Last week saw several significant economic events. The Federal Open Market Committee (FOMC) in the United States decided to cut interest rates by 25 basis points to a range of 4.50%-4.75%. Meanwhile, factory orders declined, while U.S. oil inventories increased. Data also showed improvements in the ISM Non-Manufacturing Index and consumer confidence. In the Eurozone, retail sales rose, although industrial activity contracted. The Bank of England also cut interest rates, while some economic indicators showed a decline. In Canada, employment growth was weaker than expected. Australia kept interest rates unchanged while its services PMI showed growth. On the other hand, China showed mixed results, with exports rising, imports declining, and producer prices falling.

Market Analysis

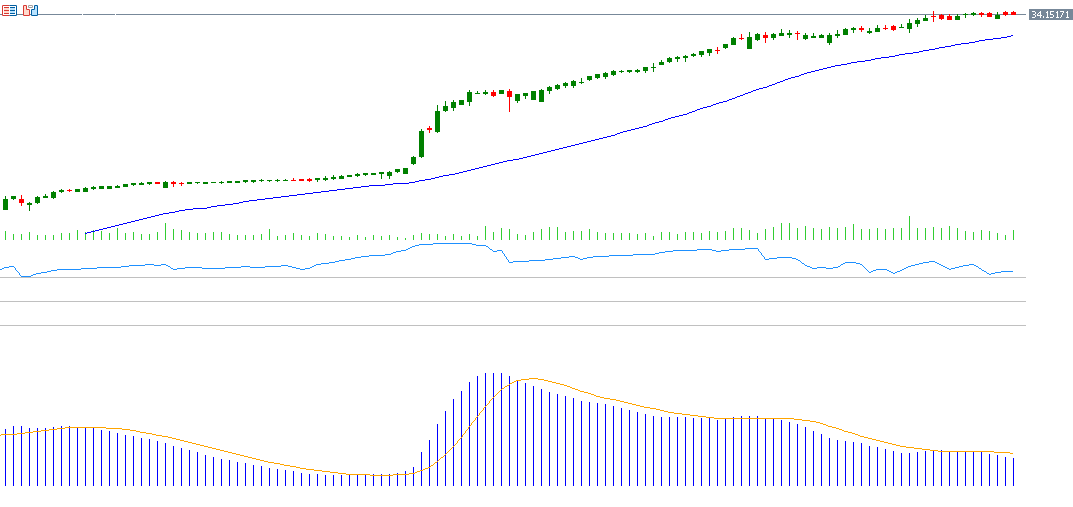

US Dollar vs. Turkish Lira

The exchange rate of the US dollar against the Turkish lira reached 34.3819 on Friday, November 8, marking its highest level since August 28, 2024. The next challenge is to reach the record level set on August 28, which was 34.3827. The USD/TRY has risen by about 17% since the beginning of the year. If the pivot point of 34.2086 is broken, support levels of 34.0004, 33.6988, and 33.4906 could be targeted. If the pivot point is surpassed, resistance levels of 34.5102, 34.7187, and 35.0200 may come into play.

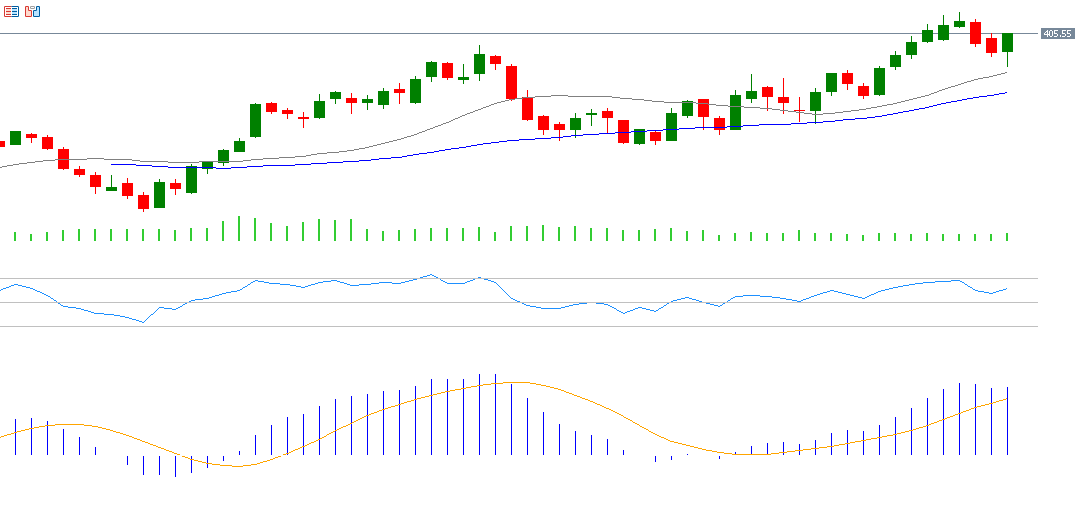

Home Depot

Home Depot’s stock has risen by about 18% since the beginning of the year. The company is expected to announce its financial results on Tuesday, November 12. Earnings per share are expected to be $3.64, down from the previous reading of $3.81. Revenue is forecast to reach $39.27 billion, compared to $37.70 billion previously.

