Last week saw significant economic developments worldwide. In the United States, initial jobless claims rose to 223,000, while existing home sales improved to 4.24 million. The University of Michigan Consumer Sentiment Index dropped to 71.1 points. The manufacturing PMI grew to 50.1 points, its highest level since June 2024, while the services PMI declined to 52.8 points. In the Eurozone, the manufacturing PMI remained in contraction at 46.1 points, while the services sector showed stable growth at 51.4 points. In Britain, wage growth reached 5.6%, but unemployment rose to 4.4%, alongside slight improvements in both the industrial and services sectors. In Canada, consumer price growth slowed to 1.8% YoY, and retail sales stagnated. Australia experienced a slight contraction in the manufacturing sector and weaker service sector growth. Meanwhile, in Japan, the central bank raised interest rates to 0.50%, consumer prices grew significantly YoY, but industrial production and exports contracted. Lastly, in China, the People’s Bank of China kept lending rates unchanged as expected.

Market Analysis

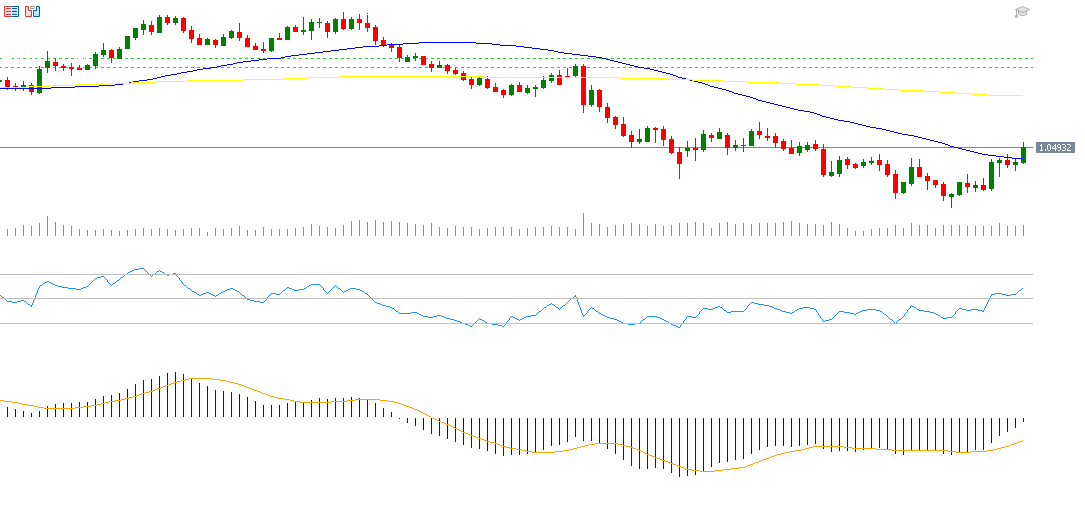

EUR/USD:

The euro rose to $1.0521 against the U.S. dollar on Friday, January 24, 2025, marking its highest level since December 17, 2024, and a 3% increase from its January 13 low of $1.0178. This recovery was driven by improved Eurozone economic data and less aggressive rhetoric from Trump regarding tariffs on the EU and China, alongside his indication of an immediate U.S. interest rate cut. Technically, the RSI is at 59, reflecting bullish momentum, while the MACD shows a bullish crossover, signaling further positive momentum.

Major U.S. Earnings

Wednesday:

