Last week featured mixed global economic data. In the United States, consumer inflation showed signs of easing while core inflation remained relatively high. Producer price inflation, however, rose sharply above expectations. Labor market data confirmed ongoing resilience with a drop in jobless claims, although retail sales came in weaker than expected. Consumer confidence fell noticeably alongside higher inflation expectations, while industrial indicators delivered mixed results—some regional surveys improved, yet overall industrial production declined.

Globally, the euro area continued to record weak growth, driven by industrial slowdown. The UK posted modest improvements in growth and output despite a slowdown in wage growth. Switzerland saw producer prices decline, while Australia’s employment figures disappointed. In contrast, New Zealand showed an uptick in PMI activity. Japan recorded stronger growth and industrial output than forecast, whereas China displayed broad-based weakness across most indicators with a rising unemployment rate.

Market Analysis

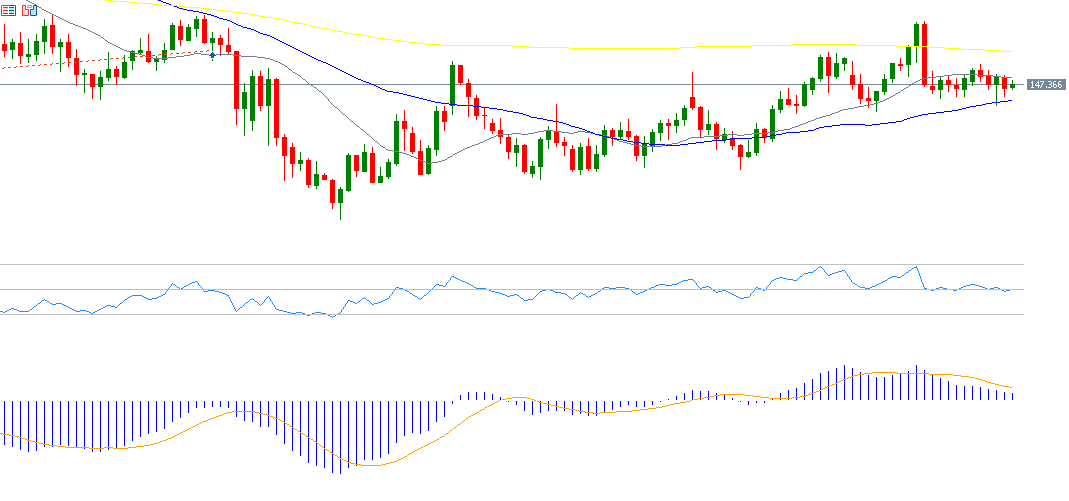

- USD/JPY

The US dollar fell against the Japanese yen to 146.22 on Thursday, August 14, the lowest since July 24, 2025, before closing at 147.17 on Friday. The pair has dropped about 6% year-to-date. The bearish momentum appears to dominate due to both fundamental and technical drivers. Key factors include higher yields on Japanese government bonds, a weaker US dollar following softer economic data such as declining Michigan consumer sentiment, and expectations that the Bank of Japan may raise interest rates soon. At the same time, uncertainty surrounds US monetary policy with markets anticipating two additional rate cuts this year, while risk aversion pushes investors toward safe-haven currencies like the yen. The RSI currently sits at 48, reflecting downside momentum, and the MACD shows a bearish crossover, adding pressure on the pair.

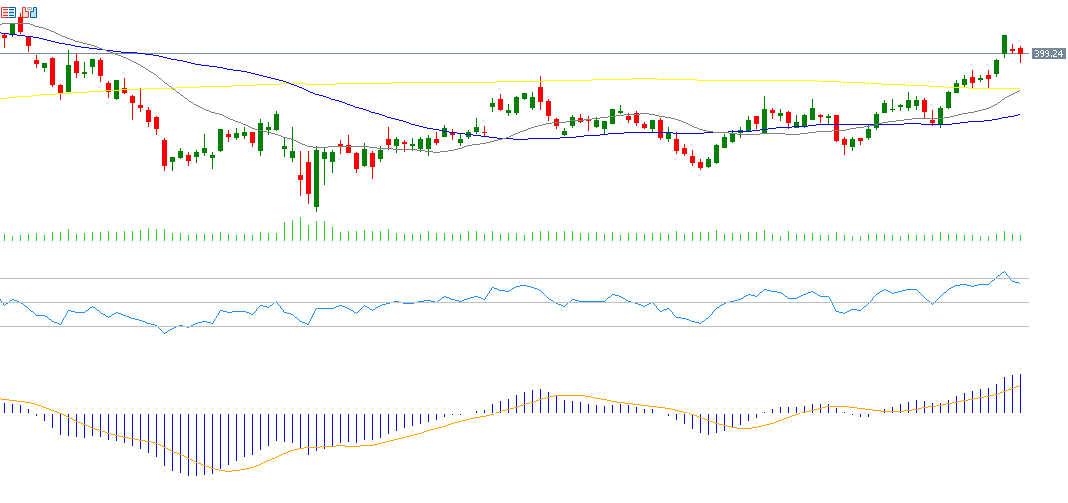

- Home Depot

Home Depot shares are up about 3% year-to-date. Markets are awaiting the company’s earnings release on Tuesday, August 19, 2025, with consensus expecting earnings per share of $4.73 versus $4.67 previously. Revenue is projected to reach $45.55 billion compared to $43.18 billion prior. The RSI currently stands at 67, suggesting bullish momentum, while the MACD shows a positive crossover that reinforces the upward trend.