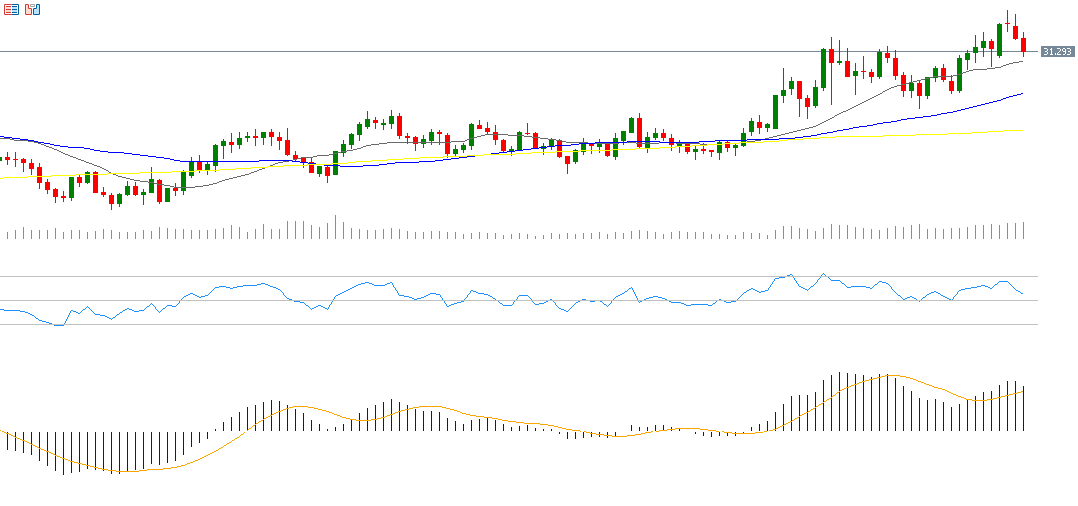

Silver

Silver prices have fallen by about 12% from the peak of $34.87 on October 22 to the low of $30.83 on November 6. This decline is attributed to the strength of the US dollar. If the pivot point of $33.27 is broken, support levels of $31.86, $31.04, and $29.63 could be targeted. If the pivot point is surpassed, resistance levels of $34.09, $35.50, and $36.32 are likely to be tested.

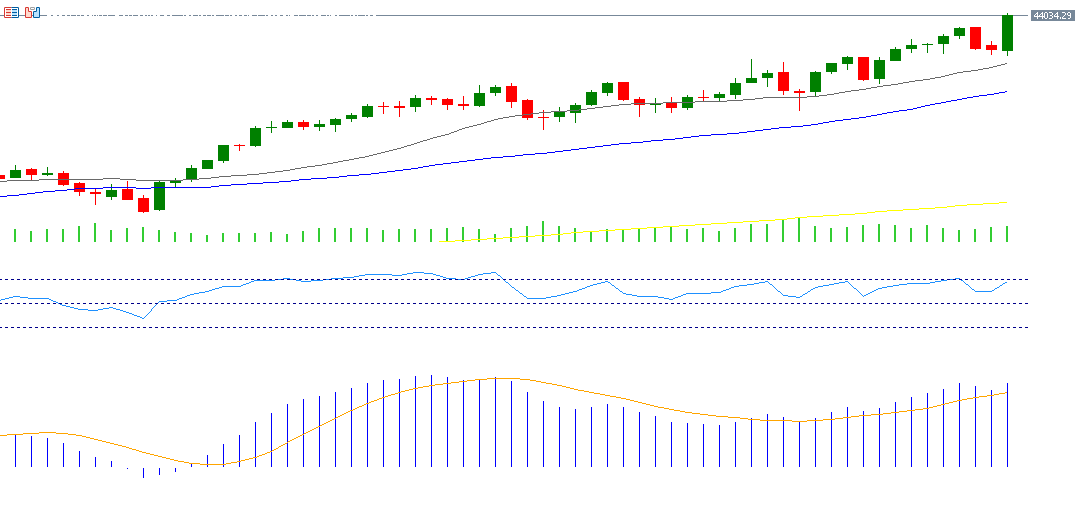

Dow Jones

The Dow Jones Index reached 44,157 points on Friday, November 8, setting a new record high. This surge was driven by the election of Donald Trump as U.S. president, which provided positive momentum for U.S. stocks, particularly with his promise to cut corporate taxes. If the pivot point of 43,410 is broken, support levels of 42,521, 40,901, and 40,012 could be targeted. If the pivot point is surpassed, resistance levels of 45,030, 45,920, and 47,539 are likely to be tested.

Key Events This Week

Markets are expecting several important economic indicators and data releases this week:

- Tuesday: Markets are looking ahead to the income and unemployment rates in the UK, including bonuses.

- Wednesday: Markets will be watching for new loans in China and the Consumer Price Index (CPI) in the United States.

- Thursday: Employment and unemployment change rates in Australia will be released, along with GDP and industrial production data for the UK. In the Eurozone, employment change, GDP, and industrial production figures are expected, along with producer price indices, jobless claims, and US crude oil inventories. Additionally, markets are awaiting a speech by Federal Reserve Chairman Jerome Powell.

- Friday: GDP and industrial production data will be released for Japan, along with fixed asset investment, retail sales, industrial production, and unemployment rate data for China. In the United States, retail sales, industrial production, and the Empire State Manufacturing Index for New York are also expected.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.