Last week witnessed several significant economic events globally. In the United States, economic data showed mixed results. The Manufacturing Purchasing Managers’ Index (PMI) rose to 49.7, indicating contraction but surpassing expectations. On the positive side, the Construction Spending Index grew by 0.4% month-on-month, better than expected. The Job Openings Index reached 7.744 million, signaling strong demand for labor, but the ADP Non-Farm Employment Change fell to 146,000, lower than expected. The Services PMI showed slight growth at 56.1, but still below forecasts. Additionally, oil inventories saw a significant drop of 5.073 million barrels, while unemployment claims rose to 224,000. Towards the end of the week, employment data was strong, with 227,000 jobs added, exceeding expectations. In the Eurozone, GDP grew by 0.9% year-on-year, in line with expectations, while retail sales dropped by 0.5%. In the UK, the Services PMI showed slight growth, but industrial activity declined. In Canada, the unemployment rate rose to 6.8%, while job growth showed positive momentum. In China, the Manufacturing PMI improved, but the Services PMI showed a decline. In Japan, household spending rose by 2.9%, exceeding expectations, although industrial activity slightly decreased.

Market Analysis

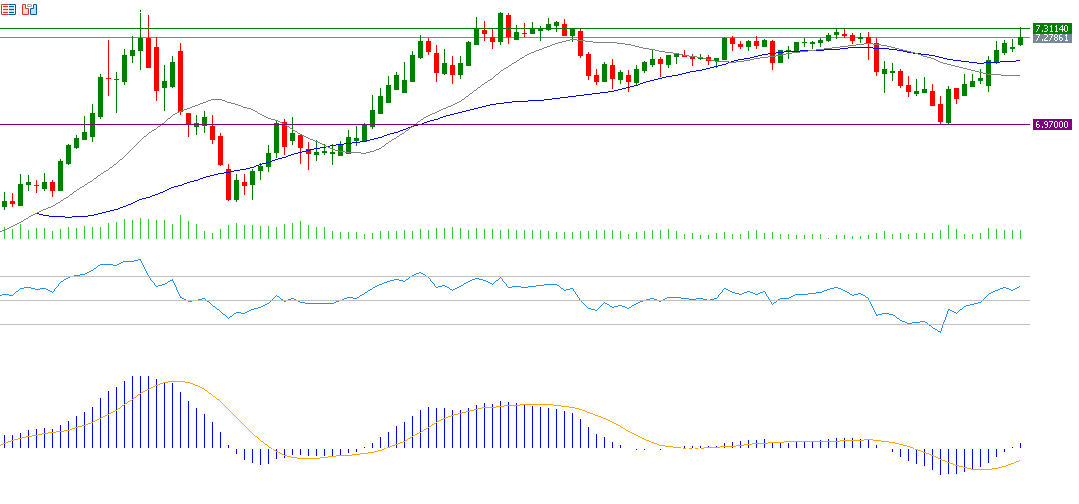

- USD/CNY: The USD/CNY pair reached 7.3142 on Tuesday, December 3, 2024, its highest level since November 3, 2023. Currently, the pair is trading near 7.2800. The pair has risen about 5% from the low of 6.9691 on September 27, 2024, and has gained approximately 2% year-to-date. The Relative Strength Index (RSI) stands at around 62, indicating positive momentum.

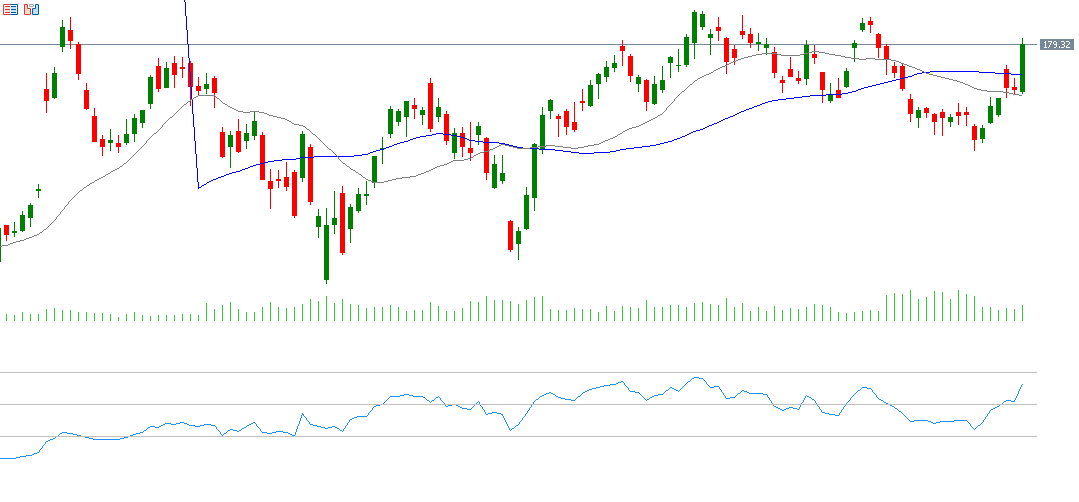

- Broadcom: Broadcom’s stock has risen by about 64% year-to-date. The market is looking forward to the company’s Q3 earnings announcement on Thursday, December 12, 2024. Analysts expect earnings of $1.39 per share, down from $11.06 in the previous quarter. Revenue is expected to reach $14.07 billion, compared to $9.30 billion in the previous report.

