Last week, major economies saw some important developments. In the United States, data showed an increase in inflation with the Consumer Price Index (CPI) rising by 2.6% year-on-year, while the Producer Price Index (PPI) increased by 2.4%, surpassing expectations. Meanwhile, jobless claims fell to 217,000, and retail sales showed a slight increase, indicating some resilience in consumer spending. In the Eurozone, GDP grew by 0.9% in Q3, despite a 2.0% decline in industrial production in September. In the UK, income growth rose to 4.3%, but unemployment also increased to 4.3%, while the economy grew by a modest 0.1%. Australia saw stable unemployment at 4.1%, but employment growth slowed. In Japan, GDP grew by 0.2%, while industrial production increased by 1.6%. In China, investment and industrial production indicators declined, while retail sales rose by 4.8%, and new loans decreased significantly.

Market Analysis

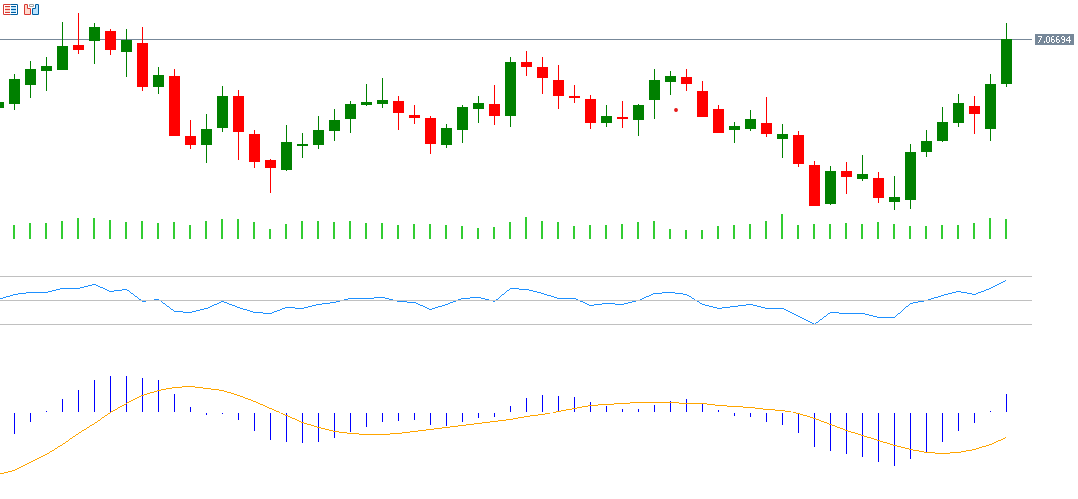

US Dollar vs. Danish Krone

The US dollar against the Danish krone continues its upward trend, reaching 7.1062 on Thursday, November 14, 2024, the highest level since October 13, 2023. The USD/DKK pair has risen by around 7% since the low of September 25, 2024, which was 6.6500, reaching a peak of 7.1062. It has also risen by around 5% year-to-date. If the pivot point of 6.9154 is broken, the pair may target support levels at 6.8618, 6.7673, and 6.7137. On the other hand, if the pivot point is surpassed, resistance levels could be 7.0099, 7.0635, and 7.1580.

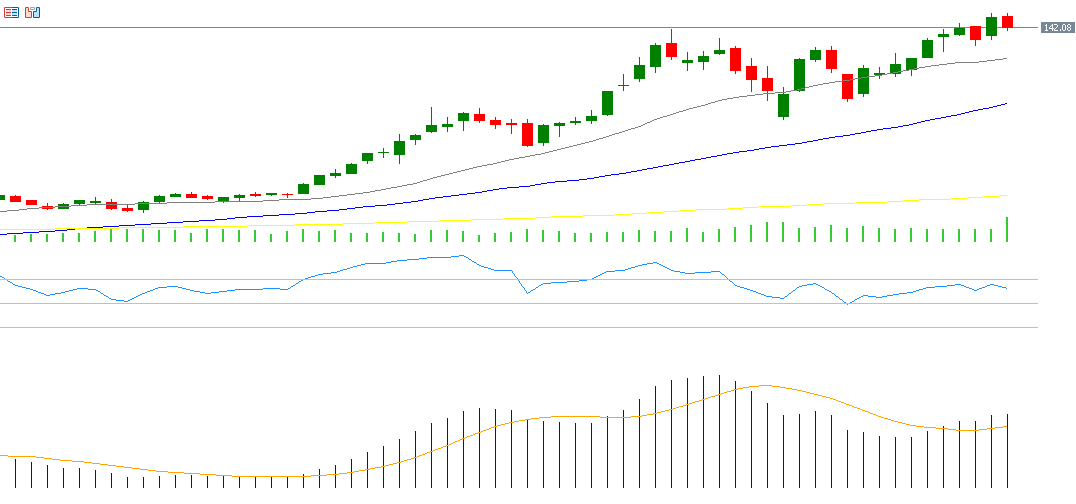

Nvidia

Nvidia shares are in an upward trend, rising by around 188% year-to-date. The markets are awaiting Nvidia’s Q3 financial results, due on November 20, 2024, with analysts expecting earnings of $0.74 per share, down from $4.02 per share in the previous reading. Regarding revenues, markets expect them to reach $32.95 billion, up from $18.12 billion in the previous quarter.