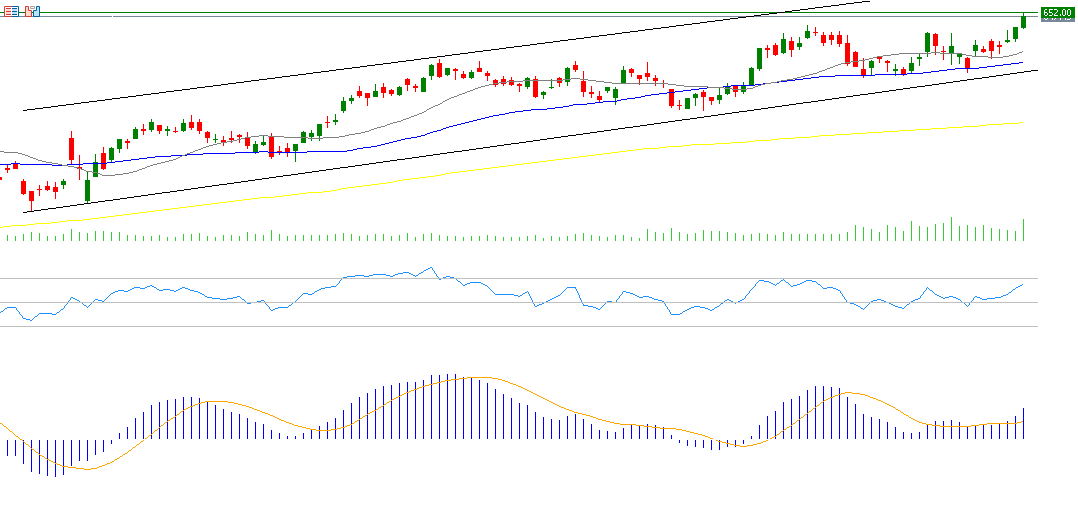

- Meta: Expected EPS: $6.73 (up from $5.33). Revenue: $47.03 billion (vs. $40.11 billion previously). The stock reached $652 on January 24, 2024, a record high, supported by an RSI of 65 and a bullish MACD crossover.

- Microsoft: Expected EPS: $3.13 (up from $2.93). Revenue: $68.92 billion (vs. $62 billion).

- Tesla: Expected EPS: $0.76 (up from $0.71). Revenue: $27.23 billion (vs. $25.17 billion).

Thursday:

- Apple: Expected EPS: $2.36 (up from $2.18). Revenue: $124.99 billion (vs. $119.58 billion).

- Visa: Expected EPS: $2.66 (up from $2.41). Revenue: $9.35 billion (vs. $8.6 billion).

- Mastercard: Expected EPS: $3.70 (up from $3.18). Revenue: $7.40 billion (vs. $6.5 billion).

Friday:

- Exxon Mobil: Expected EPS: $1.77 (down from $2.48). Revenue: $85.35 billion (vs. $95.42 billion).

- Chevron: Expected EPS: $2.34 (down from $3.45). Revenue: $48.03 billion (vs. $47.18 billion).

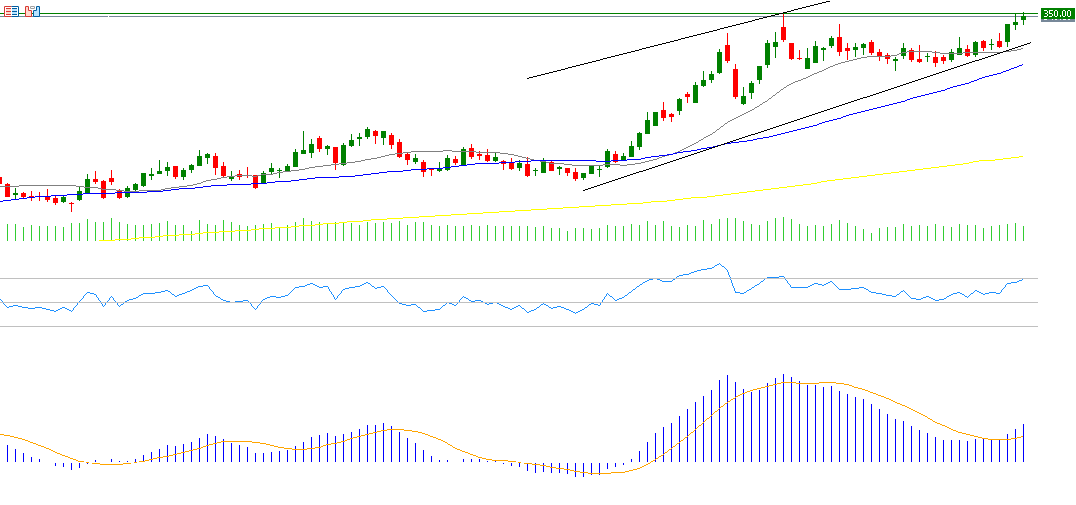

Coffee:

