Last week saw several key economic indicators across major economies. In the U.S., crude oil inventories dropped by 2.191 million barrels, retail sales grew by 0.4%, and jobless claims decreased to 241,000. However, industrial production shrank by 0.3%, and building permits fell to 1.428 million. The Eurozone saw a 25-basis point rate cut by the ECB, with industrial production rising by 1.8%, while headline inflation slowed to 1.7%. In the U.K., unemployment dropped to 4.0%, while CPI growth slowed to 1.7%. Switzerland’s producer prices fell by 1.3% annually, and Canada’s CPI dropped to 1.6%. New Zealand’s CPI rose by 2.2%, while Australia added 64.1K new jobs. Japan’s industrial production fell by 3.3%, with exports down 1.7%. In China, industrial production grew by 5.4%, retail sales by 3.2%, and unemployment fell to 5.1%, though Q3 GDP grew at 4.6%.

Market Analysis

USD/JPY Pair

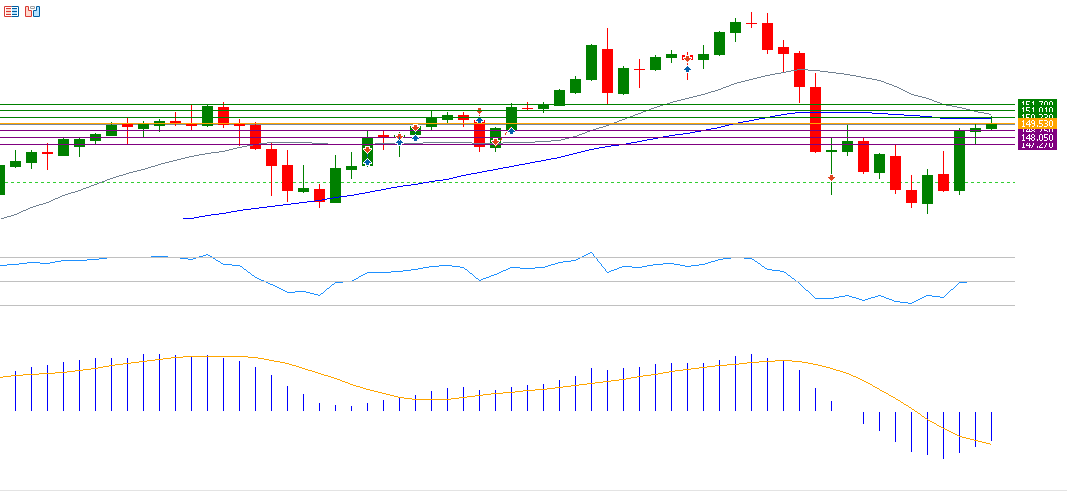

Amid uncertainty surrounding the Bank of Japan’s monetary policy, particularly concerning interest rates, and expectations of no further rate hikes this year, the yen remains weak. The USD/JPY pair has risen by 8% since its September 16, 2024 low of 139.57, reaching a peak of 150.32 on October 17, 2024.

If the USD/JPY breaks the pivot point at 149.53, it is likely to target support levels at 148.75, 148.05, and 147.27. On the upside, if it surpasses the pivot point, resistance levels at 150.23, 151.01, and 151.70 may be targeted.

IBM

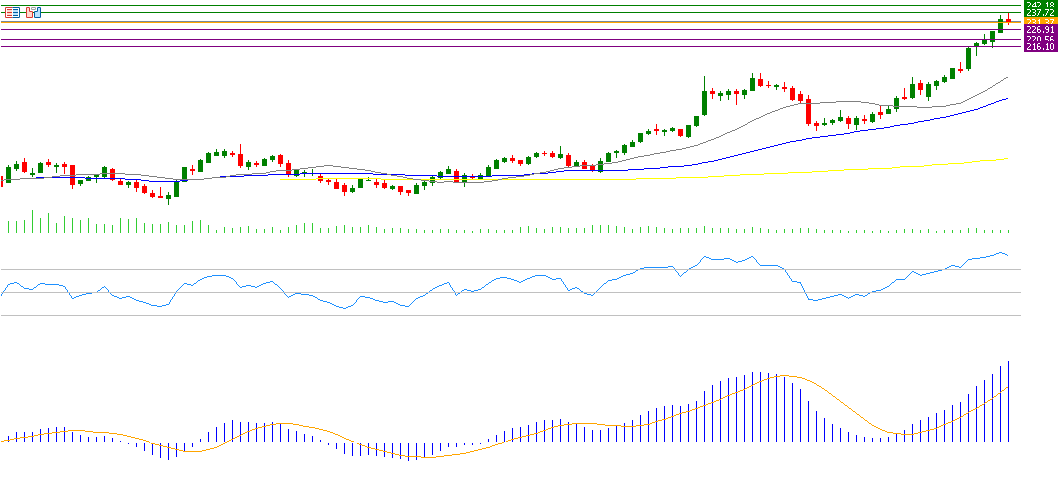

IBM’s stock price has risen by 46% since hitting a low of $162.62 on May 2, 2024, reaching a peak of $237.37 on October 15. The stock closed at $232.20 on Friday, October 18.

The market is awaiting IBM’s Q3 2024 earnings on October 23, 2024, with expectations of an EPS of $2.22, compared to $2.20 in the previous quarter. Revenues are expected to reach $15.04 billion, compared to $14.75 billion in the previous quarter.

