In the United States, the Purchasing Managers’ Index (PMI) for manufacturing fell to 47.3 points, while the Non-Farm Payroll report added 254,000 jobs and the unemployment rate dropped to 4.1%, with an increase in average wages of 4.0%. In the Eurozone, the Consumer Price Index (CPI) recorded a growth of 1.8%, with a steady unemployment rate at 6.4%. The UK saw GDP growth of 0.7%, while the Services PMI declined to 52.4 points. In Switzerland, retail sales rose by 3.2%, with an unemployment rate of 2.6%. Canada experienced an increase in the Ivey Purchasing Managers’ Index to 53.1. Australia saw a contraction in the Manufacturing PMI at 46.7 points, while retail sales increased by 0.7%. In China, the Manufacturing PMI fell to 49.8 points, indicating a slowdown in activity. Finally, in Japan, industrial production decreased by 3.3%, while retail sales rose by 2.8% year-on-year.

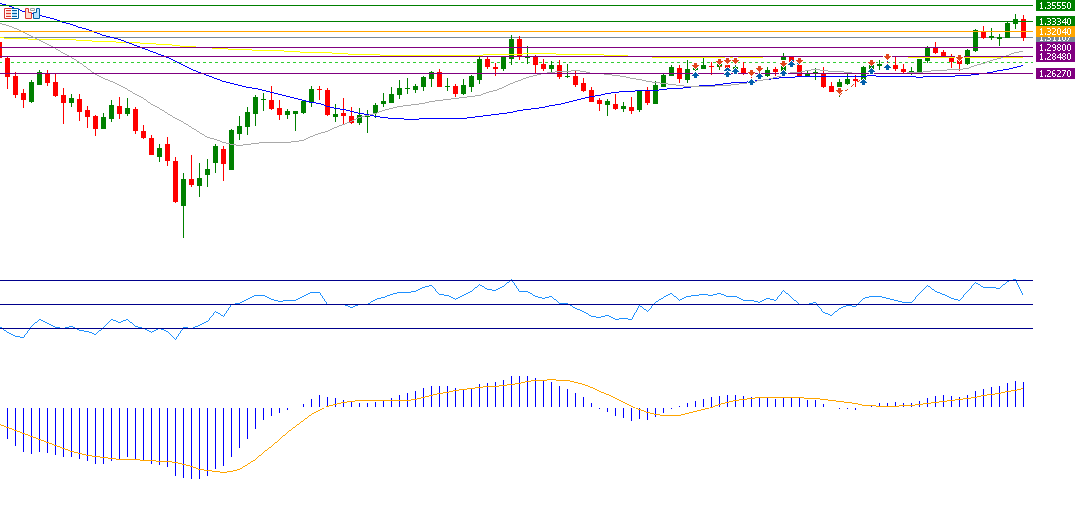

GBP/USD

The GBP/USD pair declined by about 2% from its peak of 1.3434 recorded on September 26, 2024, closing at 1.3113 on Friday, October 4, due to comments from the Bank of England governor hinting at a potential interest rate cut. If the pivot point of 1.3204 is broken for the sterling against the dollar, there is a chance it could target support levels at 1.2980, 1.2848, and 1.2627. Conversely, if the pivot point is exceeded, resistance levels at 1.3334, 1.3555, and 1.3687 could be targeted.

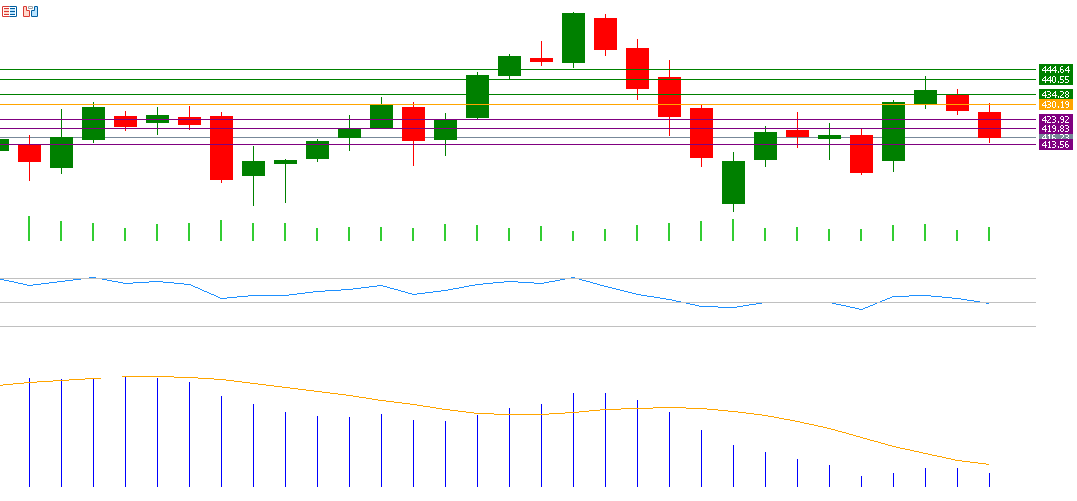

Microsoft

Microsoft’s stock price declined by about 6% from its peak of $441.85 on September 17, 2024, closing at $416.06 on Friday, October 4. Markets are anticipating the release of Microsoft’s Q3 financial results on October 22, 2024, expecting earnings of $3.10 per share, up from $2.99 per share in the previous reading. Revenue is projected to reach $64.45 billion, compared to $56.5 billion previously. If the pivot point of $430.19 is broken for Microsoft shares, there is a possibility it could target support levels at $423.92, $419.83, and $413.56. If the pivot point is surpassed, it may target resistance levels at $434.28, $440.55, and $444.64.