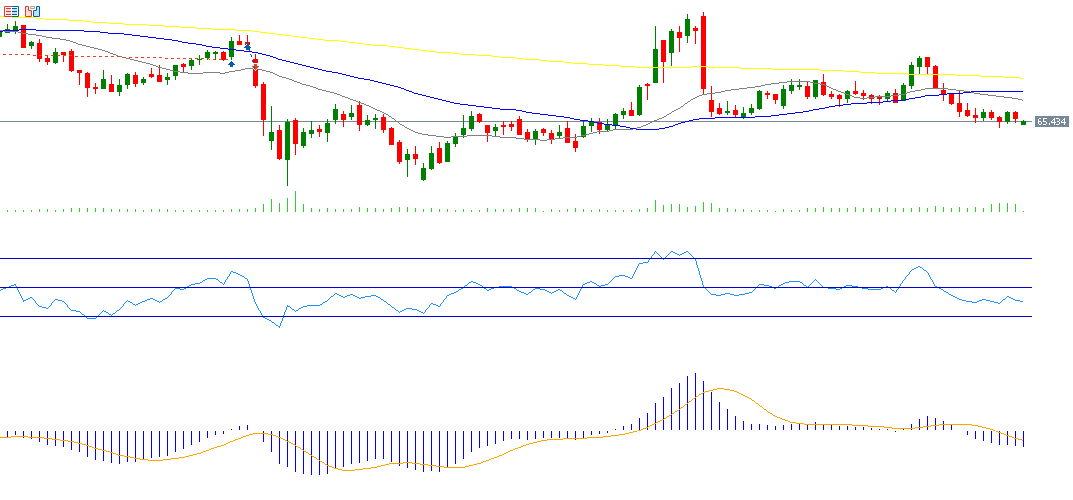

- Crude Oil

Crude oil prices fell for the second consecutive week, touching $65.01 on Wednesday, August 13—the lowest since June 6, 2025—before closing Friday at $66.12. Prices are down about 12% year-to-date. Key downward drivers include persistent geopolitical uncertainty (even after the Trump–Putin summit, which was described as constructive but produced no concrete agreements), weaker economic data from major oil consumers such as China and the US, seasonal demand expectations pointing to a September slowdown, and higher-than-expected US crude inventories. RSI is currently at 41, signaling bearish momentum, while the MACD shows a bearish crossover that adds further downside pressure.

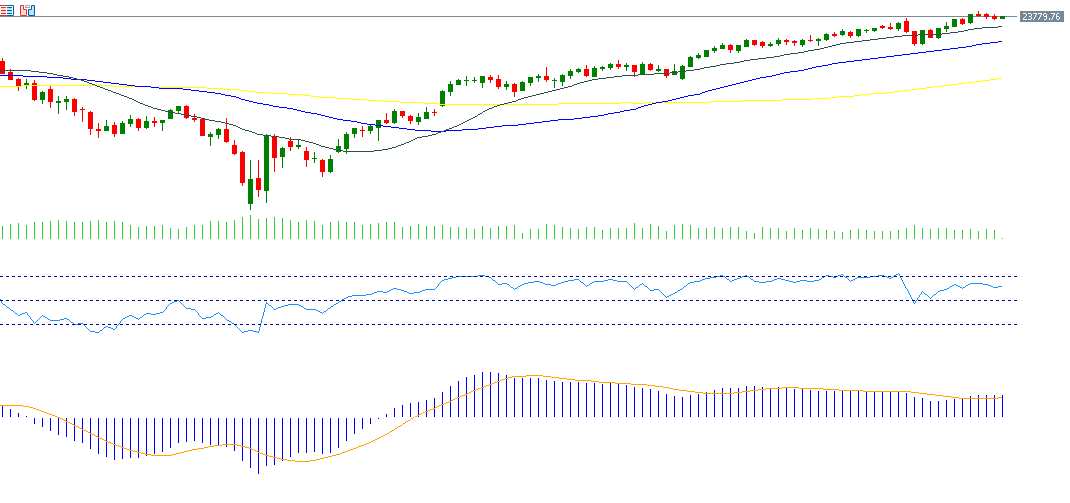

- Nasdaq 100

The Nasdaq 100 rose for a second straight week, reaching a record 23,969 on Wednesday, August 13, before closing Friday at 23,712. Gains were fueled by stronger-than-expected corporate earnings and expectations of two US interest rate cuts this year. RSI stands at 63, indicating bullish momentum, while the MACD shows a bullish crossover that supports further upside.

Key Events This Week

- Tuesday: Canada’s CPI release.

- Wednesday: China’s loan prime rate decision (expected unchanged), Reserve Bank of New Zealand policy decision (expected cut), Japan’s trade data, inflation releases from the UK and eurozone, US crude oil inventories, and FOMC meeting minutes.

- Thursday: Flash PMIs for manufacturing and services from Australia, Japan, the eurozone, the UK, and the US. Also, US existing home sales, jobless claims, and the Philadelphia Fed index. Attention will also be on the Jackson Hole Symposium, with markets awaiting Powell’s remarks on monetary policy amid divisions within the Fed regarding a September rate cut.

- Friday: Japan’s inflation data, UK retail sales, and continued focus on Jackson Hole for potential market-moving signals.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.