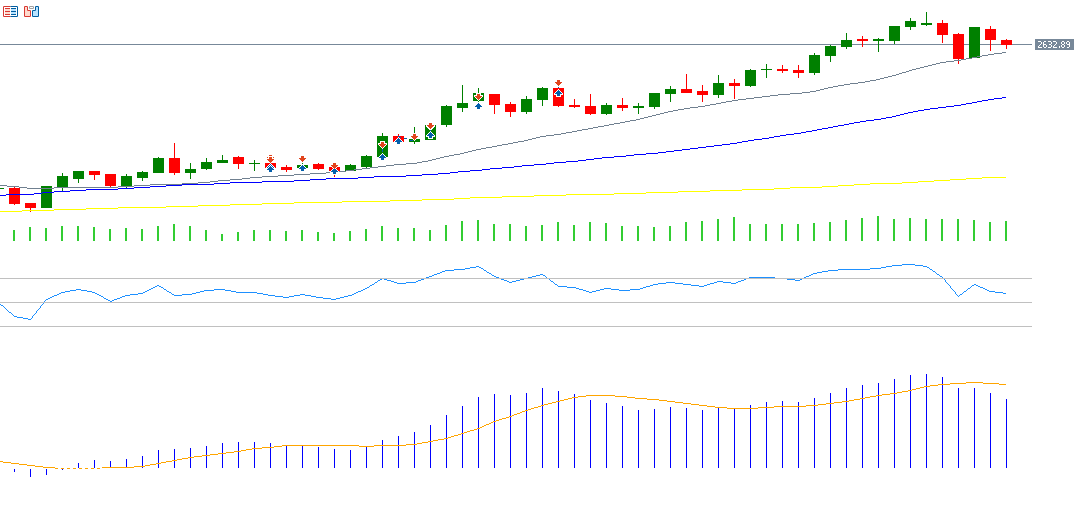

- Gold: Gold prices have been trading sideways for the past two weeks between $2,600 and $2,670, with no clear trend. Factors supporting gold include inflation in the U.S., geopolitical tensions between Russia and Ukraine, and continued central bank gold purchases. However, the strengthening U.S. dollar and easing geopolitical tensions in the Middle East are pressuring gold prices. The RSI is currently around 47, suggesting negative momentum for gold.

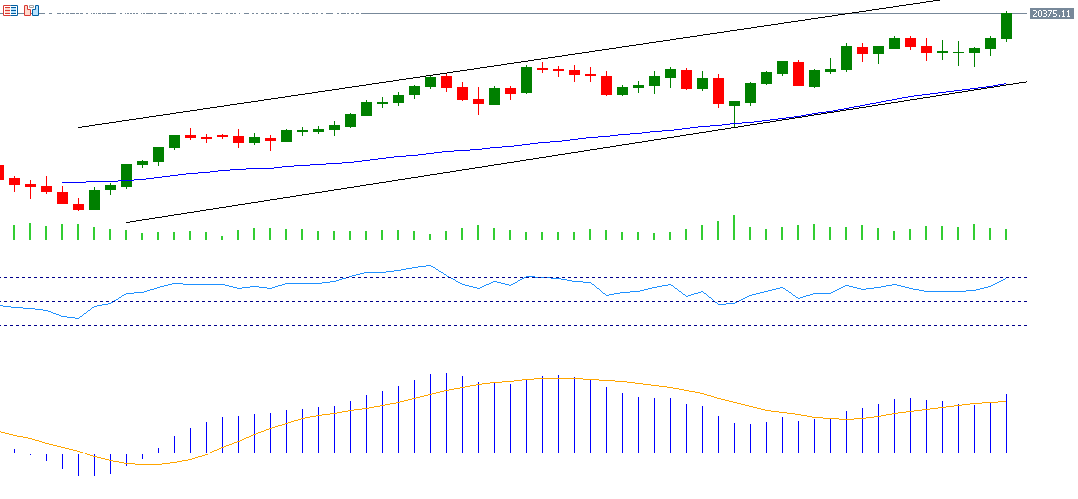

- DAX Index: Despite Germany’s economic contraction and domestic challenges, the German stock market is seeing a contrasting trend. The DAX index continues its upward trajectory, reaching a record high of 20,426 points on Friday, December 6. The index has risen about 20% since the low of 17,024 on August 5, 2024, and has gained 21% year-to-date. The RSI stands at around 73, in the overbought territory, indicating positive momentum for the DAX.

Key Events This Week

Markets are awaiting several important economic indicators and events this week:

- Today, Japan’s GDP and China’s Consumer and Producer Price Indexes will be released.

- On Tuesday, the Reserve Bank of Australia’s interest rate decision and China’s trade data will be closely watched.

- On Wednesday, the Bank of Canada’s interest rate decision, as well as the U.S. Consumer Price Index (CPI) and crude oil inventories, will be announced.

- Thursday will see decisions on interest rates from the Swiss National Bank and the European Central Bank, along with Australian employment data, UK GDP, and U.S. Producer Price Index (PPI) and unemployment claims.

- Finally, on Friday, industrial production data from Japan, the UK, and the Eurozone will be released.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.