By Camilo Botia,

As Bitcoin’s value climbs to new heights, the spotlight is on the upcoming “halving” event and its potential influence on its price trajectory. For some, halving is pivotal in reinforcing Bitcoin’s value proposition as an increasingly scarce asset. Others dismiss it as mere technical jargon hyped up by speculators to drive prices. So, what’s the truth, and why does it matter?

The Bitcoin halving is a built-in mechanism within the Bitcoin blockchain that periodically decreases the rate at which new Bitcoins enter circulation. Conceived by Bitcoin’s creator, Satoshi Nakamoto, the halving is designed to ensure Bitcoin has a finite supply of 21 million tokens. Approximately 19 million tokens already exist.

Blockchain technology relies on “miners” who use specialized computers to solve complex problems and validate transactions, adding blocks to the chain. Miners earn rewards in Bitcoin. The halving essentially cuts these rewards in half, slowing down the creation of new Bitcoins.

While there’s no exact date, the next halving is anticipated in late April 2024. Halvings happen roughly every four years, triggered when 210,000 blocks are added to the blockchain.

Bitcoin proponents champion the scarcity principle – if demand remains constant or increases, a reduced supply should theoretically boost Bitcoin’s value. However, others argue that the halving’s impact is already priced into Bitcoin’s current value. Additionally, the opaque nature of the mining sector, with limited data on Bitcoin reserves, makes it difficult to predict how miners might influence prices by selling their holdings.

Pinpointing the driving force behind crypto rallies is notoriously difficult, especially given the lesser transparency compared to traditional markets. The recent surge in Bitcoin is often attributed to the SEC’s approval of Bitcoin ETFs and expectations of interest rate cuts. However, in the realm of crypto trading, market narratives can gain momentum and become self-fulfilling, even if their origins are speculative.

Analyzing previous halvings doesn’t offer clear-cut evidence of a direct price impact. While past halvings have been followed by periods of price increase, other factors like loose monetary policies and pandemic-driven retail investment could easily have contributed to these rallies.

While the Bitcoin halving is a fascinating mechanism built into the cryptocurrency’s design, isolating its impact on prices is complex and uncertain. Regulators repeatedly warn about the speculative nature of Bitcoin markets, driven by hype and fear of missing out. Understanding the risks remains crucial for investors, even as the countdown to the halving begins.

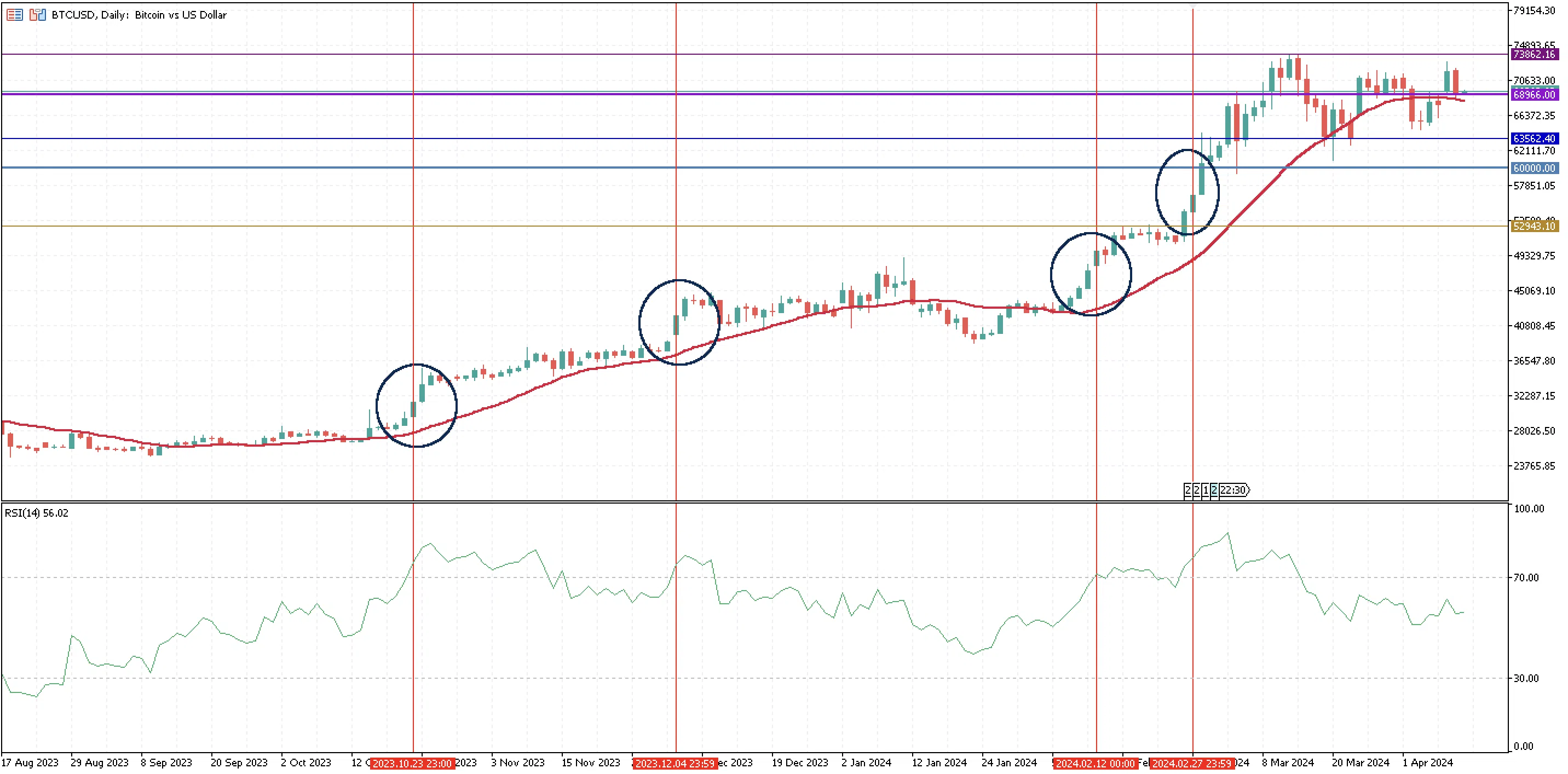

Bitcoin price has been consolidating around $68,966 and keeps trading above its 20-day moving average. There is a second support at around $63,562.4. On the other hand, the next significant resistance for the price is the all-time high of $73,862.16, which could limit a future Bitcoin rally if the halving indeed pushes the price up.