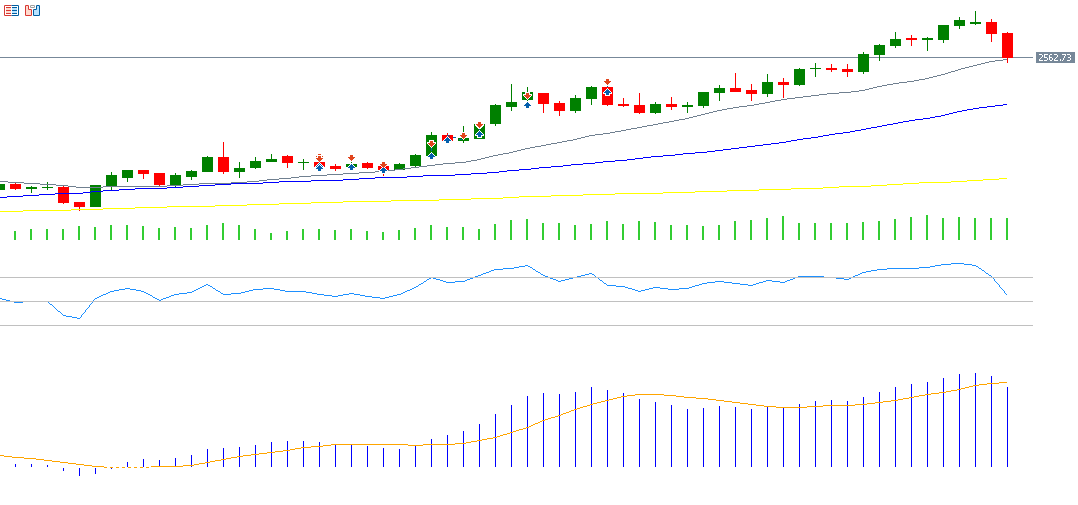

Gold

Gold prices have declined by around 9% from the peak of $2,790 on October 30 to the low of $2,536 on November 14. This drop is attributed to the strength of the US dollar. However, gold has risen by approximately 24% year-to-date.

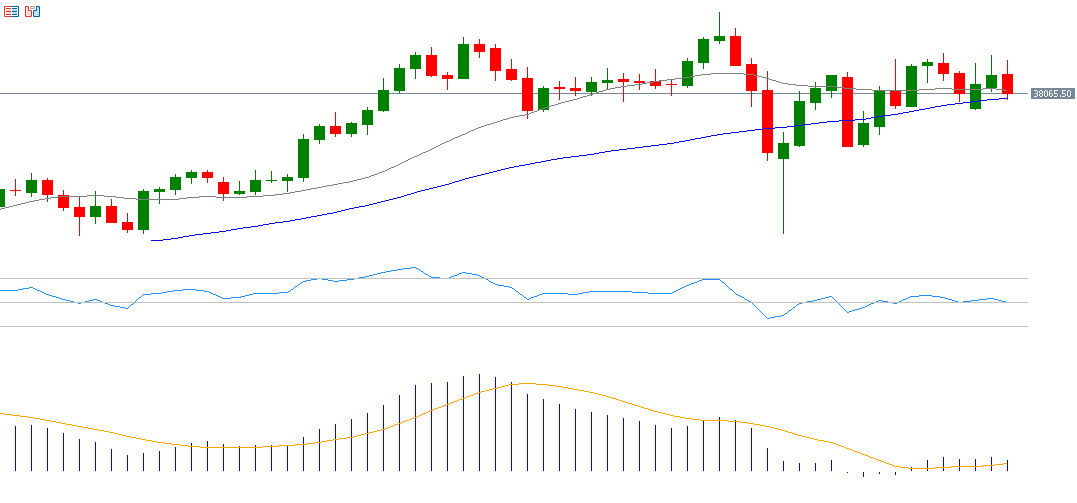

Nikkei 225

The Nikkei 225 index has been trading sideways since September 20 of this year, fluctuating between 37,650 and 40,250 points, without a clear trend. It has, however, risen by around 16% year-to-date. If the pivot point of 39,123 is broken, the index may target support levels at 38,324, 37,147, and 36,348. If the pivot point is surpassed, resistance levels could be at 40,299, 41,098, and 42,275.

Key Events This Week

This week, the markets are awaiting several important economic indicators and data releases:

- On Tuesday, markets will be watching the Consumer Price Index (CPI) data for the Eurozone and Canada, as well as building permits in the US.

- On Wednesday, the focus will be on the People’s Bank of China’s key lending rate, along with Japan’s export and import figures, UK CPI, and US crude oil inventories.

- On Thursday, the markets will be looking at initial jobless claims, the Philadelphia Fed Manufacturing Index, and existing home sales in the US.

- Finally, on Friday, Japan’s CPI will be released, along with the Purchasing Managers’ Indices (PMIs) for manufacturing and services in Australia, Japan, the Eurozone, the UK, and the US. Retail sales data will also be released for the UK and Canada, alongside the University of Michigan’s Consumer Sentiment Index in the US.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.