tensions easing—especially after the trade agreement reached yesterday between the United States and the United Kingdom, along with anticipation of this week’s talks in Switzerland between the U.S. and China—investor sentiment has improved. Investors have begun returning to high-risk assets, with Bitcoin at the forefront. Bitcoin prices have risen approximately 9% year-to-date.

There are several factors supporting Bitcoin, including:

- Continuous capital inflows into Bitcoin-related Exchange-Traded Funds (ETFs) for the fourth consecutive week.

- Trump’s pledge to make the United States the crypto capital of the world, along with plans to establish a U.S. strategic Bitcoin reserve.

- Growing risk appetite among investors, especially large institutions, who are adding Bitcoin to their portfolios for diversification, amid strong optimism toward the sector.

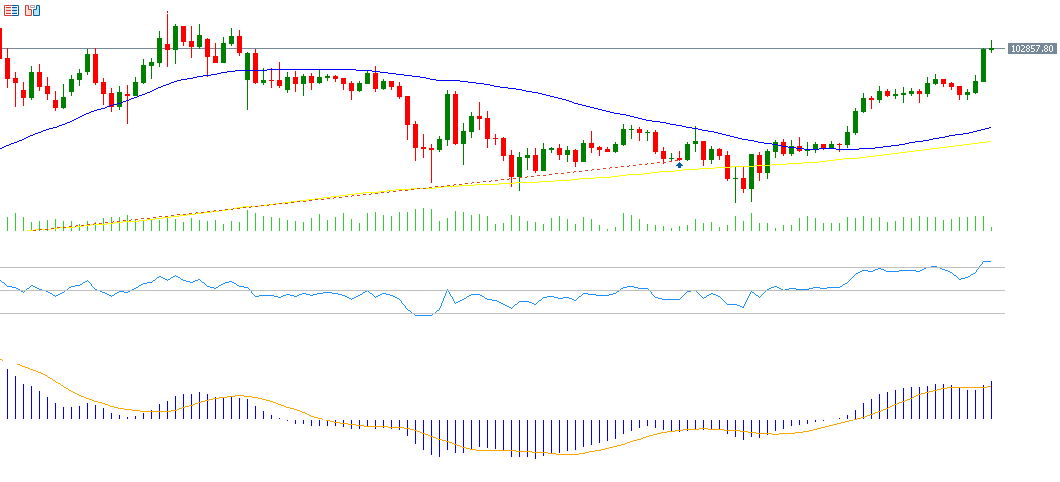

From a technical perspective, indicators suggest continued upward momentum in Bitcoin for the following reasons:

- The Relative Strength Index (RSI) is currently at 74 points, placing it in the overbought zone—an indication of strong bullish momentum.

- A bullish crossover between the blue MACD line and the orange Signal Line, further supporting the bullish outlook.

Bitcoin’s biggest challenge now lies in reaching and breaking through the $109,300 level.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.