By Camilo Botia,

Boeing’s woes deepened on Monday as the Justice Department opened a criminal investigation into a recent accident on a 737 Max jet, sending its shares tumbling.

Boeign’s stock price fell as much as 4.4% in New York, its most significant one-day drop since January. The accident, in which a fuselage panel blew out during an Alaska Airlines flight, has already caused considerable damage to Boeing’s reputation and finances. The Justice Department’s investigation adds another layer of pressure to the aircraft manufacturer, while regulators have already tightened oversight of Boeing’s manufacturing processes and capped production due to the accident.

The company’s crisis has attracted significant public attention, fueled by recent incidents and revelations about manufacturing lapses. Lawmakers, regulators, and even airline passengers are scrutinizing Boeing’s safety practices. This criminal investigation and ongoing safety concerns create uncertainty for investors, causing negative press surrounding Boeing’s recent incidents, scaring away investors, and further depressing the stock price, which has already lost 25% of its value during the year.

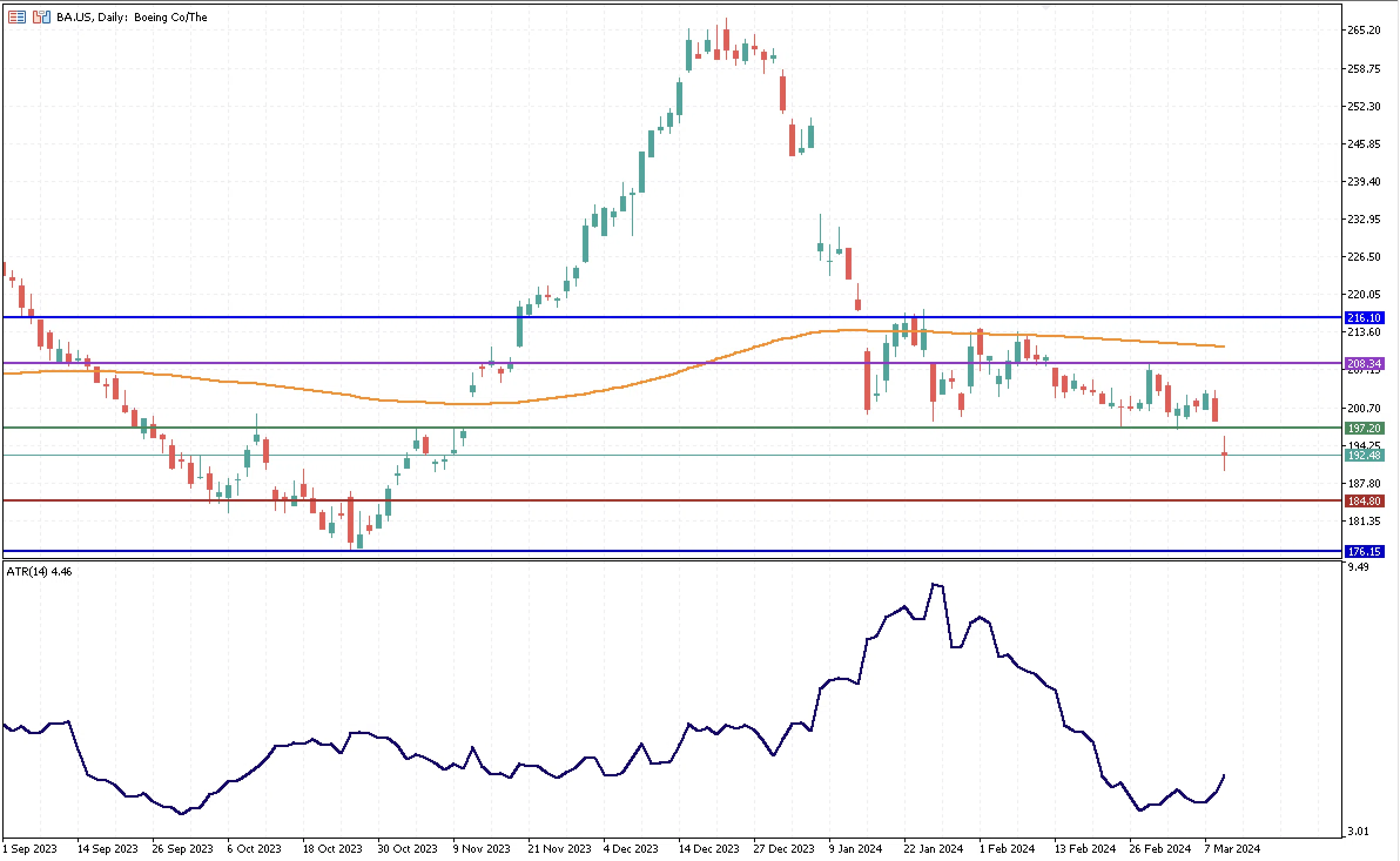

The stock has been in a consolidation phase since mid-January, between its monthly resistance of $216.0 and weekly support of $197.2, which prevented the price from reaching lower lows for four months. However, with the recent news, the stock has reached a new record low for 2024 at $189.77, and volatility seems to have started increasing, as shown by the ATR indicator, which is now edging higher and is located at 4.5, compared to 3.7 two weeks ago.

If the bearish sentiment persists, the stock could reach weekly support at $184.80 and beyond monthly support at $176.15. On the other hand, if the price were to recover, the $197,20 level would now be the closest resistance and above the $208.34 level.