If IBM breaks the pivot point at $231.37, it may target support levels at $226.91, $220.56, and $216.10. On the upside, if it surpasses the pivot, resistance levels at $237.72, $242.18, and $248.53 may be targeted.

Gold

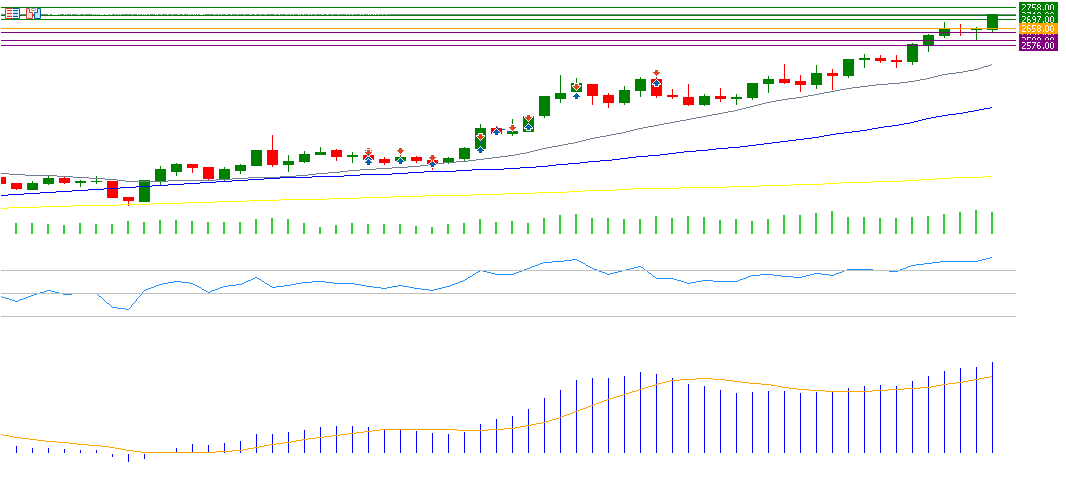

Gold prices hit $2,722 on Friday, October 18, 2024, a new all-time high, up about 32% year-to-date. Gold is currently benefiting from global central banks’ purchases, U.S. interest rate cuts, and geopolitical tensions.

If gold breaks the pivot point at $2,658, it may target support levels at $2,637, $2,598, and $2,576. On the upside, if it surpasses the pivot, resistance levels at $2,697, $2,719, and $2,758 may be targeted.

DAX Index

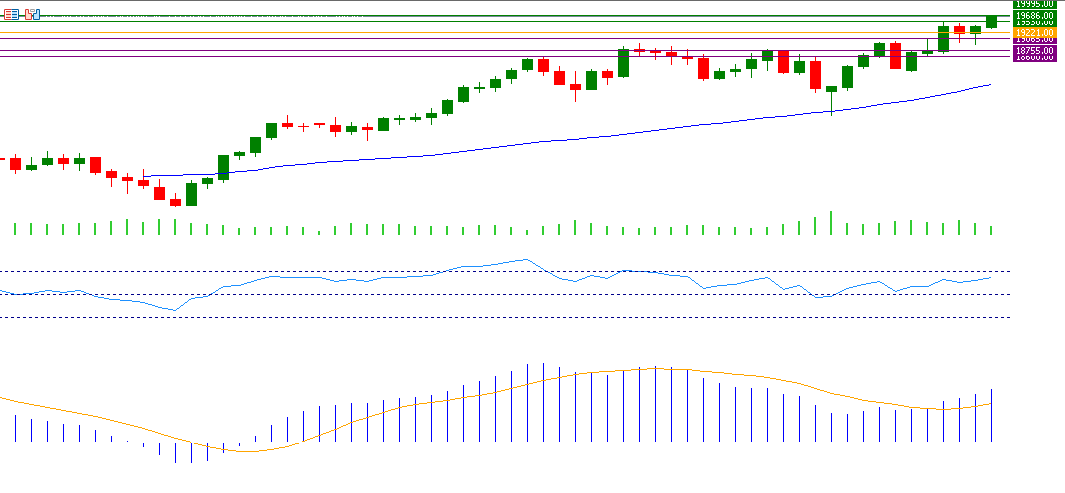

Despite continued weakness in the German economy, the DAX index reached 19,675 points on Thursday, October 17, 2024, its highest level ever. The index has risen by 16% since its August 5, 2024 low of 17,025 points.

If the DAX breaks the pivot point at 19,221, it may target support levels at 19,065, 18,755, and 18,600. On the upside, if it surpasses the pivot, resistance levels at 19,530, 19,686, and 19,995 may be targeted.

Key Events This Week

Markets are awaiting several important economic indicators and events this week:

• Today: The People’s Bank of China will release the prime lending rate.

• Wednesday: Markets will focus on the interest rate decision by the Bank of Canada, as well as U.S. existing home sales and Eurozone consumer confidence index.

• Thursday: Markets will focus on the Manufacturing and Services PMI in Australia, Japan, the Eurozone, the U.K., and the U.S., in addition to U.S. unemployment claims and new home sales.

• Friday: The Tokyo CPI, U.S. durable goods orders and consumer confidence index, and Canadian retail sales will be released.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.