Last week featured mixed economic data globally. In the United States, indicators showed notable improvement, with jobless claims declining, and new home sales and both manufacturing and services PMI rising, although existing home sales declined. In the Eurozone, inflation rates remained stable, while both manufacturing and services PMIs showed significant contraction.

In the United Kingdom, inflation exceeded expectations, supported by strong retail sales and growth in the services sector, while the manufacturing sector continued to decline. In Australia, the Reserve Bank cut interest rates by 50 basis points amid relatively stable economic data. Canada recorded stronger retail sales alongside a slowdown in inflation.

Japan saw a drop in the services PMI, while the manufacturing PMI improved slightly. Inflation hit its highest level since January 2023. In China, data reflected a slowdown in economic growth, with declines in retail sales and fixed asset investment, despite improvements in industrial production and lower unemployment. Meanwhile, the central bank cut lending rates to support growth.

Market Analysis

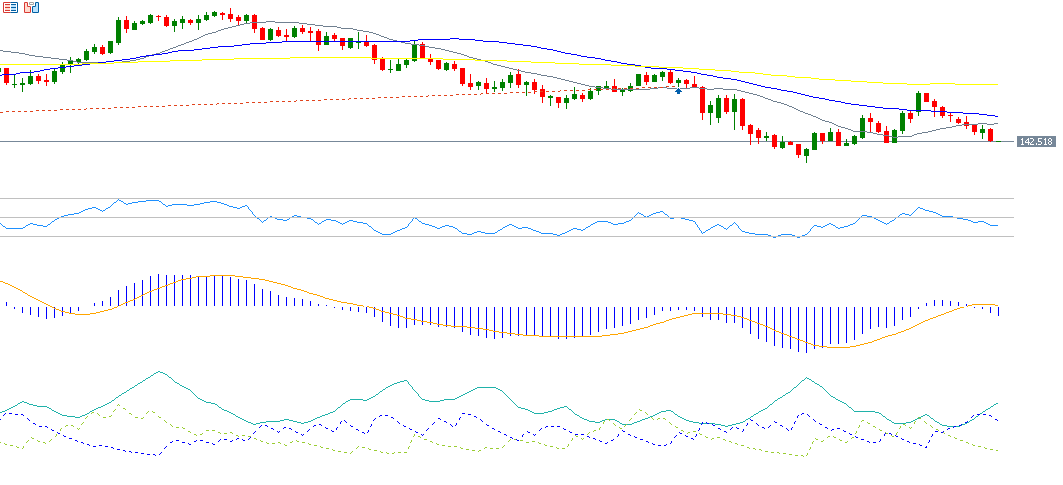

USD/JPY

The USD/JPY pair traded at 142.42 on Friday, May 23 — its lowest level since May 7, 2025. The pair has declined approximately 9% year-to-date. The outlook remains bearish, influenced by several fundamental and technical factors. The Relative Strength Index (RSI) currently stands at 41, signaling bearish momentum. The MACD also shows a bearish crossover, with the MACD line (blue) crossing below the Signal Line (orange), reinforcing the negative sentiment for USD/JPY.

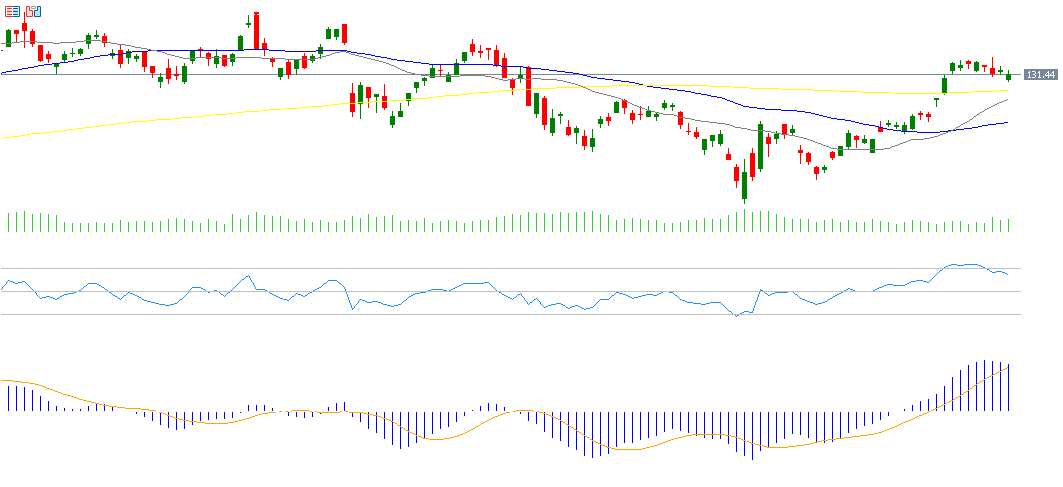

NVIDIA

NVIDIA’s stock has fallen around 2% year-to-date. The market is closely watching the company’s earnings release scheduled for Wednesday, May 28, 2025, with expectations of earnings per share at $0.93, up from $0.61 in the previous reading. Revenues are projected to reach $43.35 billion, compared to $26.04 billion previously. The RSI currently stands at 64, indicating positive momentum. The MACD shows a bullish crossover, with the MACD line crossing above the Signal Line, supporting a bullish outlook for NVIDIA’s stock.