Arabica coffee futures in New York reached $349.68 on Friday, January 24, 2025, the highest level since 1977, up 9% YTD. The rally is attributed to concerns over crop yields in Brazil and Vietnam due to climate change, along with global supply chain issues. The RSI at 70 indicates overbought conditions, with strong upward momentum.

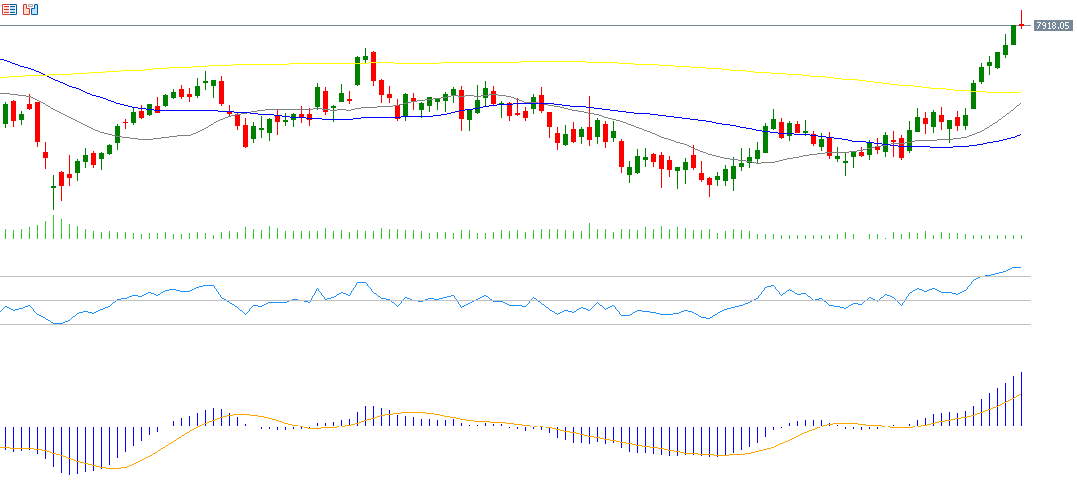

CAC 40:

The CAC 40 index rose to 7,897 points on January 24, 2025, its highest level since January 11, 2024, up 7% YTD. Expectations of further ECB rate cuts are driving positive sentiment. The RSI stands at 77, suggesting overbought conditions, while a bullish MACD crossover signal continued upward momentum.

Key Economic Events to Watch This Week

Monday:

- China: Release of the Manufacturing and Non-Manufacturing PMI data.

- U.S.: Building Permits and New Home Sales figures.

Tuesday:

- U.S.: Durable Goods Orders and Consumer Confidence Index.

Wednesday:

- Canada: Interest rate decision by the Bank of Canada, with expectations of a 25 basis points cut from 3.25% to 3.00%.

- U.S.: Federal Reserve interest rate decision, expected to remain steady at 4.25%-4.50%. Markets will closely monitor Fed Chair Jerome Powell’s comments for insights into the future rate trajectory.

- Australia: Consumer Price Index (CPI).

- U.S.: Crude Oil Inventory report.

Thursday:

- Eurozone: European Central Bank (ECB) interest rate decision, anticipated to be cut by 25 basis points from 3.00% to 2.75%. President Christine Lagarde’s remarks will be a focal point for markets.

- Eurozone: GDP figures.

- U.S.: GDP data and Jobless Claims reports.

Friday:

- Japan: Tokyo Consumer Price Index (CPI).

- China: Caixin Manufacturing PMI.

- U.S.: Core Personal Consumption Expenditures (PCE) Price Index.

- Canada: GDP data.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.