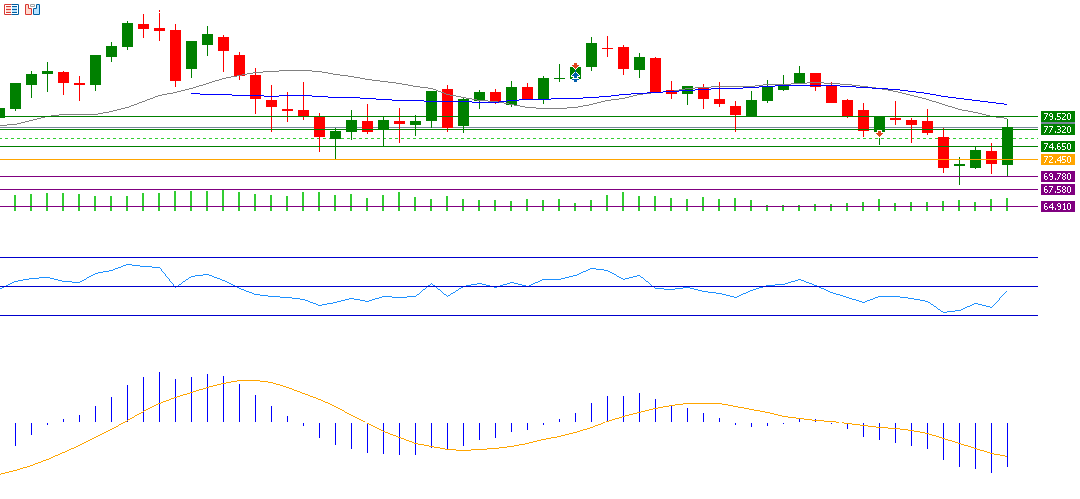

Crude Oil (Brent)

Crude oil prices rose to $79.26 on Friday, October 4, 2024, the highest level since August 30, 2024, due to escalating geopolitical tensions in the Middle East and concerns about potential supply disruptions, especially since the region accounts for about one-third of global oil supplies. If the pivot point of $72.45 for crude oil is broken, there is a possibility of targeting support levels at $69.78, $67.58, and $64.91. If the pivot point is exceeded, resistance levels at $74.65, $77.32, and $79.52 may be targeted.

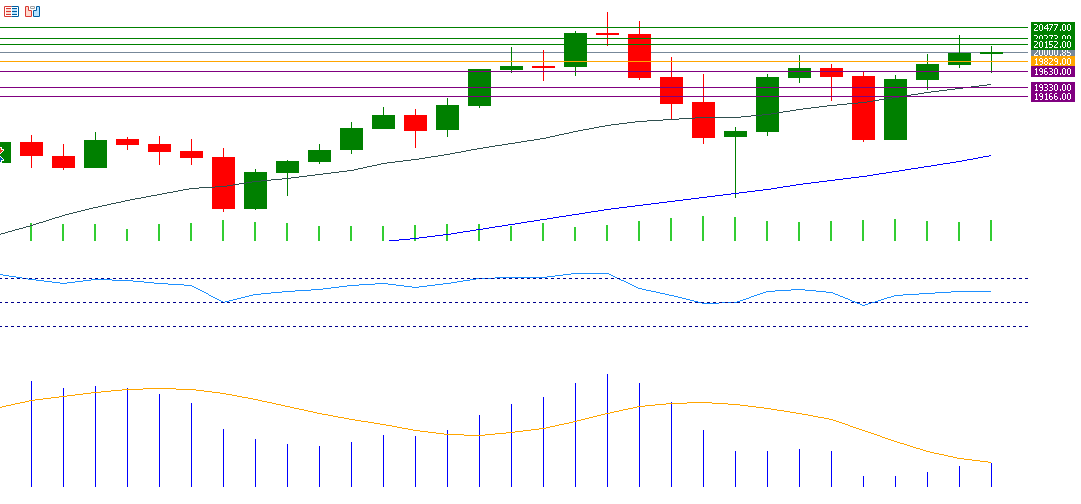

Nasdaq 100

The Nasdaq 100 index rose on Friday, October 4, 2024, closing at 20,035 points, buoyed by better-than-expected U.S. labor market data, including the Non-Farm Payroll report, unemployment rate, and average hourly wages, suggesting a reduced likelihood of the U.S. economy entering a recession. Thus, the chances of a soft landing are currently the most likely scenario, providing positive momentum for the Nasdaq 100 index. If the pivot point of 19,829 is broken for the Nasdaq 100, it may target support levels at 19,630, 19,330, and 19,166. If the pivot point is exceeded, it could target resistance levels at 20,152, 20,273, and 20,477.

Key Events This Week

Markets are looking forward to several important economic indicators and data this week:

- Today, the People’s Bank of China is releasing foreign exchange reserves and Eurozone retail sales data.

- On Tuesday, markets await Japan’s household spending index.

- On Wednesday, the Reserve Bank of New Zealand’s interest rate decision is expected, with forecasts suggesting rates will remain at 5.25%. U.S. crude oil inventories and the minutes from the Federal Open Market Committee meeting will also be released.

- On Thursday, the U.S. Consumer Price Index and unemployment claims will be published.

- Finally, on Friday, New Zealand’s business PMI, UK GDP and industrial production indicators, U.S. producer price index, and Michigan consumer sentiment index will be released, along with Canada’s building permits and employment change rates.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.