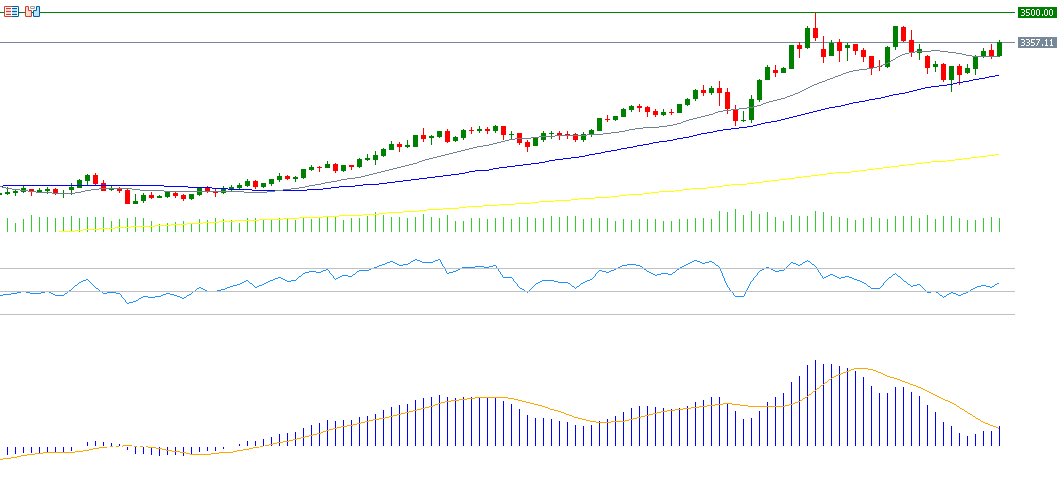

Gold

Gold prices surged by approximately 4.80% last week, reaching $3,366 on Friday, May 23 — the highest level since May 8, 2025. The precious metal has risen about 8% from its May 15 low of $3,121 to last Friday’s peak and is up 28% year-to-date. The rally is driven by several key factors, including a weaker U.S. dollar, rising geopolitical tensions, and trade frictions — particularly between the U.S. and the European Union, following threats by former President Donald Trump to impose 50% tariffs on European goods starting June 1. The RSI is currently at 58, reflecting bullish momentum. The MACD also shows a bullish crossover, suggesting continued upside for gold.

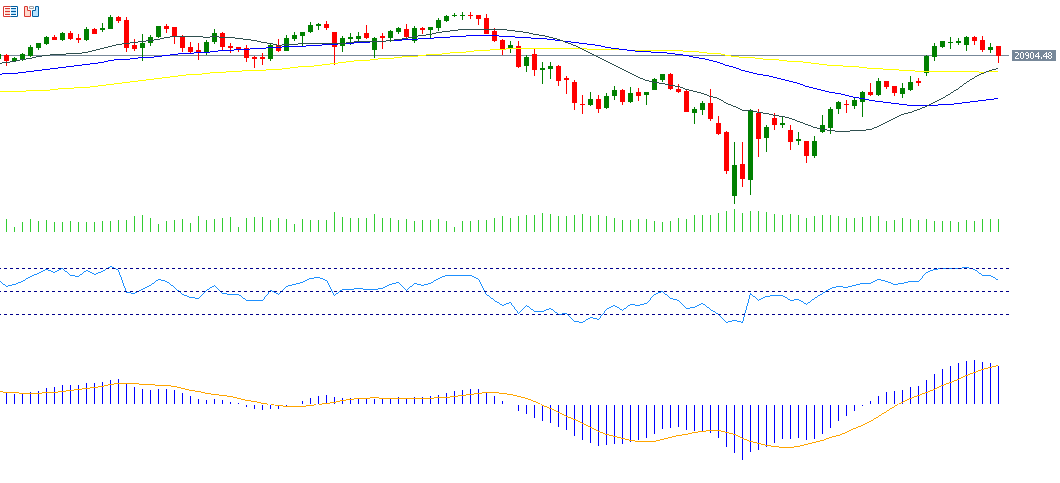

Nasdaq 100

The Nasdaq 100 index dropped approximately 2.39% last week, primarily due to rising yields on long-term U.S. Treasury bonds and escalating trade tensions. The index is down about 0.46% year-to-date. The RSI currently reads 60, indicating bullish momentum, while the MACD shows a bullish crossover with the Signal Line, supporting a continued positive outlook for the index.

Key Events This Week

Markets are anticipating several important economic indicators and events this week:

- Tuesday: U.S. Consumer Confidence and Durable Goods Orders reports will be released.

- Wednesday: Focus will be on the Reserve Bank of New Zealand’s interest rate decision, with expectations of a 25-basis-point cut from 3.50% to 3.25%. The Federal Open Market Committee (FOMC) meeting minutes will also be released.

- Thursday: The U.S. will release weekly jobless claims, GDP data, pending home sales, and crude oil inventories.

- Friday: Key data releases include Tokyo Core CPI, Australian retail sales, U.S. Core PCE Price Index and Michigan Consumer Sentiment, and Canada’s GDP report.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.